Technical Bias: Neutral

Key Takeaways

- US dollar dived against the Swiss franc, as sellers took control.

- A break of 0.8880 resistance level might encourage the US dollar buyers to take it higher.

- USDCHF support seen at 0.8855 and resistance ahead at 0.8900.

The US dollar after declining towards the 0.8850 support level managed to find bids against the Swiss franc, but faces a monster resistance around the 0.8880 resistance area.

Technical Analysis

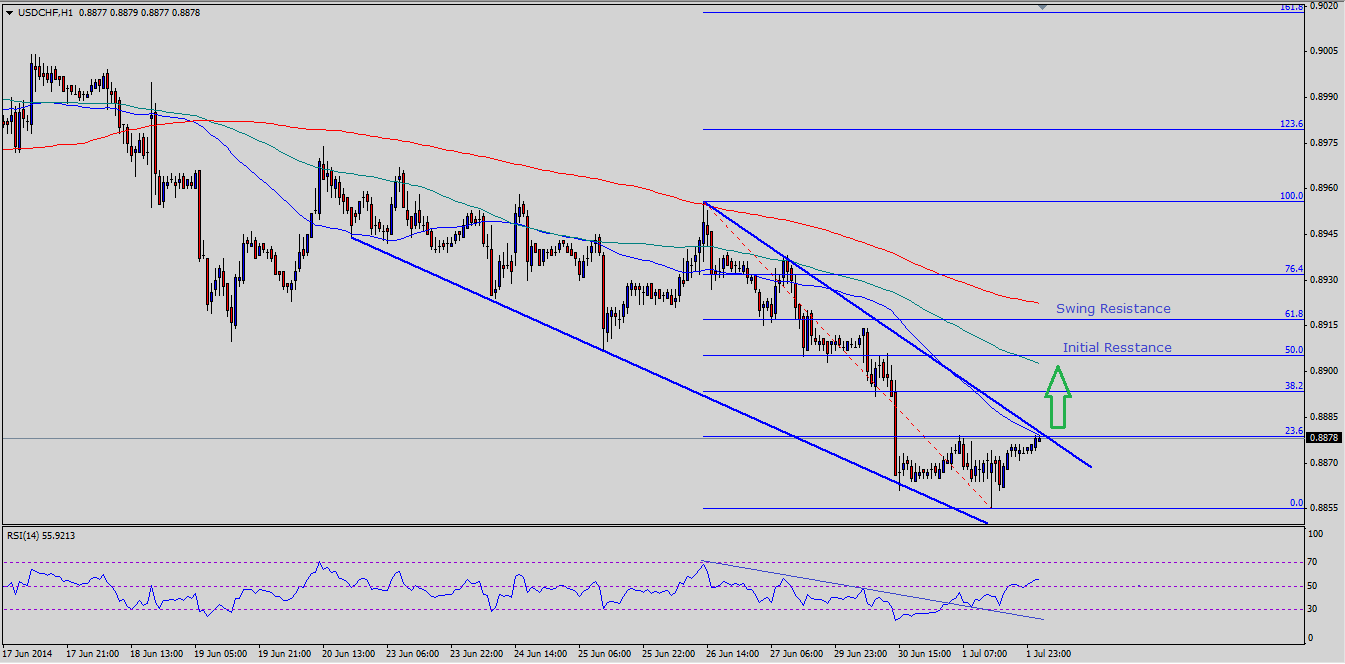

There is a critical bearish trend line forming on the hourly timeframe for the USDCHF pair. Currently, the pair is trading around the same trend line, which is also an important confluence resistance area. The 50 hourly simple moving average and 23.6% Fibonacci retracement level of the last drop from the 0.8955 high to 0.8855 low are around the mentioned trend line. So, a break and close above the confluence resistance area might trigger a move higher in the pair. Initial resistance post the break can be seen around the 50% fib level, which also coincides with the 100 hourly SMA. Any further strength might take the pair towards the 61.8% fib level. One key point to note here is that the RSI also had a trend line, which was breached earlier during the Asian session. So, this can be seen as a divergence sign, which could take the pair higher in the coming sessions.

Alternatively, if the pair fails around the trend line resistance zone, then it could dive to re-test the recent low of 0.8855. If sellers take control, then a break below the 0.8855 support level is also possible, but it would largely depend on the incoming economic data from the US.

US ADP Nonfarm Employment Change

Later during the NY session, the US ADP Nonfarm Employment Change data will be released by the Automatic Data Processing (ADP). The forecast is slated for a gain of 200K jobs. If the outcome misses the forecast, then the US dollar might find it hard to hold the ground moving ahead.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.