Fundamental Bias: Bearish

Key Factors

- Softer than expected Australian inflation data to boost dovish outlook of the RBA.

- Dismal Chinese manufacturing and factory activity to add further pressure on the Aussie buyers.

- Failure to hold a major trend line suggest risk of a much larger Australian dollar breakout.

The Australian dollar traded below an important bullish trend line yesterday after the US durable goods orders data was released. Furthermore, signs of increasing tensions between Russia and Ukraine also dented the Australian dollar recovery.

The Australian dollar dropped to three-week lows against the U.S. dollar on Thursday, after the release of US durable goods orders by the US Census Bureau. The report suggested that the US durable goods orders rose 2.6% m/m in March vs. 2% expected and 2.1% prior. Moreover, excluding transportation, new orders increased 2.0 percent. Excluding defense, new orders jumped 1.8 percent.

Fundamentals

The Aussie buyers will definitely struggle to take the currency higher, as the recent incoming data warned against chasing the Australian dollar higher. The most significant release this week was the inflation report. The CPI rose 0.6% in the March quarter 2014, compared with a rise of 0.8% in the December quarter 2013. Moreover, China’s HSBC manufacturing purchasing managers’ index was also released, which registered a minor rise from 48.0 to 48.3, but still below the all-important 50 level. All these factors might weigh on the Aussie in the short term.

Technicals

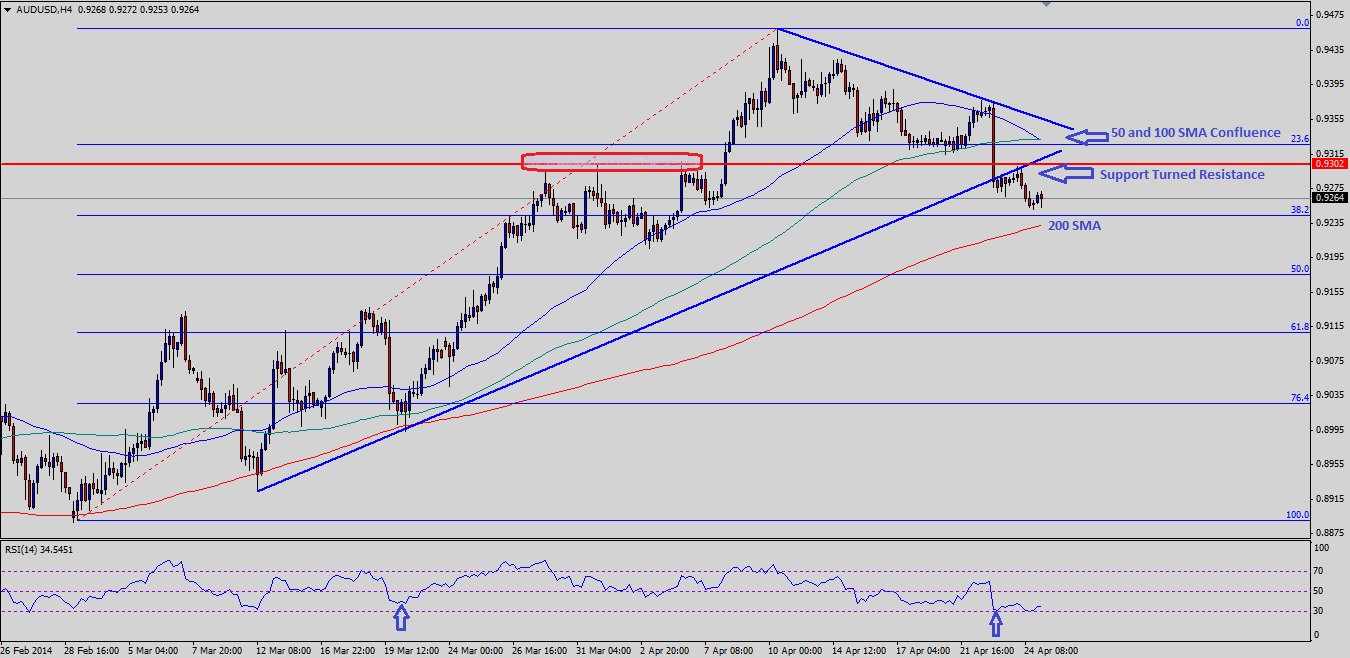

AUDUSD sellers managed to break an important trend line connecting all previous lows starting from 0.8923 during New York’ session. The buyers fought hard to take the pair higher again, but the broken trend line acted as a short term barrier. The AUDUSD intraday technicals are slightly bearish while trading below 0.9300 looking to test support in the 0.9220-0.9200 area. The mentioned support area holds a lot of significance as 200 simple moving average on the 4 hour timeframe sits around the same area. A break either side of 200 SMA is likely to exposure 50% Fibonacci retracement level of the last major leg higher from 0.8888 low to 0.9460 high.

Looking Ahead

If there is a big move in the US dollar, then AUDUSD might dive towards 0.9220 support level. Alternatively, we might witness a move back towards the confluence area of 100 and 50 (4h) SMA’s.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.