Market Sentiment – Neutral

Key Takeaways

US dollar hits weekly high vs Swiss Franc

US Existing Home sales remain flat in March

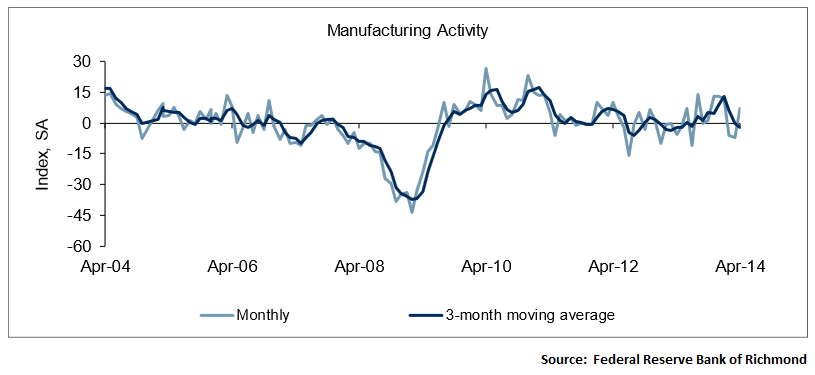

Richmond Manufacturing index climbs to 7

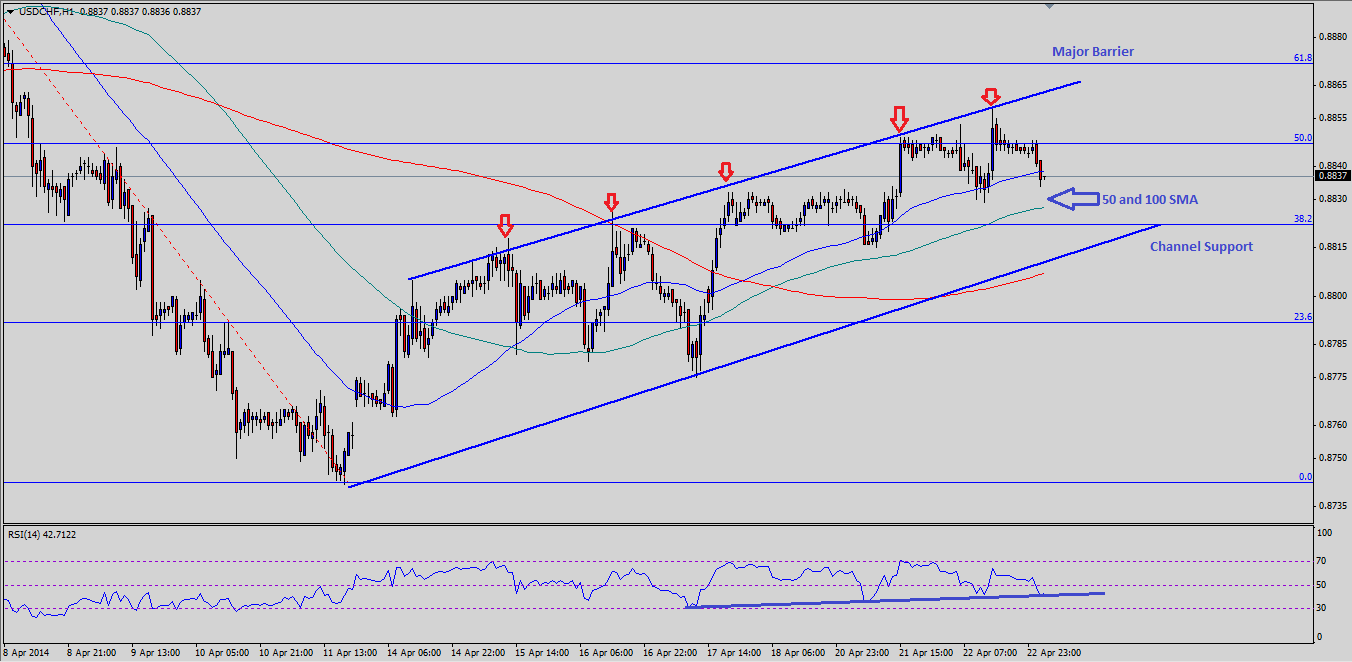

The dollar edged higher versus the Swiss Franc after the US Existing home sales and Richmond’s manufacturing index were released during yesterday’s New York session. The dollar rose to its highest level in nearly seven days against the Swiss franc, as the market sentiment got a lift post economic releases.

USDCHF upside pressures remain intact. Some traders, however, played down the possibility of USDCHF trading higher, and suggested that the rally from April 11, 2014 low was only corrective.

US Existing Home Sales and Richmond Manufacturing index

Yesterday, the US Existing Home Sales and Richmond’s manufacturing index were published by the National Association of Realtors and Federal Reserve Bank of Richmond respectively. The existing home sales remained flat in March, and slipped 0.2 percent to a seasonally adjusted annual rate of 4.59 million in March from 4.60 million in February. The highlight was the Richmond Manufacturing Index, which climbed to 7 from -7, beating the expectations of 0. Employment rose, while wages advanced at a slower rate, according to the report.

Technical Analysis

USDCHF has managed to form a solid bullish channel on the hourly timeframe. The pair failed to take out the channel resistance a number of times, but the positive is that the sellers have failed to match the number of attempts on the downside. Despite mixed economic data, USDCHF managed to trade higher and registered a new weekly high at 0.8858, and found resistance in the form of channel trendline. A break higher might take the pair towards the 61.8% Fibonacci retracement level of the last major drop.

There is a major trendline noted on the RSI, which might act as a catalyst for the pair. However, as long as the pair is tracking the channel more upside cannot be denied.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.