Key Takeaways

- Dollar steady after comments from Fed’s Yellen

- AUDUSD tested and failed around key resistance area

The dollar despite losing its gain against the Euro and British pound has managed to maintain interest against the Australian dollar. AUDUSD has struggled to find bids after the Federal Reserve Chairwoman Janet Yellen indicated in a speech that they have no plans to increase interest rates ahead of schedule, as policy makers have held the key interest-rate in a range of 0 to 0.25 percent since 2008 to back the economy.

AUDUSD is trading lower post the release of China’s GDP. According to the National Bureau of Statistics, China’s economy expanded 7.4 percent from a year earlier, more than the forecast of 7.3 percent. However, the recovering is still declining, which caught the attention of AUD bears.

Technical Analysis

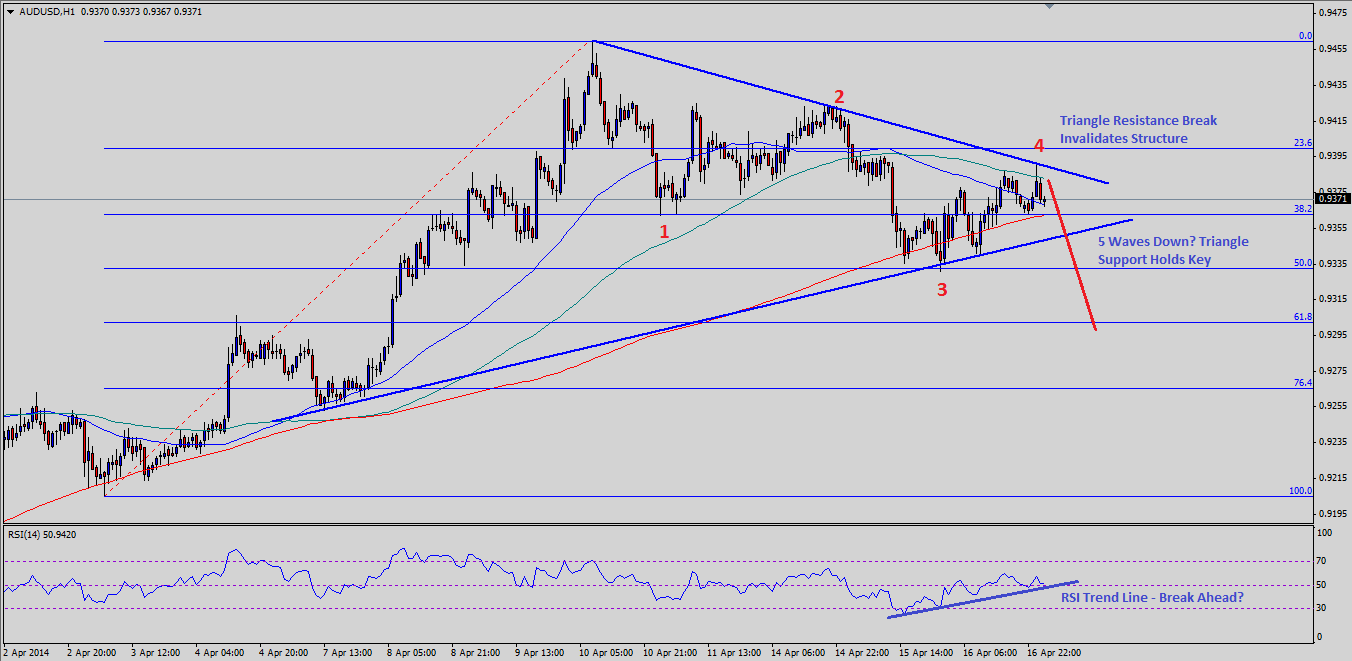

AUDUSD is forming a perfect bearish structure after setting a high at 0.9459. The pair recently dropped close to 0.9330, which represents 50% retracement level of the last move higher from the 0.9205 low to 0.9459 high. There is a contracting triangle forming on the 4 hour timeframe connecting lows and highs, which hold the key moving ahead.

The pair is currently in the fourth wave of the recent drop, and there are chances that the pair breaks the triangle support area to complete a 5-wave structure. A break below might take the pair towards the 61.8% fib retracement level, which also coincides with April 04, 2104 high.

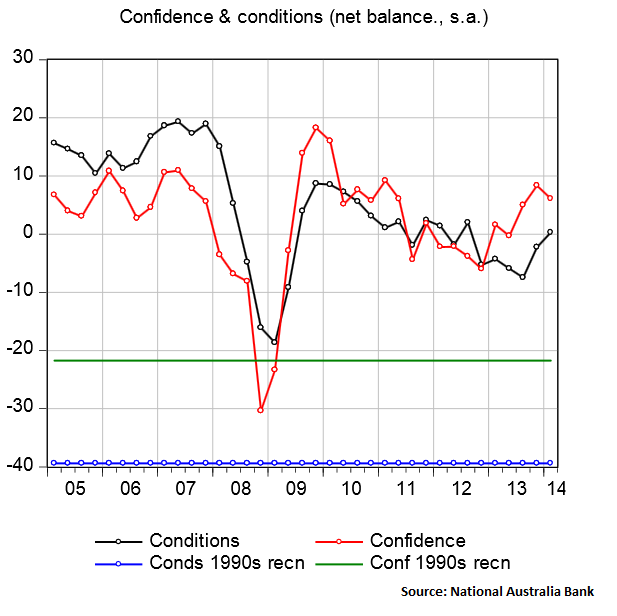

National Australia Bank's Business Confidence

The National Australia Bank Business Confidence was released in the Asian session. The outcome was disappointing, as business confidence eased from its recent high of 8 to 6, but remained elevated in the March quarter. The report highlighted that the “special question on the impact of currency still showing wholesale and manufacturing most affected by the level of the AUD”. This is not something which can distract the Australian dollar bears.

If the sellers take control, and manage to push AUDUSD below the triangle support level, then more losses are feasible in the coming days.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.