U.S. dollar is largely trading higher Intraday despite disappointing initial jobless claims and trade balance figures. Investors seem to be nervous ahead of US Nonfarm payrolls and unemployment report. Major pairs such as EURUSD, GBPUSD and AUDUSD are trading lower since yesterday’s European session.

EURUSD was the worst performer, as a series of events including ECB press conference affected the buyer’s sentiment. Arguably, the most important economic release is lined up today. US Department of Labor will publish March’s Nonfarm payrolls and unemployment rate, which could act a major catalyst for the US dollar moving forward. According to forecasts, Nonfarm payrolls figure is expected to gain 200K jobs in March, and unemployment rate to fall 0.1% from 6.7% to 6.6%.

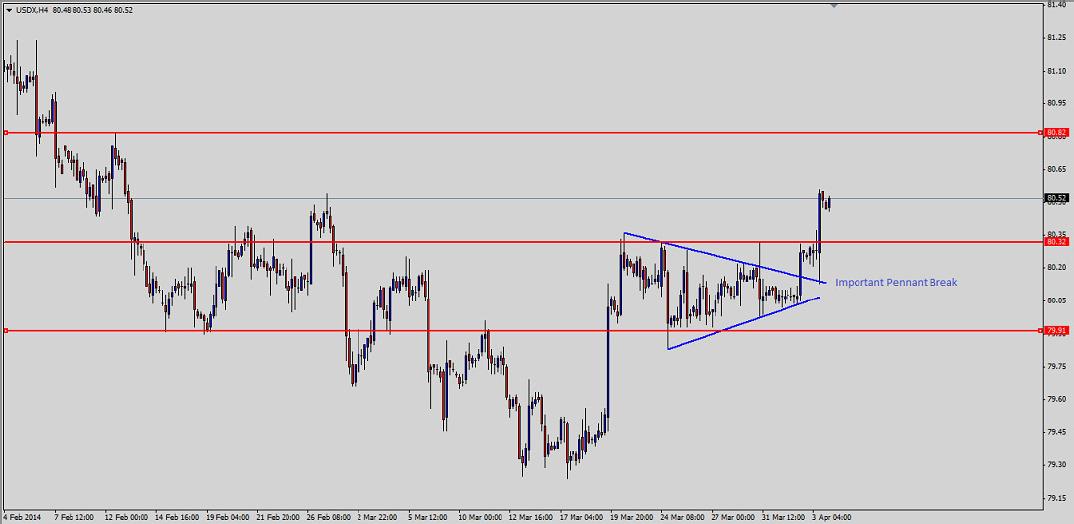

U.S. dollar Index: Key break ahead of important data

U.S. dollar index broke an important resistance and moved higher, as bullish pennant formed on the 4 hour timeframe gave away for further upside acceleration. There was a bullish pennant formed, which was breached yesterday post important economic releases. The European Central Bank (ECB) rate decision and press conference made the difference. At the press conference, ECB President Mario Draghi remarks ignited bearish move in the Euro. His dovish comments on possible QE and escalated Euro currency created bearish pressure, as EURUSD pair traded lower and even tested 1.3700 support level.

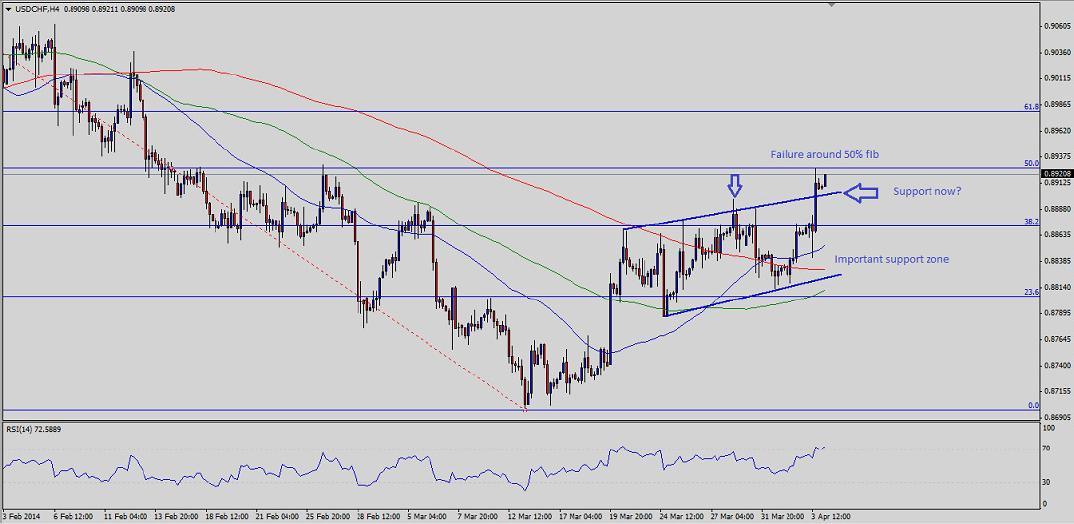

USDCHF: Lacking follow through?

USDCHF pair is also trading higher, but looks like the pair is lacking follow through.There was flag formed on the 4 hour timeframe, which was taken out during yesterday’s US session.However, buyers struggled around 50% Fibonacci retracement level of the last down move from 0.9155 high to recent 0.8698 low. Flag resistance might act as a support.

RSI is at extreme levels, which suggest that the pair might retrace some of the recent gains in short term. Current price is 0.8918, resistance lies at 0.8928 (50.0% Fib), 0.8980 (61.8% Fib) and 0.9000.

Support seen around 0.8900 (Flag support), 0.8850 (4H 50 SMA) and 0.8830 (4H 200 SMA).

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'