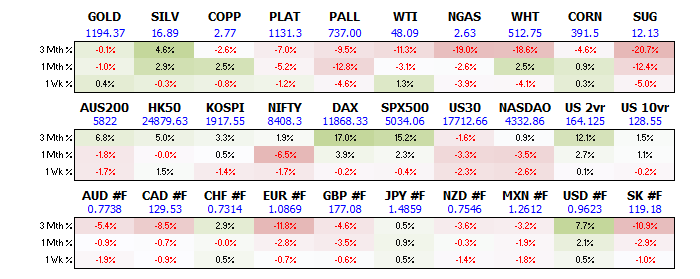

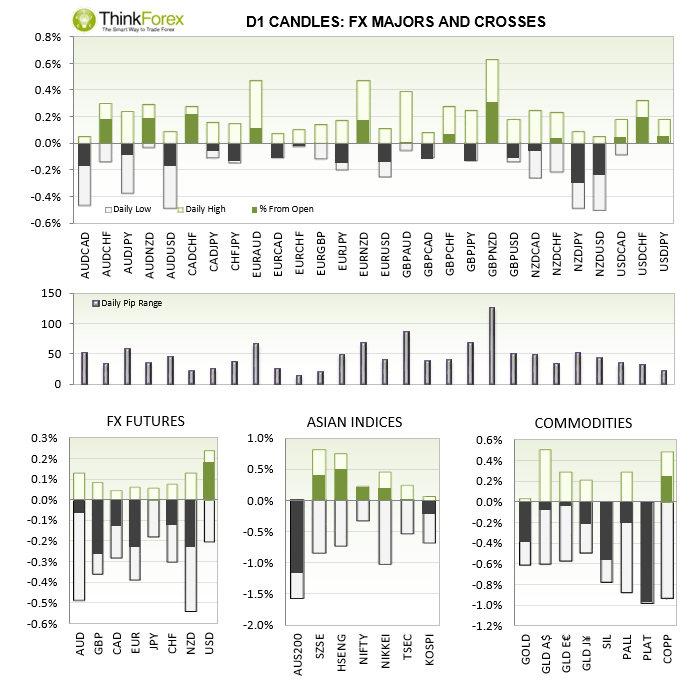

MARKET SNAPSHOT:

UP NEXT:

TECHNICAL ANALYSIS:

GBPCAD: Confirms change of near-term trend

Friday broke above the prior swing high and bearish trendline to suggest a change in trend is taking place. To trade this on the long side I would prefer to see a pullback to around 1.8662-92 area befire a run up towards 1.89.

If we see a deeper pullback then we can see if the previous trendline holds as support before seeking bullish setups.

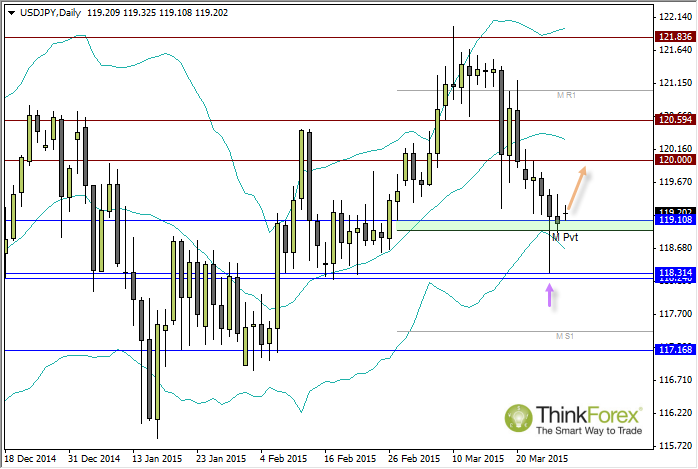

USDJPY: Potential for USDJPY to follow USDCAD

I had expected to see a bounce in both CAD and JPY last week but, so far, only CAD has seen the bounce. Yen has gained strength for its safe haven status so if we see a return to risk-on from investors then I would expect USDJPY to bounce higher along with USD Indices (US30 also looks ripe for a bounce above support).

Technically Thursday's Bullish Hammer penetrated but closed above the lower Bollinger Band with Friday producing an Inside Day, above the Monthly Pivot. If we do see a return to risk on then Friday's low may provide an area to consider for a tighter stop.

However as I suspect the corrective nature of global markets to continue then I would prefer to keep profit objectives tight and not outstay my welcome.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.