Chinese economy growing at its slowest pace in 5yrs, coming in at 7.3%. Industrial production was above expectations at 9%.

RBA released the monetary policy minutes but was a non-event price wise. Read the breakdown here

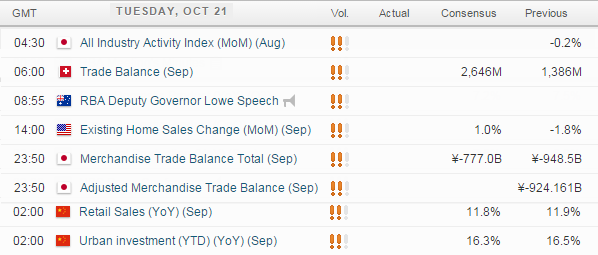

UP NEXT:

TECHNICAL ANALYSIS:

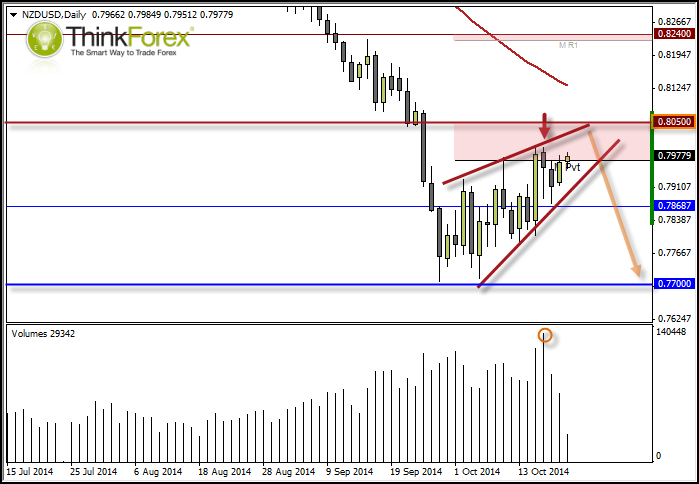

NZDUSD: Title

Today was one of those days I was struggling to find anything of particular interest, mainly because many of the currency pairs are either stuck within horrid ranges, or have no pending catalysts.

Therefor I am now referring to D1 as this is something to keep in your watchlist.

Due to my analysis of the USD Index I suspect we will continue to see choppy range trading this week. However NZDUSD is now drifting towards the upper part of the 77-80c range, with bearish divergence and a Hanging Man on higher volume. This does suggest we may have an interim top approaching 80.50, the Jan low, and potential for a Bearish Wedge.

We do not have data from NZ until Thursday and Friday which includes Trade Balance and CPI. Any soft data here should see NZDUSD back within range. However before this we also have US inflation data which is strong could see the topping sooner or later.

A break above 80.50 invalidates the analysis so we can place a stop above here as we await the catalysts. This then leaves the decision of how to enter. Picking tops can be tricky as there is always room for one more high, so I would prefer to set a sell limit below 80.50 with a stop well inside this key level, which could achieve a minimum of a 2:1 reward/risk ratio.

Target 1: 0.786

Target 2: 0.77

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.