UP NEXT:

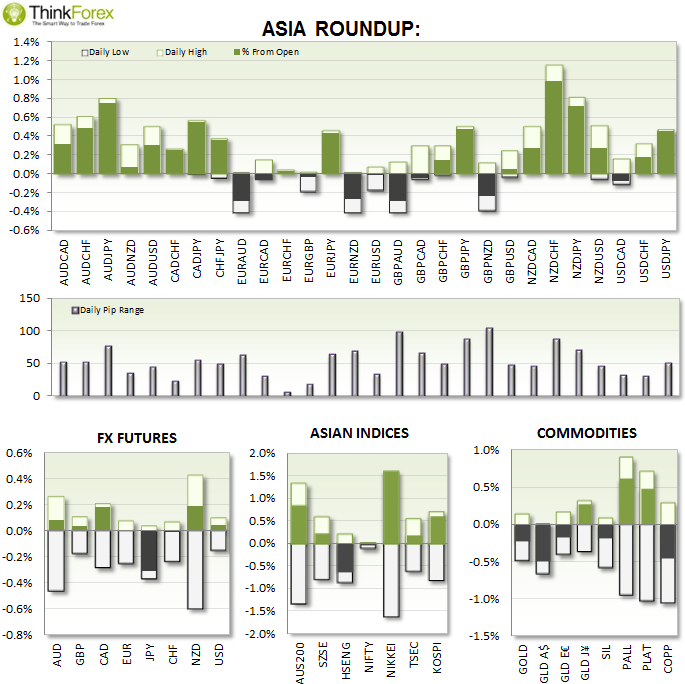

No 'red' news today so I expect price action to trade within ranges with potential for whipsaws between key levels. The markets are waiting to Central Bank speeches and minutes to be released to may be better to trade intraday timeframes and not outstay your welcome.

TECHNICAL ANALYSIS:

USDCAD: Seeking bullish setups above 1.12

With a lack of news tonight the risk is for choppy trading across the board. USDCAD is meandering around the weekly pivot and coiling up within a potential bullish wedge pattern.

Technically I suspect we'll get a move towards 1.12 support where we could then seek bullish setups in hope of the bullish wedge. However for this to materialise we do require a USD bullish catalyst, so be prepared for limited moves and to remain within ranges.

We are currently trading near the annual highs so we may find any bullish moves quite limited as we lead up to US inflation data later this week.

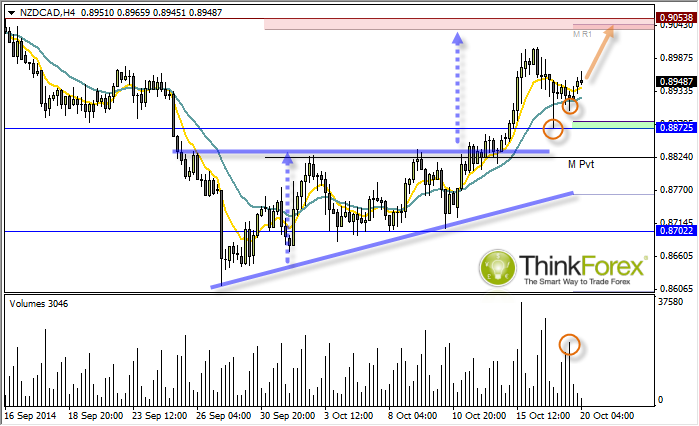

NZDCAD: Intraday targets 90c

The original analysis called for 0.8860 to hold as resistance for a swing trade short. It was not to be. Instead we saw an upside break of this level which confirmed an Ascending Triangle, projecting an approximate bullish target around 0.90.

Intraday timeframes favour the bullish momentum and provides higher highs and lows. We have also seen a spike low at 0.8872 to suggest a swing low, which was then accompanied by higher volume on low-range candles to suggest another swing low has formed.

Therefore the idea is to seek bullish setups above these swing lows to target 0.90.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.