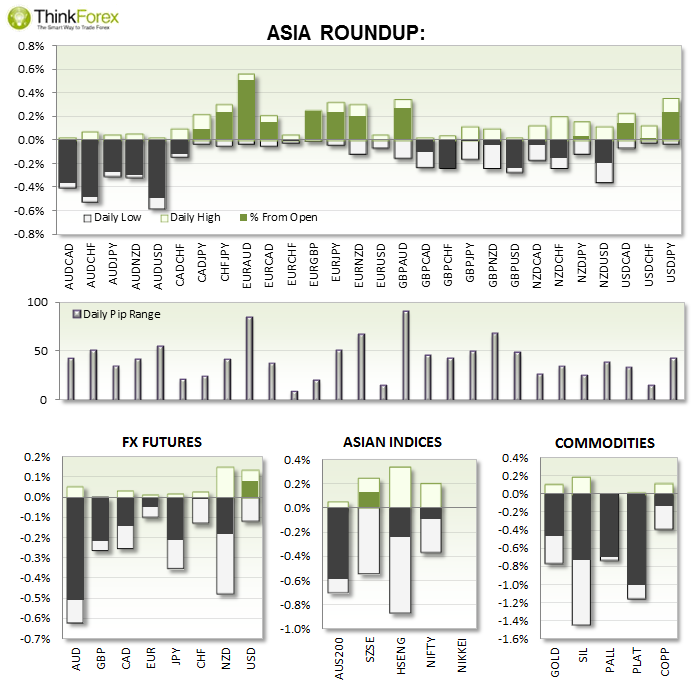

Australian Dollar continues to unravel: 2 members of RBA (including Glenn Stevens) expect the A$ to continue to unwind over the foreseeable future, so perhaps we are finally seeing the resumption of the A$ downtrend I have been banging on about all year! Maybe...

USD remains strong: Traders continue to pile into the Greenback in the lead-up to next week FOMC and FED meetings next week. It could be another explosive week, especially if they disappoint.

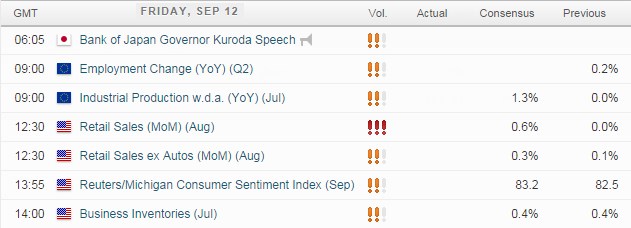

UP NEXT:

EUR: High expectations for industrial production, which leaves room for disappointment if falls flat. EURUSD remains within range but could be due a breakout this session.

US: Data from the US is more likely to provide any catalysts tonight. Keeping in mind that the Greenback has been exceptionally strong, so if we see enough poor data tonight this could cause deeper retracements. Until then it is advisable to stick with the dominant, USD bullish trend.

TECHNICAL ANALYSIS:

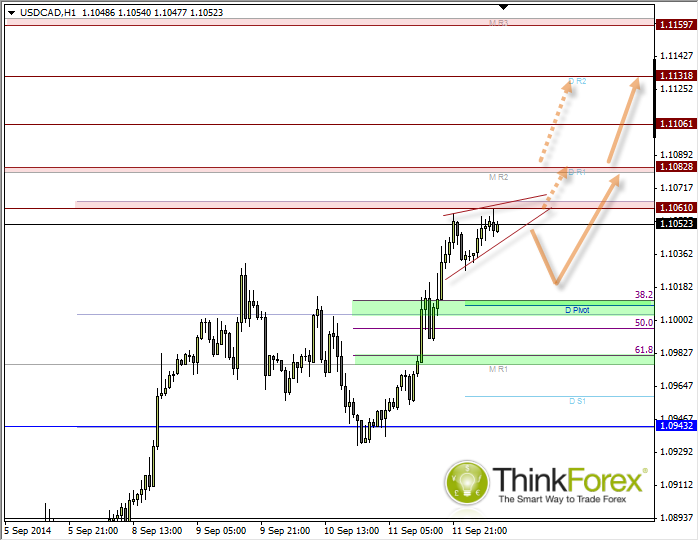

USDCAD: Hovers below resistance; Awaits next directional clue

With a US data dump tonight we do run the risk of low-range trading leading up to this event. This makes an ending diagonal (bearish wedge) below the resistance zone a likely scenario, which if confirmed would target the base of the wedge pattern as a minimum.

At which point, taking into consideration the bullish trend on daily, weekly and monthly timeframes then I can consider bullish setups at the highlighted support zones.

Should the bearish wedge not materialise then we can expect direct gains above the weekly highs to the next resistance zone.

EURUSD: Potential triangle; Selling into rallies below 1.30

With data form Eurozone and US tonight it should [hopefully] be enough to break out of range. Fingers crossed. Whilst it may be tempting to look at EURUSD D1 and say 'this looks oversold' it always leaves room for another leg lower if we see poor Euro data and string US.

That said, if we close the week around current levels it will provide a Bullish Hammer on D1. until then, I am seeking sell set-ups below 1.30 as this is a string zone of resistance. Ideally we will see direct losses as part of a continuation pattern.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD climbs above 1.2450 after US data

GBP/USD extended its recovery from the multi-month low it touched near 1.2400 and turned positive on the day above 1.2450. The modest selling pressure surrounding the US Dollar after dismal housing data supports the pair's rebound.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.