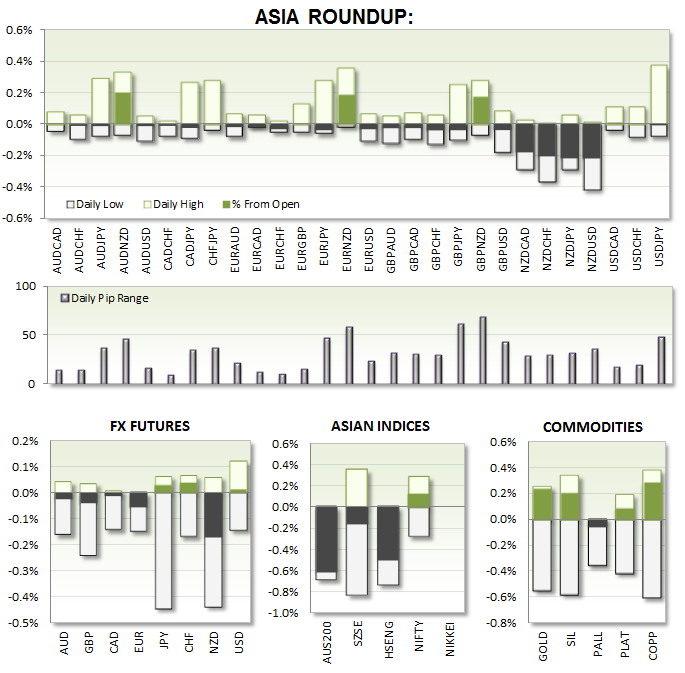

Not surprisingly prices were very sheepish and traded in narrow ranges following yesterday's excitement, and awaiting Nonfarms tonight. This type of environment tends to suit scalpers and short-term trades, whilst punishing those seeking breaks out established trends.

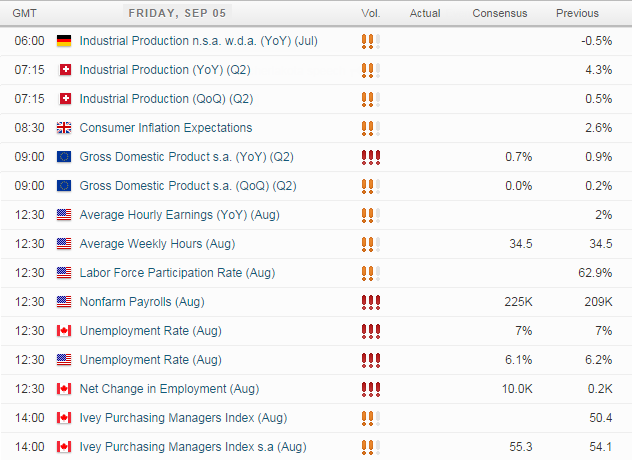

UP NEXT:

Whilst the markets still recover from last night's actions we have a decent bill of action tonight too. The chances are it may not be so explosive as the ECB actions but as long as we know where to look and for what reasons then opportunity should still await.

EUR: With growth linked to inflation (or lack of) we may find that a surprise upside figure from the Eurozone tonight could some profit taking on EUR pairs. Just don't expect it to change the increasingly bearish trend overnight.

US and CAD: With employment data released form both CAD and US at one then USDCAD could be the go-to pair. Please register for today's webinar for a break down of this release. Also note we have Ivey PMI for August. although Nonfarm data is likely to provide the most action.

TECHNICAL ANALYSIS:

As I will be hosting a webinar on Nonfarm Payroll shortly covering the majors, today I will include setups to monitor for the week/s ahead and a pair generally unrelated to NFP.

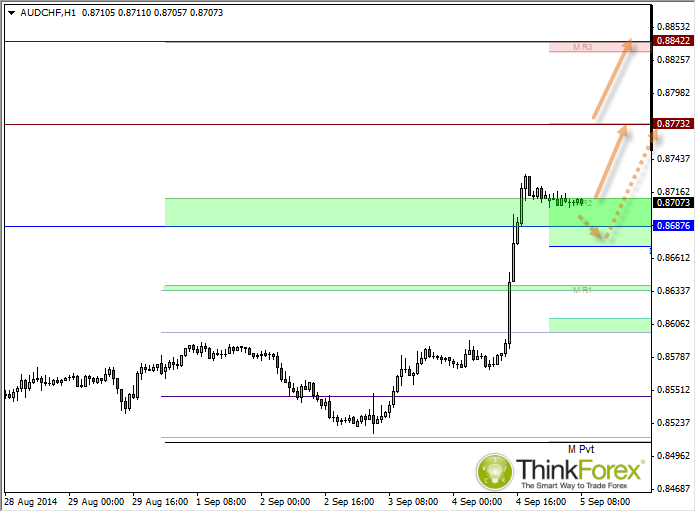

AUDCHF: Calm before the storm

A cursory glance at the upper timeframes will quickly confirm the bullishness of this pair. Trading above the daily pivot we should allow room for a downwards spike before the trend continues towards 0.877 and 0.884.

CADJPY: One for your watchlist

This may be one to monitor next week. However we remain within a bullish trend where a 'buy-the-dip' strategy is favoured. As we have Canadian employment data we could see some volatile here to which may require a redraw of the channel. Ideally CAD data will come in strong to help create a retracement towards the lower channel, allowing us to seek bullish setups from Monday onwards.

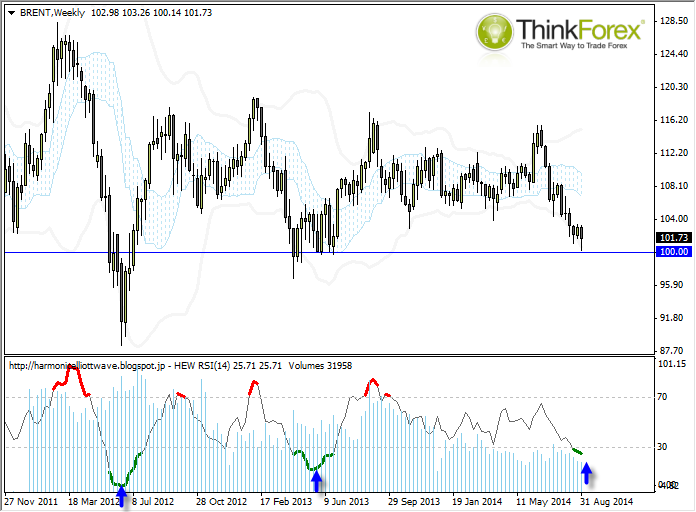

WTI: One for your watchlists

Price tested the 100 target set a few weeks back. I would not be seeking to buy at these lows along, however both WTI and Brent are pausing at support levels on W1 which suggests potential for a basing pattern to form.

Looking ahead, if an eventual bullish trend does develop then this would help see USD retrace over coming weeks and allow us to plan our Major cross trades too.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.