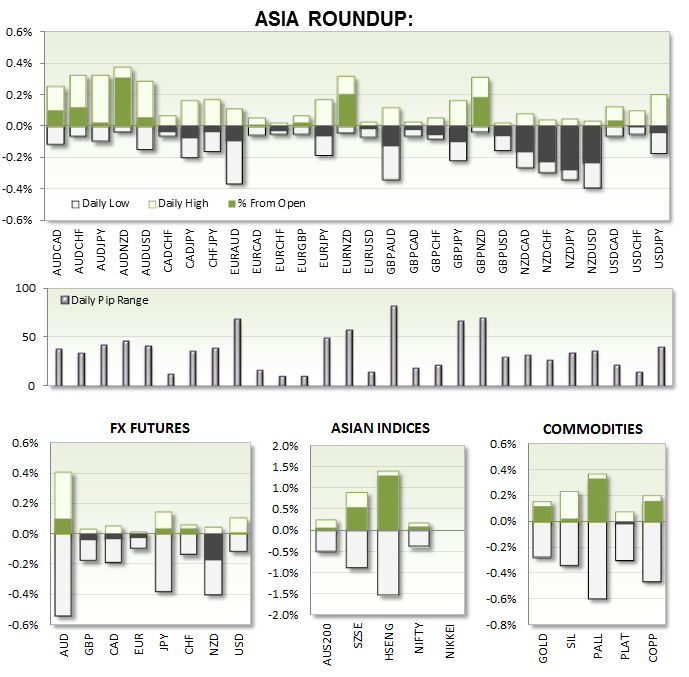

Money Flow:

- Early Asia saw a continuation of USD strength, but it was Cable in particular that stole the show with a break to a new 23-week low. It recovered mildly back above the March '14 lows but a reminder of just how fragile GBP looks right now. Near the end of the session the USD gave back across the board, but not sure if this triggered by profit taking, heavy shorts entering or both at this stage. However it raises the odds of 'corrective' price behaviour and to remain within yesterday’s trading ranges.

News:

AUS GDP came in slightly above expectations to see A$ spike to 93c but this was shortly lived as price promptly returned to pre-GDP levels. The markets awaited Glen Stevens speech where he cited low rates are good, but they avoid build up of risk. Whilst business is well positioned to looses strings.

China Services PMI rebounds form 9-year low of 50 to sit at 54.1

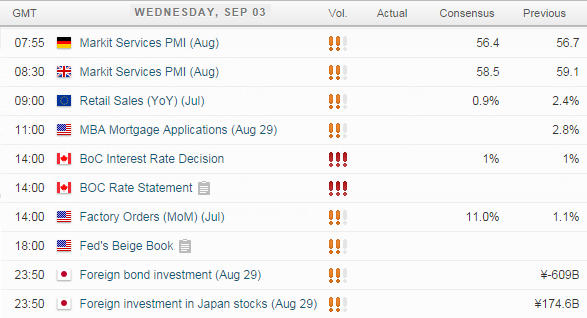

UP NEXT:

UK: Despite yesterday's construction PMI at its highest since Feb it was the Scottish Independence debate which took the main headlines and saw Cable break to fresh new lows. This appears to be the main driver for Cable at the moment so it may not be a scheduled release which effects it so much.

EUR: Retail Sales for Eurozone and Services PMI for Germany, Spain, Italy and Eurozone are likely to be overshadowed by tomorrow's ECB minimum bid rate. Therefore I expect any EURUSD moves to be dictated by USD money flow if we see any action today.

CAD: Rate Decision - Please read today's post for an insight

USD: Factory orders are expected at an impressive 11% so any shortfall here is likely to cause a mild correction on USD. However due to overall Greenback strength it would be wise not to fight the raging bull. The Beige book is of more interest to the economists than day traders, so not likely to cause a tradable reaction.

TECHNICAL ANALYSIS:

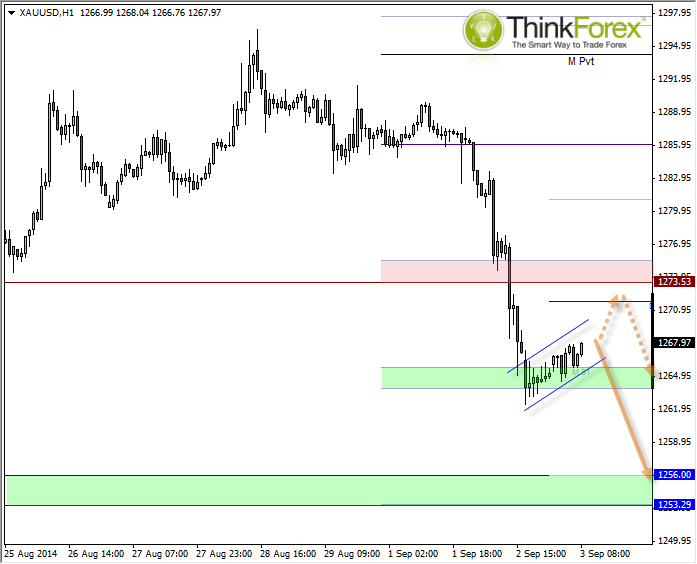

GOLD: Dead-Cat bounce anyone?

Bias:

Due to the nature of yesterday;s decline (hard and fast) I will deem any rally a retracement. We have currently found support ar the Monthly/Weekly S1 Pivots but we really need to remain below $1273 resistance for this analysis to remain valid. However in true spirit of a Dead-Cat bounce, the smaller the retracement the more downside we can assume if it occurs.

Counter-Bias:

Gold tends to react to Geo-political news, USD strength (or weakness) or the feel to take risk (which tends to be Gold selling). So if we do not see a combination of the above then we may end up in choppy, non-directional trading. What the catalyst may be I cannot predict, but at this stage I will assume we require continued USD strength for this to play out for the bias.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.