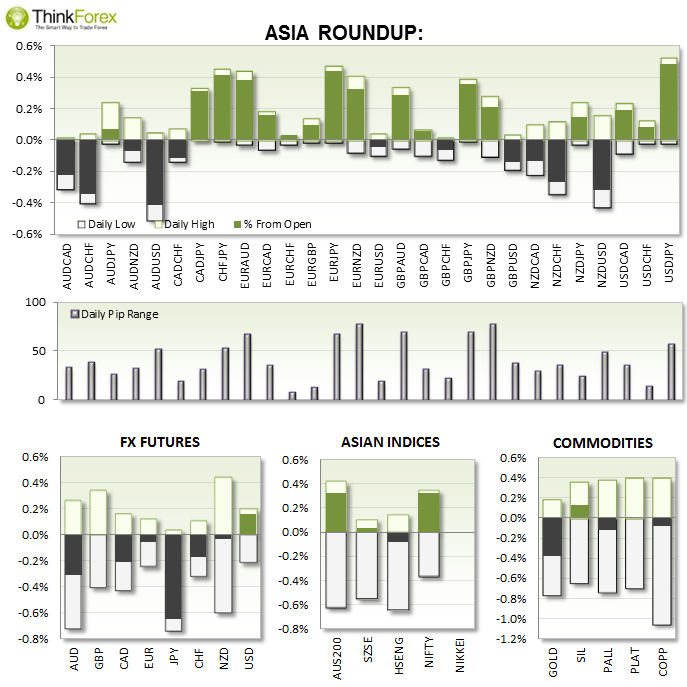

AUD: Consumer confidence falls whilst House Building approvals increase to effectively cancel each other out; Cash rate remains on hold at 2.5%;

JPY: Sold off across the board, fueled by a strong Nikkei following hopes of GFIP reform.

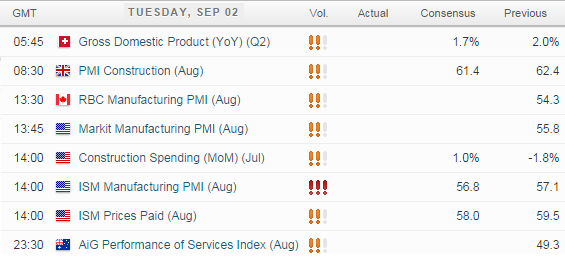

UP NEXT:

UK PMI: The sector appears to have peaked a few months back and today is forecast slightly lower at 61.40. Due to the lower expectations we can take any reading above 61.50 as bullish for GBP, and even more so if it is higher than last month's 62.4. We have seen a steady stream of UK data missing the mark of late, yet still managed to stay up against the Greenback next week. This could be a sign that a bottom is forming on the longer-term charts (early days yet though so trend trades remain the favoured approach).

US Data: We have 4 releases over 15-mins from US with the headline figure also being PMI. It is a similar story to UK PMI so the same analysis applies.

TECHNICAL ANALYSIS:

GBPJPY: Targeting 174.20 within bullish channel

It is refreshing to see clear trends developing. Here we have a texbook trend on H1 within a tight bullish channel. Due to the fact the pullbacks are relatively small we do run the risk of direct gains and not pulliung back to 173.50.

However we do have UK PMI data which is falls short may produvde that deeper reracement. 173.50 provides several techical levels of support so I would prefer to seek bullish setups above this level, and stand aside if we break below 173.50.

Counter-trend traders could consider bearish setups below 173.50 towards 173.It is refreshing to see clear trends developing. Here we have a textbook trend on H1 within a tight bullish channel. Due to the fact the pullbacks are relatively small we do run the risk of direct gains and not pulling back to 173.50.

However we do have UK PMI data which is falls short may prodded that deeper retracement. 173.50 provides several technical levels of support so I would prefer to seek bullish setups above this level, and stand aside if we break below 173.50.

Counter-trend traders could consider bearish setups below 173.50 towards 173.

GBPUSD: Bullish opportunities within a bearish pattern

The British Pound has managed to fend of the mighty Greenback this past week, however the intraday timeframes are suggesting a potential bearish flag is forming. However whilst it remains within the channel then we can consider bullish trades above the lower trendlines.

A likely stalling point is 1.6610, and a break below the lower trendline confirms a bearish resumption in line with the daily and weekly timeframes.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.