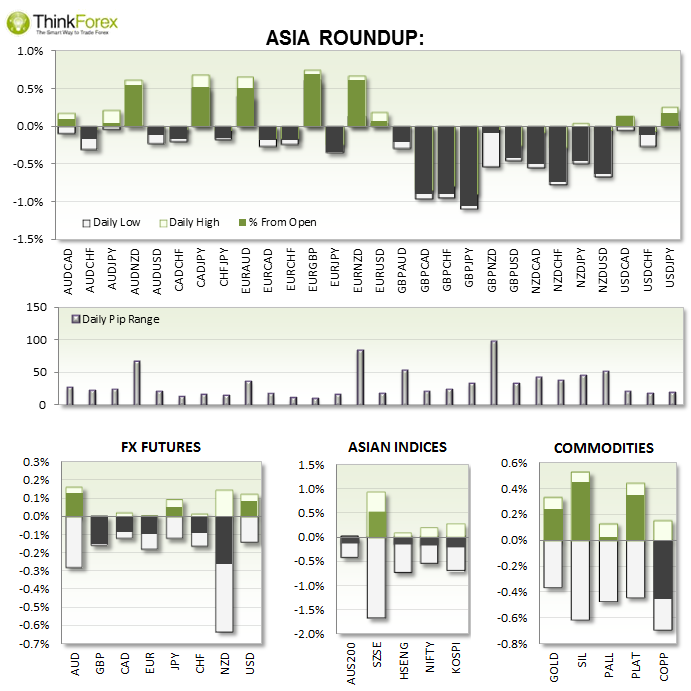

AUD business confidence at highs not seen since October 2013 and rises for a 4th consecutive month.

NZD House Price Index contracts a further -0.7% to see the 3rd consecutive decline. The Kiwi Dollar took a hit across the board and testing key S/R levels against USD, JPY and EUR. AUDNZD traded to a 3-day high.

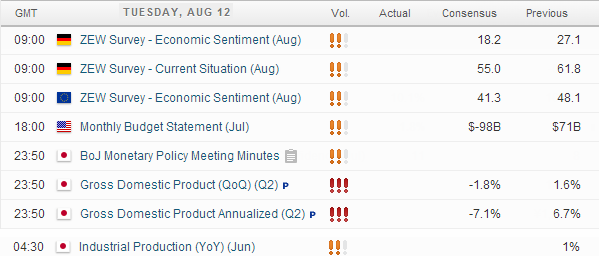

UP NEXT:

TECHNICAL ANALYSIS:

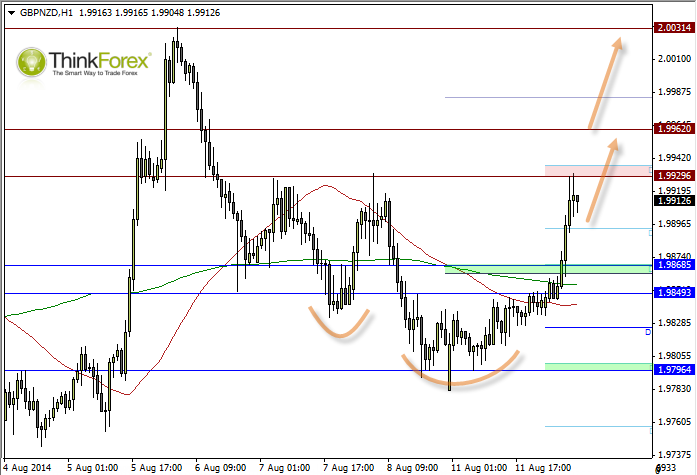

GBPNZD: Bottoms up!

Whilst it would appear at first we have missed a big part of the bullish move, there may be a longer-term opportunity to consider bullish setups above 1.9930-40. It appears to be a 'cup and handle pattern' although the handle (smaller rounded bottom) tends to be on the right and not the left. Still, it does highlight a clear breakout level - so if we do trade above the resistance zone we could seek bullish setups on lower timeframes in the direction of the breakout.

For those who wish to get in earlier we could consider buying any pullbacks at support levels to anticipate the breakout. A level to consider is around 1.9840.

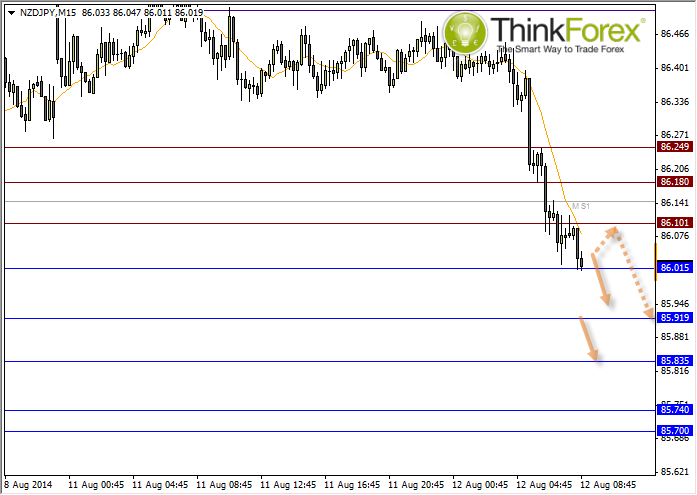

NZDJPY: Intraday momentum is clearly bearish

It's not often I refer to the 5 min chart but the trend is well established and there are clear levels of S/R to consider as profit objectives or buy/sell zones in line with the trend.

As the Kiwi has by far been the biggest mover throughout Asia we are requiring for this sentiment to continue when Europe and London markets open.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD recovers to near 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to near 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY bounces back toward 154.50 amid risk-recovery

USD/JPY bounces back toward 154.50 in Asian trading on Thursday, having tested 154.00 on the latest US Dollar pullback and Japan's FX intervention risks. A recovery in risk appetite is aiding the rebound in the pair.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.