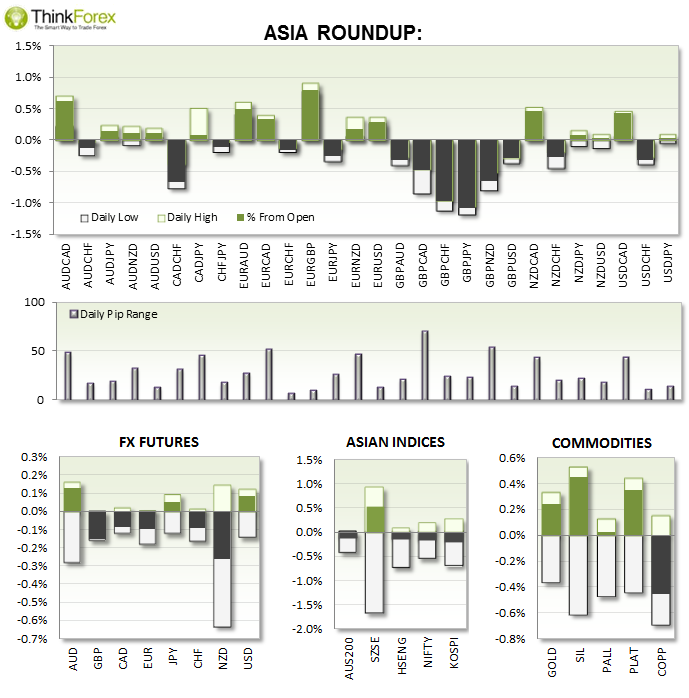

Quiet start to the FX week as prices remained near last week's closing prices

JPY consumer confidence up from last month but slightly below expectations, at 41.5 vs 42.3 forecast;

Tertiary Industry Activity contracts by -0.1% m/m

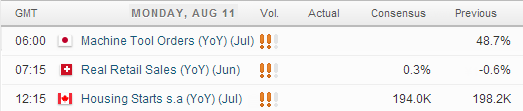

UP NEXT:

Being a relatively quiet start to the week we can expect market moves to be limited (albeit any increase geo-political concerns). Under such events then safe havens such as USD, CHF, JPY and Gold tend to attract the money flow.

TECHNICAL ANALYSIS:

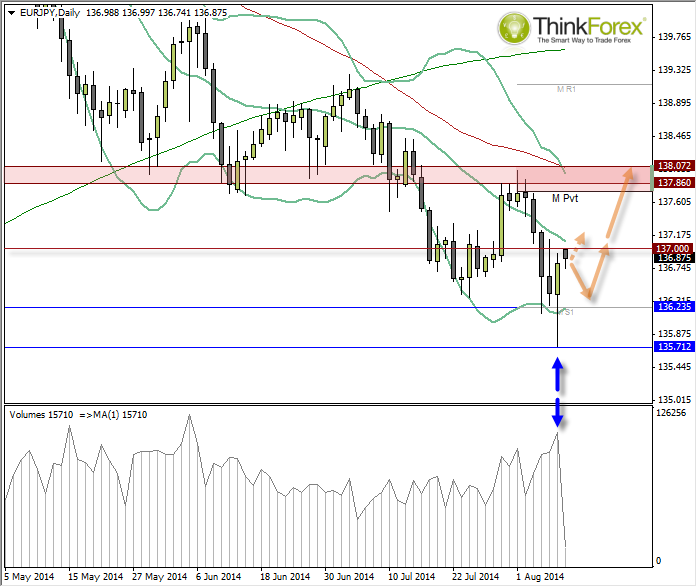

EURJPY: Trading the bans

Friday's candle with a Bullish Hammer with an elongated body and on high volume. This suggests a bottom (near-term) and the fact it is now back within the Bollinger Band suggests we may now travel towards the opposite band.

However at current prices is difficult to achieve a decent reward/risk ratio, so I would prefer to buy into any weakness and seeking bullish setups on lower timeframes within the body of Friday’s candle.

Of course the trouble with this strategy is you are trading against the trend, which makes it extra risky. For this reason I would require a decent reward/risk ratio to justify the additional risk.

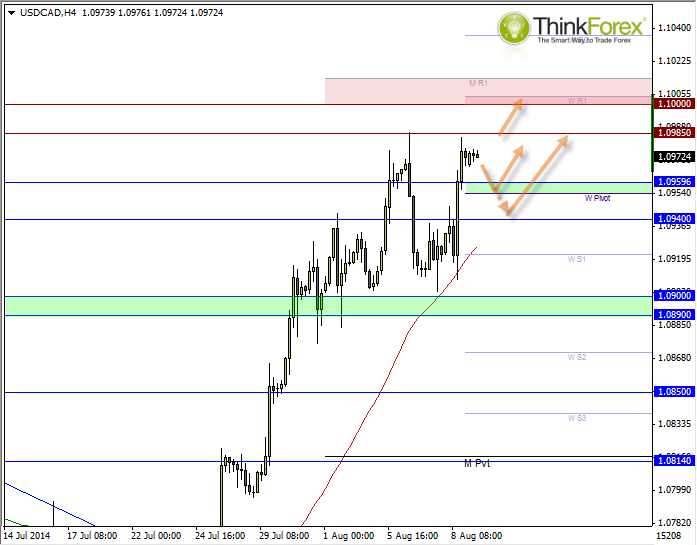

USDCAD: Eyeing up 1.10

We can within a cat-whisker within this key level and that fact that USDCAD closed near the weekly highs and open back up at these levels (without gapping) suggests we may well test 1.10 this session.

With Canadian Data out tonight then any shortfall should help support USDCAD en route to 1.10.

Any retracement towards 1.0955 may entice bullish swing traders, or for a deeper pullback we can consider buy setups around 1.094 However below here I would prefer to stand aside until a clearer direction begins to take hold.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.