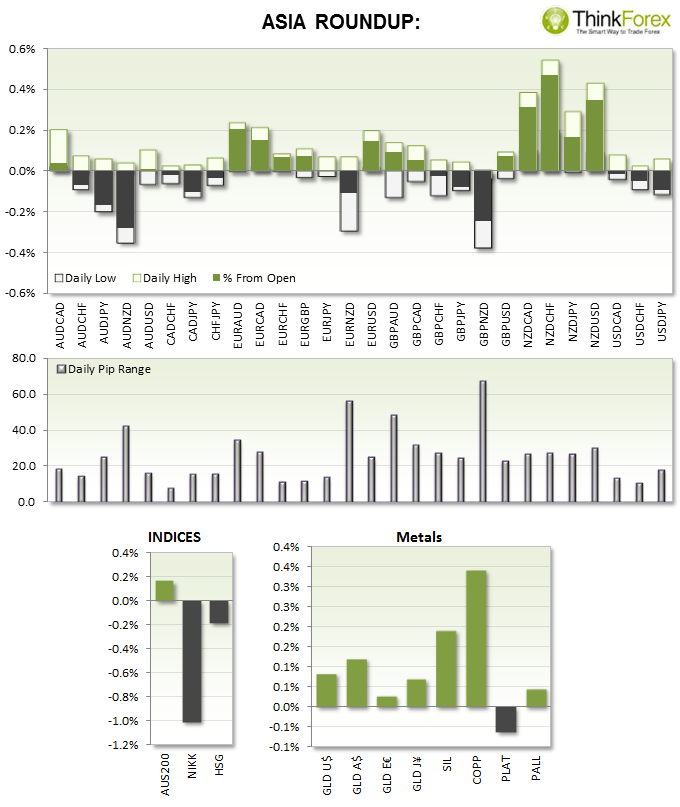

Lower liquidity today due to Japanese Bank Holiday

HSBC upgrade Chine growth forecast to 7.5%, up 0.1%

AUDNZD traded higher form open early Asia as Traders favoured the A$ over N$

NZD immigration remains strong which poses upside risk for Kiwi Dollar

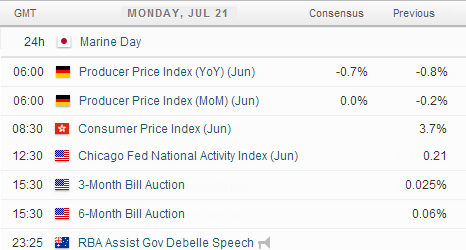

UP NEXT:

No red news to drive the markets today so we may be in for a quieter session, albeit further escalation surrounding Malaysian Flight MH17.

TECHNICAL ANALYSIS:

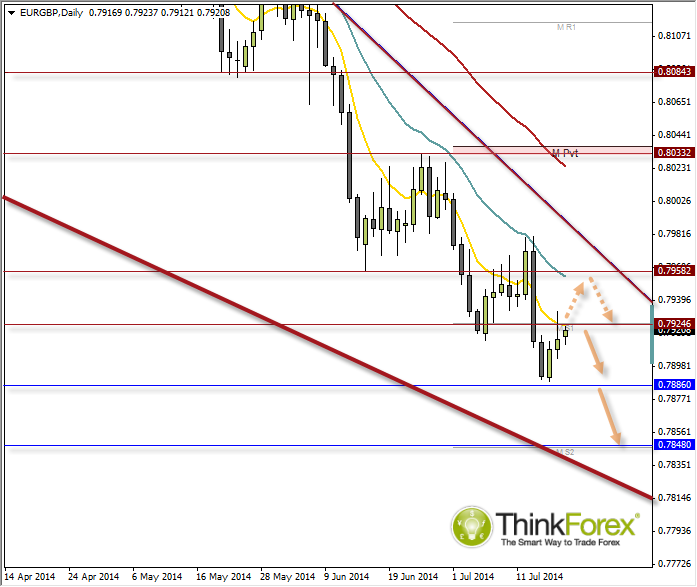

EURGBP D1: Seeking bearish setups on the daily timeframe

Friday closed with Shooting Star below the 8eMA and 0.7925 resistance level. As we remain light on News tonight this may take a few days to come into play, but the trend remains bearish as continues to print lower lows/highs.

If we break above Friday’s high then seek bearish setups below 0.7958, which is likely to provide more reliable resistance with the 21eMA, horizontal resistance and bearish trendline.

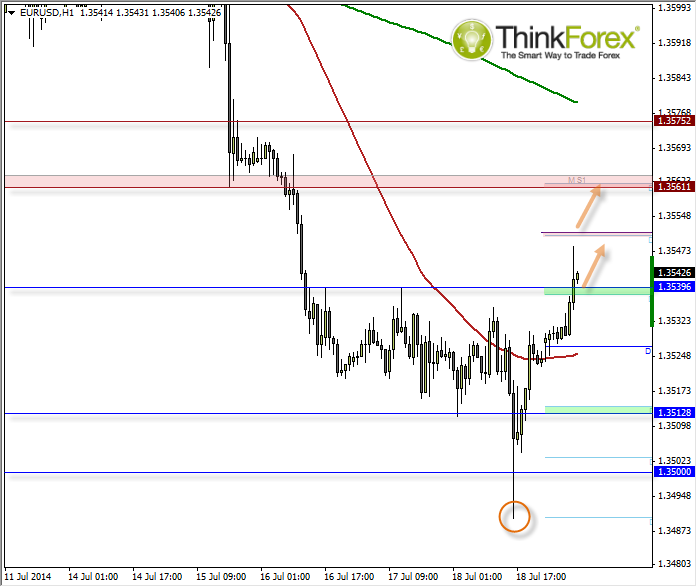

EURUSD H1: Intraday spike warns of pending strength

The closely watched 1.50 level finally gave way last Friday, only to see it bounce aggressively back above to produce a Bullish Hammer. This spike low could be taken as the first clue to near-term strength, but going into today’s European open we can also see that price has broken above 1.354 resistance (now likely support) and intraday bullish momentum is increasing.

This favours long setups on lower timeframes using the daily and weekly pivots as intraday targets.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'