ASIA ROUNDUP:

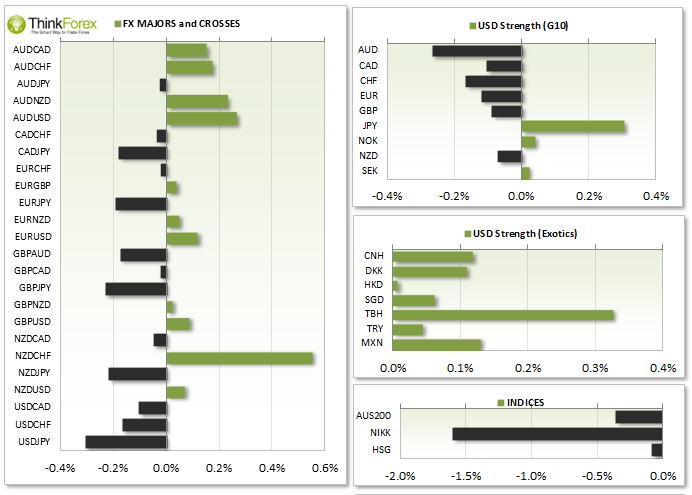

NZ Trade Balance came in above expectations to see the Kiwi Dollar break to a 2.8yr high. It edged lower during early Asia and trades below Weekly R2 Pivot.

Japan's jobless rate falls to lowest in 17 years in May; Inflation slows slightly with retail sales down -0.4%, however coming in better than the -1.9% expected and last months -4.9%.

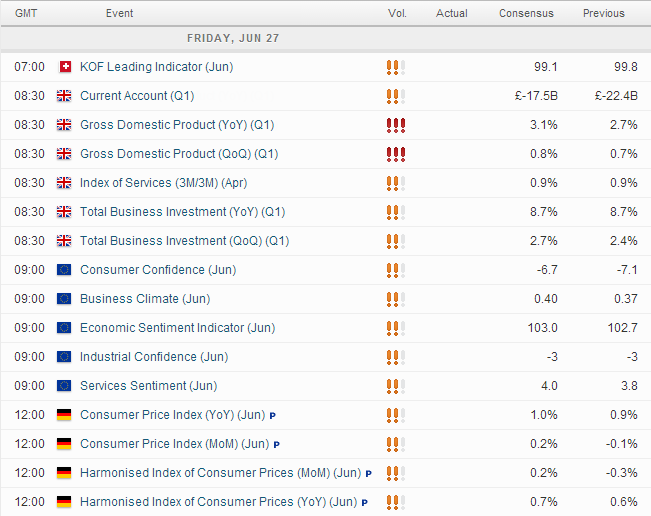

UP NEXT:

UK GDP is the 3rd release, so generally not as much volatility can be expected unless the first two are heavily revised. However any positive readings will add further pressure for BoE to raise interest rates 'sooner than later'.

UK Current Account continues to be in decline with today's consensus...

German Data, whilst listed as 12:00 GMT, is data that is released throughout the trading day as it comes from 6 separate states. Therefore it is something to be aware of to assess overall strength of Eurozone, but may be harder to trade the data itself.

TECHNICAL ANALYSIS:

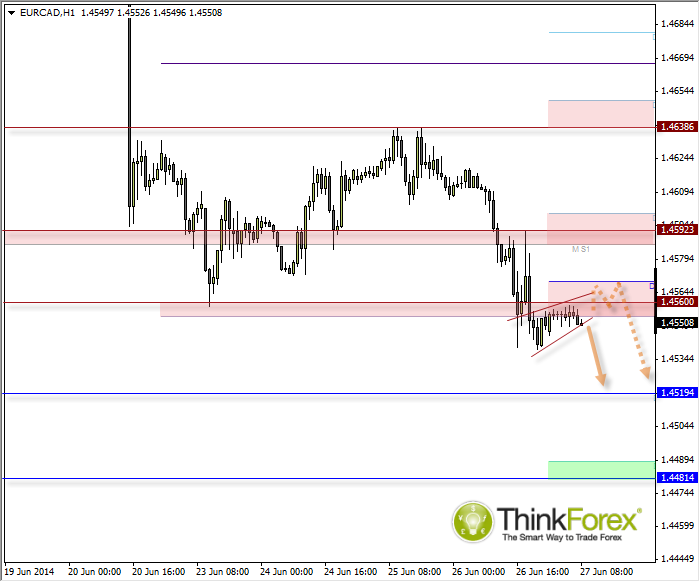

EURCAD: Bearish below daily pivot

Whilst price trades within a potential bearish continuation pattern, it also allows plenty of room to trade back to the daily pivot before losses resume. With Euro data out tonight and NZD currently the strongest FX currency there is room for movement here, regardless of which direction.

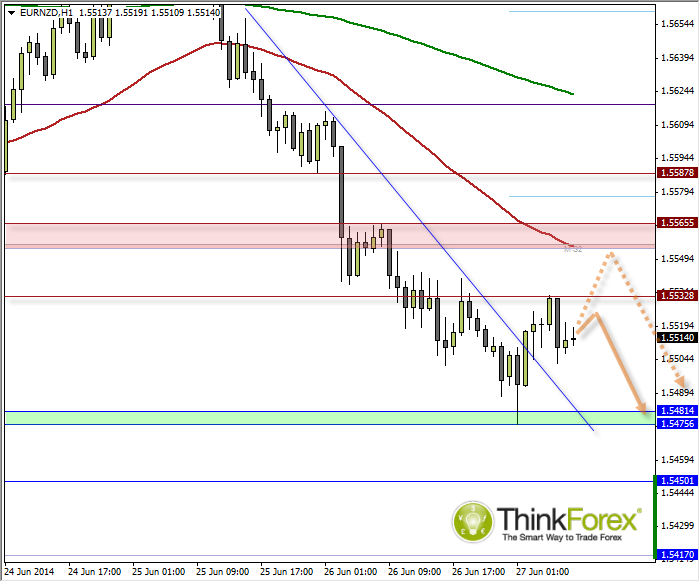

EURNZD: One more dip lower?

Whilst 1.5532 has just been rejected by a Bearish Engulfing candle on H4 to suggest a swing high is in place, the preceding upswing did break a bearish trendline to warn of pending strength. This leaves room for a deeper retracement towards 1.555 before a resumption of the bullish trend.

However due to NZD being the strongest Major currency at the moment further losses are expected. It is just a case of identifying the end of the [suspected] current correction.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.