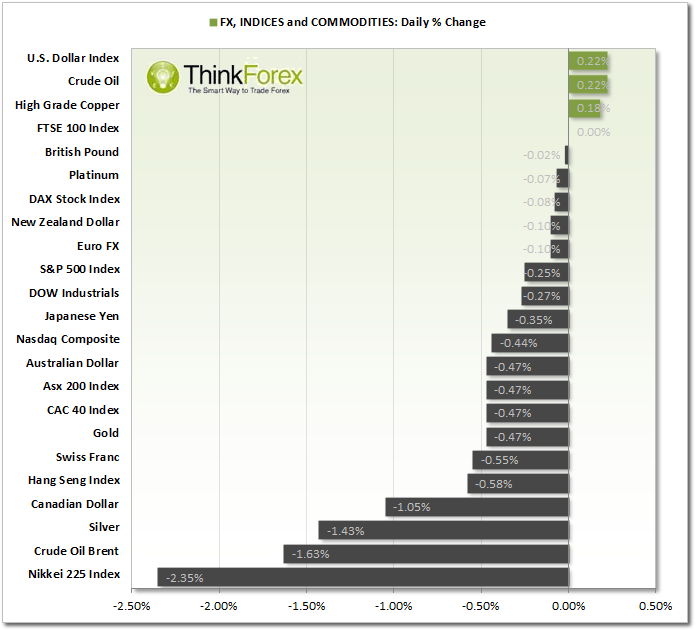

Market Snapshot:

US economic growth was given an extra boost as the trade deficit gave its lowest reading in 4 years, driven by America's domestic energy revolution. As a result Morgan Stanley has raised its Q4 growth to 3.3% and JPM claim this is more in line with 3% as opposed to 2.5% as previously thought.

USDCAD broke out to a record high today. NZD is by far the strongest single currency this week and currently trading at record highs against CHF, CAD and JPY.

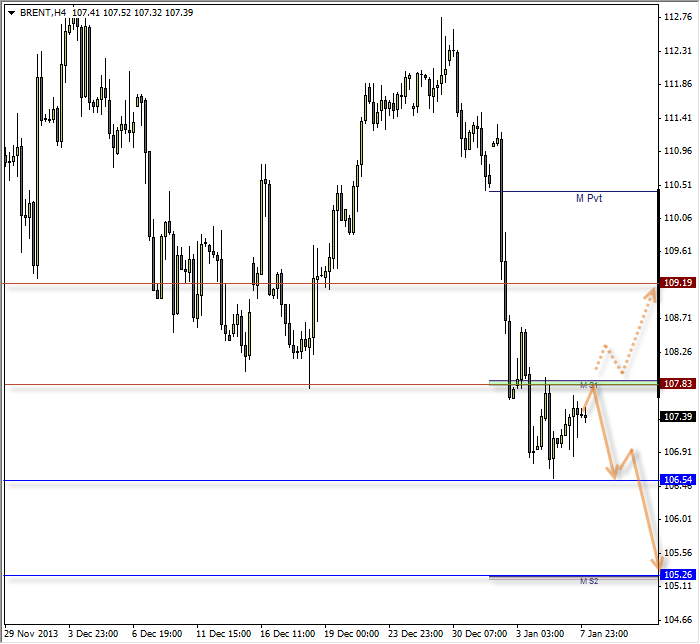

BRENT: Within bearish correction with potential down to 105.20

This trade may take a little while to play out but the bearish bias is assumed due to the speed and trajectory of the direct losses from 111.50 swing high.

We have also broken beneath the Monthly S1 pivot which has also acted as resistance along with the pivotal S/R level of 107.80. As long as 107.80 holds as resistance then next target is the lower area of 106.50 with a suspected breakout down to 105.30.

In the event we break above 107.80 then the preference is to wait for a pullback to this area and seek bullish positions with a possible target around 109.00.

As Brent is traded in USD should the bearish bias play out then this would cause inflow to USD and help it appreciate in strength. Therefor it is always adviseable to keep an eye on the commodity markets even if you trade Forex exculsively.

GOLD: Potential 5-wave count projects target at 1220

Yesterday's analysis played out much better this time around. The broken trendline held and we formed a Hanging Man Reversal (bearish candle with high wick) beneath the resistance level, before reversing and hitting the initial 1228 target.

I am not one to usually use Elliot Waves as part of my day to day analysis but this potential 5-wave move down did jump out at me. Additionally the Fibonacci extension of the 3rd wave does project a potential 5th wave ending around a support level, so I decided to include it in today's analysis.

What I am not as clear on is if we have seen the end of wave 'iv'. If we have then we should see direct losses down to the 1220 area. However we may have to also consider we are still within wave 'iv' and for either a 'flat' (dotted line) or expanded flat to occur before resumption of losses.

Due to the pivotal S/R at 1233 I have excluded the possibility of the expanded flat (as this would break above this level) so my bias is for direct losses down to 1220, with the potential for a rally to 1233 before a resumption of losses.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.