- USD/CAD Breaks 1.31, Surges to 10 Year Highs

- AUD Dips Ahead of RBA

- NZD Resilient Ahead of Dairy Auction

- GBP: Potential for Big Gains This Week

- Dollar Ticks Up Despite Data and Yields

- Euro Shrugs Off Major Losses for Greek Stocks

Currencies in Play - CAD, AUD, GBP

Nearly all of the major currencies are in play this week but our initial focus will be on the Canadian dollar, Australian dollar and the British pound. USD/CAD climbed to its strongest level in 10, almost 11 years on the back of falling oil prices, the prospect of a National Election and a surprise contraction in GDP growth in the month of May. Over the weekend Prime Minister Stephen Harper called for an election on October 19th. This election comes against a backdrop of an "uncertain and unstable" economy at a time when the currency is very weak. As a result, Harper may have to do more than plea for Canadians to extend his 9-year term to 12 years. While we believe that the Conservatives will remain in power, political uncertainty is rarely good for a currency. Over the past 3 months, the Canadian dollar lost over 7% of its value against the greenback making travel and trade between the U.S. and Canada the cheapest since 1994. In the long run, this will be very positive for Canada's economy but in the short term, the decline in the currency and the more than 20% drop in oil prices means further gains for USD/CAD. This week's Canadian employment report could be ugly and having cracked above 1.31, there is no major resistance in USD/CAD until 1.3475, the 61.8% Fibonacci retracement of the 2002 to 2007 meltdown.

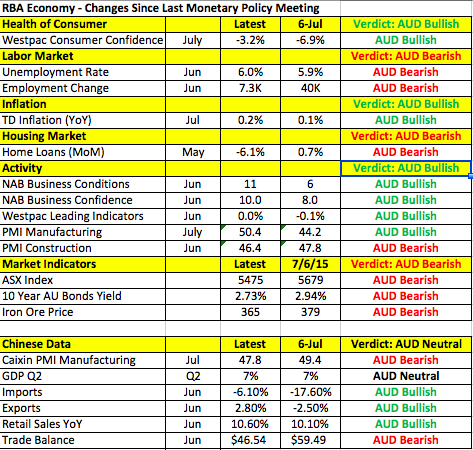

Meanwhile the Australian dollar remains under pressure ahead of tonight's Reserve Bank of Australia monetary policy announcement. Dovish comments are not a done deal because the following table shows that there have been both improvements and deterioration in Australia's economy since the last meeting but Chinese stocks continue to fall and both the government and Caixin reported a slowdown in manufacturing activity in July. When the RBA last met, they made no mention of China in their monetary policy statement even as stocks were tumbling. The central bank simply left rates unchanged and said further exchange rate depreciation seems likely. The price action of AUD suggests that investors are cautiously pessimistic. We believe that while the RBA is not ready to cut interest rates now, further easing should be considered given the strains on China's economy. The New Zealand dollar on the other hand is holding up unusually well due to expectations for tomorrow's dairy auction. Prices fell over 10% last month and investors are hoping for a rebound or more moderate decline.

GBP: Potential for Big Gains This Week

Sterling ended the day unchanged against the U.S. dollar but we believe there's a potential for big gains in the currency this week. According to this morning's PMI report, manufacturing activity grew at a faster pace in the month of July. While the British pound did not receive a boost because the index rebounded from a 2 year low and export demand dropped for the fourth consecutive month, the overall improvement in manufacturing activity should keep the Bank of England optimistic about the outlook for the economy. As the central bank is in no position to raise interest rates in 2015, this perspective will be important because their tone will be the main focus this week. It will be a historic week for the British pound because for the first time ever, the Bank of England will deliver its monetary policy announcement, release the minutes from the meeting and its Quarterly Inflation Report at the same time on "Super Thursday". Forty five minutes later, BoE Governor Carney will hold a press conference. We know that the head of the U.K. central bank tends to maintain a hawkish bias. The big question is how many Monetary Policy Committee members will vote against keeping rates unchanged. Even if one shifts away from the consensus, it could be enough to drive sterling sharply higher.

Dollar Ticks Up Despite Data and Yields

The U.S. dollar ended the North American trading session unchanged or higher against most of the major currencies. The dollar remains extremely resilient in the face of falling yields and mixed economic data. Even though most investors believe that September is a realistic option for the Federal Reserve to raise rates, as we said on Friday the dollar has become extremely overbought and as a result unambiguously positive data is needed to sustain the currency's momentum. Personal income rose more than expected in June but personal spending growth slowed along with the PCE deflator, construction spending and manufacturing activity. The ISM index dropped from 53.5 to 52.7, its lowest level in 3 months. The main focus this week will be on jobs. The Federal Reserve made it clear that they want to see more improvement in job growth before pulling the trigger on tightening. Economists are looking for payrolls growth to hold steady around 225K and that will be good enough. As long as there aren't significant misses in any of the underlying components, which includes an increase in average hourly earnings, the dollar could hold onto its gains. However if wage growth slows, the unemployment rate rises or payrolls increase by less than 200K, then the greenback is in trouble. Factory orders and the IBD/TIPP Economic Optimism Index are scheduled for release on Tuesday.

Euro Shrugs Off Major Losses for Greek Stocks

It was no surprise that the Athens Stock Exchange saw major losses today after re-opening for the first time since June. Stocks closed down 16% but the impact on the euro was limited because everyone anticipated the move. Greece remains a trouble spot for the Eurozone but as each week progresses investors are discounting the crisis a little bit more and betting on an eventual deal with the EU. Meanwhile economic data from the Eurozone continues to improve with the manufacturing PMI indices revised upwards in the month of July for Germany and the Eurozone. While the U.S. labor market report is scheduled for release this week, we do not expect the EUR/USD to break its 3 month low of 1.0809. Instead we expect the pair to drift between the 1.08 to 1.10 range.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold price shines amid fears of fresh escalation in Middle East tensions

Gold price rebounds to $2,380 in Thursday’s European session after posting losses on Wednesday. The precious metal holds gains amid fears that Middle East tensions could worsen and spread beyond Gaza if Israel responds brutally to Iran.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.