- Behind the 1% Drop in the Dollar

- NZD Jumps 1%, But Beware of Selling into RBNZ

- AUD Traders Shrug Off RBA Minutes

- USD/CAD Rejects 1.30

- EUR/USD Short Squeeze

- GBP Consolidates Ahead of Bank of England Minutes

Behind the 1% Drop in the Dollar

The sell-off in the U.S. dollar today caught many traders by surprise. No U.S. economic reports were released but that did not stop the greenback from losing over 1 percent of its value versus the euro and New Zealand dollars. The move was driven primarily by the decline in Treasury yields as ten-year rates fell more than 4bp on a day when Eurozone, Australian and U.K. rates increased. However in the grand scheme of things the decline in rates is small and should not have triggered such a deep slide in the greenback. Instead we believe that the dollar's weakness had more to do with the currency being overbought. We have been arguing for a pullback in USD/JPY for a few days and now it seems that the decline in the buck carried over to other currencies. Today's decline in the dollar was driven by profit taking. Over the past 2 months, the EUR/USD, AUD/USD and NZD/USD became deeply oversold and the lack of catalysts today gave investors the perfect excuse to lock in some gains especially as the fear of a Grexit subsides and Chinese stocks stabilize. We are still bullish dollars but the lack of market moving U.S. data means that we could see further profit taking in the greenback. This decline should be viewed as an opportunity to buy the dollar at lower levels ahead of next week's FOMC rate decision. Although the Fed is not expected to raise interest rates in July, the tone of the monetary policy statement should be optimistic, reinforcing the notion that the economy is ready for tightening.

We will be looking to buy USD/JPY around 122.75/123.00 and believe that we will have the opportunity to do so not only because there could be some additional correction in the greenback but also because the latest Bank of Japan comments could have a further impact on the yen. This morning BoJ Governor Kuroda said he expects Japan's inflation rate to accelerate considerably in the coming months. This improvement in price pressures gave the BoJ head the confidence to say that there is no need for additional easing at this time which confirms that the BoJ is done for now. Some analysts had been looking for the Quantitative Easing program to be increased in 2015 but given Kuroda's latest comments and the tone of the latest BoJ minutes, this possibility is becoming less likely.

NZD Jumps 1%, But Beware of Selling into RBNZ

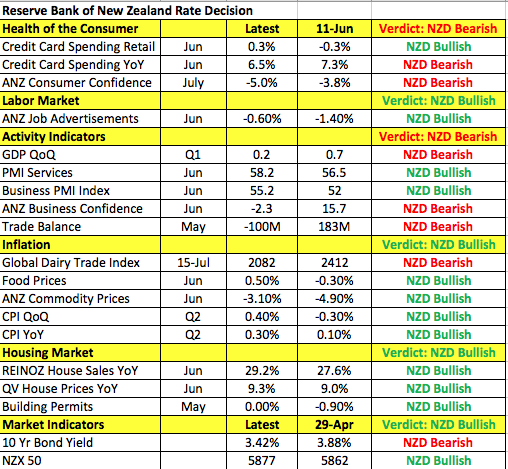

All three commodity currencies traded higher today with the New Zealand dollar experiencing the strongest gains. Over the past 48 hours, NZD/USD rose more than 2%, which is surprising for many because the Reserve Bank is gearing up to lower interest rates for the second time in a row. In June the RBNZ cut rates by 25bp and an equivalent reduction is expected for July. Considering that the Federal Reserve is preparing to raise rates, the prospect for easing by the RBNZ should be driving NZD/USD lower and not higher. Yet over the past 3 months, NZD/USD has fallen 13% and since the last monetary policy meeting it is down 5%. Investors have had plenty of opportunity to price in this week's rate cut especially as dairy prices continue to fall. The big question ahead is whether the RBNZ will signal plans to ease again. According to Prime Minister Key who spoke earlier this week, the New Zealand dollar has fallen faster than they anticipated, which suggests that he is comfortable with the decline in the currency and wants to see its effect on the economy before taking additional action. Based on the following table below, the RBNZ could shift to neutral. There are many reasons why they could choose to do so - #1 parts of the economy is improving (see table below) #2 there is a housing bubble in Auckland #3 Chinese stocks are stabilizing #4 NZD is down a lot versus AUD and finally #5 three back to back rate hikes is not warranted. If the RBNZ shifts to neutral, it could trigger a stronger recovery in NZD/USD. Meanwhile the Australian dollar shrugged off last night's Reserve Bank of Australia meeting minutes. According to the RBA, a further decline in the currency seems likely and necessary because output growth most likely slowed in Q2. However they stopped short of saying that easing is necessary. USD/CAD backed off 1.30 as oil held above $50 a barrel.

EUR/USD Short Squeeze

The euro enjoyed its strongest one day rally against the U.S. dollar this month. The 1% rise in the currency pair was sparked by the hope that the Greek Parliament will vote yes and approve a second series of bailout measures tomorrow. This is a necessary step to starting negotiations with international creditors. Having already approved the first round of bailout measures last week, the hope is high that the Parliament will vote yes tomorrow. According to the Greek government, the negotiations should be completed by August 20th. EU and IMF officials are scheduled to arrive in Athens on Friday for fresh talks. Based on the rebound in EUR/USD investors are clearly optimistic and we would be surprised if the Parliament rejected the latest reforms. The next area of uncertainty is the bailout negotiations and whether Germany allows for some form of debt relief. In the meantime, 1.10 is the level to watch on the upside for EUR/USD resistance.

GBP Consolidates Ahead of Bank of England Minutes

Interestingly enough the British pound was the only major currency that failed to benefit from the anti-dollar rally. Sterling ended the day unchanged versus the U.S. dollar and sharply lower versus the euro. U.K. public sector finances did not have any impact on the currency and the closely anticipated speech from Governor Carney should have lifted the currency. According to the BoE head, higher interest rates likely to be needed in the next few years. They are not expected to raise rates this year but a hike could come in early 2016. While Carney's choice of words was less aggressive than last week, we expect his optimism to be reflected in tomorrow's BoE minutes.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD flirts with 1.0700 post-US PMIs

EUR/USD maintains its daily gains and climbs to fresh highs near the 1.0700 mark against the backdrop of the resumption of the selling pressure in the Greenback, in the wake of weaker-than-expected flash US PMIs for the month of April.

GBP/USD surpasses 1.2400 on further Dollar selling

Persistent bearish tone in the US Dollar lends support to the broad risk complex and bolsters the recovery in GBP/USD, which manages well to rise to fresh highs north of 1.2400 the figure post-US PMIs.

Gold trims losses on disappointing US PMIs

Gold (XAU/USD) reclaims part of the ground lost and pares initial losses on the back of further weakness in the Greenback following disheartening US PMIs prints.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.