Technical Analysis

EUR/USD stopped by 1.2740

“We continue to expect further easing measures in Q1, and would look for ECB officials to continue to stress willingness to do more if necessary.”

- BNP Paribas (based on CNBC)

Pair’s Outlook

Although EUR/USD seemed to have found strong support at 1.26 when it hit the Aug-Sep down-trend, the rally initiated there was unable to penetrate the resistance at 1.2740. Now the currency pair is unlikely to launch an attack on the 2013 low before it travels down to this year’s minimum at 1.25. But if the Euro closes beneath this level, the next support will be at 1.24—the current location of the monthly S1.

Traders’ Sentiment

Neither the bulls nor the bears have an advantage at the moment—both take up a half of the SWFX market. In the meantime, the share of orders to sell the European currency against the US Dollar grew from 49 to 59%.

GBP/USD slides to 1.59

“Sterling is likely to underperform in the near term as rate hike expectations get pushed back.”

- CIBC World Markets (based on Reuters)

- Pair’s Outlook

The Sterling took a major hit yesterday, falling nearly 200 pips in one day, as the support represented by the monthly S1 and now former 2014 low failed to nullify the downward momentum. Accordingly, GBP/USD is now set to test another demand area at 1.5862/25. If this cluster of supports is also violated, there is a high chance the price will keep falling towards the monthly S2 at 1.5711, even though the technical indicators are mostly mixed.

Traders’ Sentiment

There was a slight increase in the percentage of long positions (from 57 to 59%), but it did not affect the overall situation in the SWFX market—the sentiment is moderately bullish, just like yesterday or five days ago.

USD/JPY is poised to resume rally

“The yen rally has faltered as it approached its upper Bollinger Band. If the yen weakens below 107.50 per dollar, it could signal the yen’s rebound is over.”

- Gaitame.com (based on Bloomberg)

- Pair’s Outlook

There are signs USD/JPY has finally bottomed out at 106.60 after tumbling all the way from 110. Yesterday the pair managed to negate some of the most recent losses, thus confirming strong demand below 107 (38.2% Fibo and 55-day SMA). However, except for the weekly studies, there is no encouragement from the indicators on different time-frames, and only a close above 108 will imply the Buck is ready to challenge the 2014 high once again.

Traders’ Sentiment

We continue to observe absence of any substantial difference between the amounts of long and short positions open, meaning the market is undecided. The portion of the former is 48% and the portion of the latter is 52%.

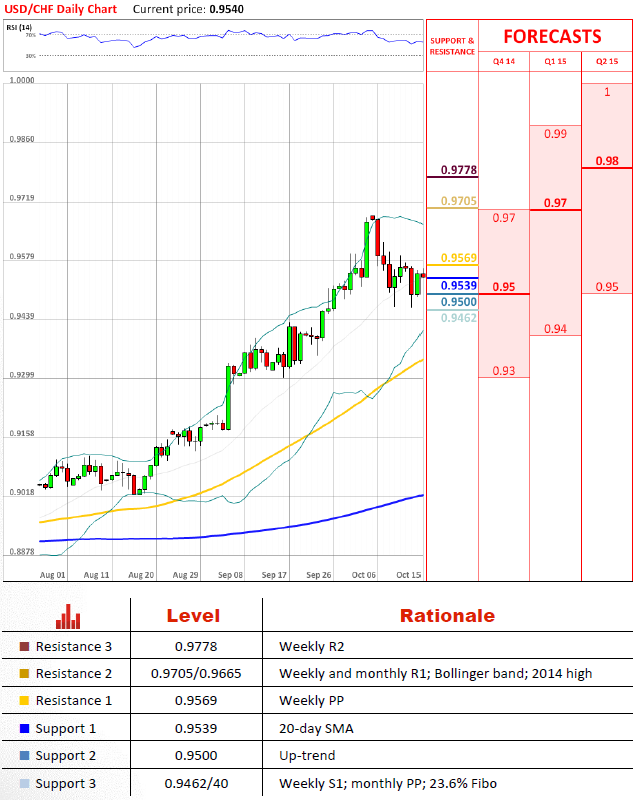

USD/CHF is short-term bullish

“With the ECB cutting interest rates and honing in on quantitative easing, the SNB will have no choice but to extend the timeframe of its currency cap against the euro.”

- Moody’s Analytics (based on Bloomberg)

- Pair’s Outlook

Despite intensive selling the last few days the rising support line (Aug 17 and Sep 4 lows) remains intact. Therefore, the outlook for USD/CHF is still positive, with the immediate obstacle standing at 0.9569 and a more serious threat to the bullish perspective at 0.97. The latter resistance is mainly formed by the monthly R1 and 2014 peak, meaning it is the key to even higher levels, such as the 2013 high at 0.9840.

Traders’ Sentiment

Apparently, yesterday’s performance of USD/CHF encouraged the Dollar-bulls, being that the share of longs went up from 57 to 60%. At the same time, the gap between the buy (48%) and sell (52%) orders placed 100 pips from the spot price came to naught.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.