Technical Analysis

EUR/USD confirmed 200-day SMA as resistance

“The medium-term view is still one of a lower exchange rate given the monetary policy divergence.”

- JPMorgan (based on CNBC)

Pair’s Outlook

For the time being the 200-day SMA successfully carries out its mission, namely is not letting the Euro to advance further, even though the monthly studies are mostly bullish. If 1.37 continues to cap the rate, EUR/USD should soon return to the 2014 lows just below 1.35, a level that needs to be overcome in order for the bearish intentions to be confirmed. Otherwise there may be a re-test of the 100-day SMA at 1.3737.Traders’ Sentiment

The advantage of the bears seen yesterday has been almost fully erased during the last 24 hours, leaving only an insignificant difference between the amounts of long (45%) and short (55%) positions.

GBP/USD poised for more gains

“U.K. manufacturing continued to flourish in June, rounding off one of the best quarters for the sector over the past two decades.”

- Markit (based on MarketWatch)

Pair’s Outlook

The Great British Pound continues to strengthen after crossing the 2009 high, and the currency seems to be unlikely to stop until it reaches the edge of the bullish channel at 1.74. This is evidenced by a majority of the technical indicators giving ’buy’ signals, though the advantage is not overwhelming. The immediate resistance is at 1.7182/72 (weekly R3 and Bollinger band), followed by the monthly R1 at 1.7248.Traders’ Sentiment

An overwhelming majority of the SWFX market participants consider the Sterling to be overvalued, namely 74% of them, and their number is increasing. As for the orders, the gap between the buy (45%) and sell (55%) ones is only marginal.

USD/JPY rebounds from 101.20

“I can’t see volatility getting any lower. The market is pricing in very, very easy monetary policy forever in the U.S.”

- Thomas Averill, Rochford Capital (based on Bloomberg)

Pair’s Outlook

USD/JPY seems to be well-underpinned by 101.20, but it could be only a pull-back to the recently breached up-trend before another, even stronger, bearish wave. But this will be decided once the pair rises up to 102.15. If the U.S. Dollar continues the recovery from there, there will be a high possibility of the price re-visiting this year’s high at 104. Conversely, should the bears prevail, the support represented by 2014 lows will be expected to be broken.Traders’ Sentiment

Traders appear to have been encouraged by USD/JPY finding support—the percentage of long positions went up from 70% to 72%. Meanwhile, the share of buy orders 50 pips from the spot plummeted from 70% to 59%.

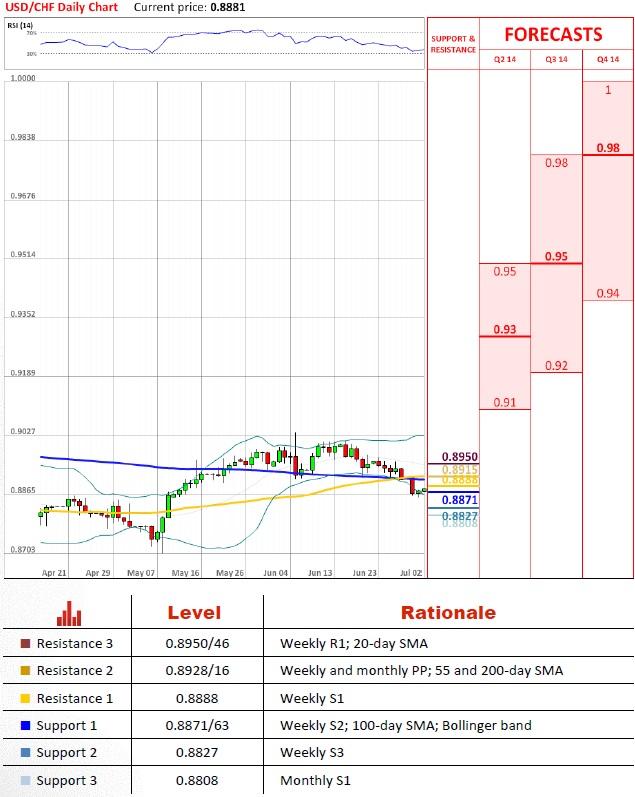

USD/CHF faces demand at 0.8870

“The U.S. data has been weakening somewhat, and that is accelerating dollar selling. We need some hawkish signals from the Fed to change that trend.”

- Barclays (based on Bloomberg)

Pair’s Outlook

Right now the 100-day SMA is coping with the selling pressure that was a result of a failure at 0.90. However, taking into account a cluster of resistances at 0.8928/16, the likelihood of a robust recovery from here is low, and a breach of 0.8871/64 given these conditions seems to be a more probable course of events; also being that the monthly indicators are bearish. USD/CHF should then target the monthly S1 at 0.8808.Traders’ Sentiment

The distribution between the bulls and bears in the market is more or less the same as yesterday—74% of traders expect the greenback to appreciate and 26% think otherwise, which is a large deviation from their 10-day averages of 68.5% and 31.5% respectively.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.