Technical Analysis

EUR/USD forces its way through 1.3823/15

“With the increased market expectations for QE providing support to European asset markets and peripheral markets outperforming as a result of renewed foreign investor appetite, we would anticipate EUR remaining supported, at least until the ECB decides to take action.”

- Morgan Stanley (based on MarketWatch)

Pair’s Outlook

EUR/USD is still struggling to decouple from the monthly pivot point, as it is apparently facing tough resistance. However, if 1.3823/15 is broken, there will be no significant levels until 1.39, which is supposed to be a ceiling for the currency pair, even though both the short and long-term technical indicators are pointing upwards. After the test of the down-trend, the Euro is expected to come under strong selling pressure, which could then alleviate near 1.37.

Traders’ Sentiment

SWFX market participants largely stick to the view that the common currency is going to depreciate—65% of open positions are short. At the same time, the share of sell orders is on the rise—it increased from 60% up to 64%.

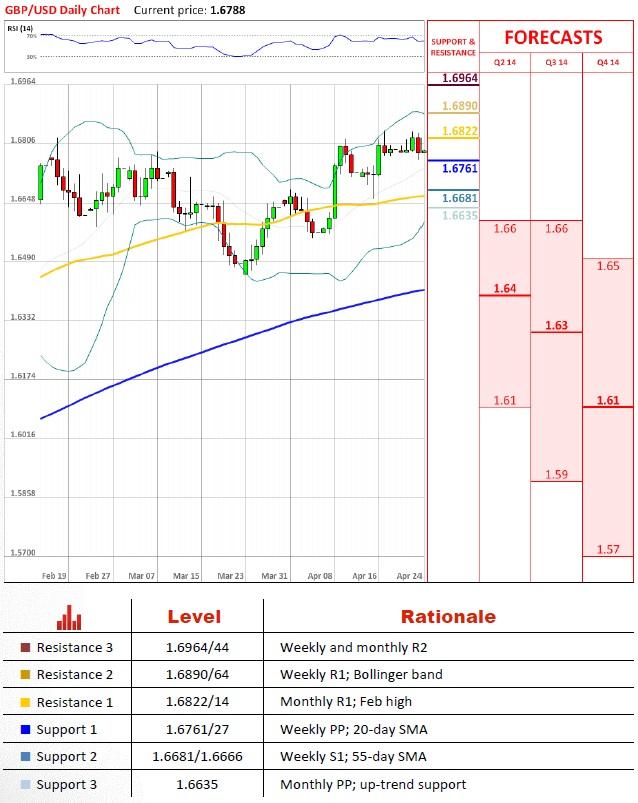

GBP/USD confirms resistance at 1.6822/14

“The [BOE] minutes are highlighting a rise in wages and a more durable recovery and is also quiet about sterling strength. So we could see sterling recover.”

- Western Union (based on Reuters)

Pair’s Outlook

Although at first it seemed as if the resistance at 1.6822/14 is about to be breached, later in the day the bears moved GBP/USD away from the Feb high. But, unless the price falls beneath the nearest supports, such as the weekly PP and 20-day SMA, which would be a bearish sign, the technical studies assure us that the Pound retains a bullish potential and it is able to reach 1.70, if the monthly R1 and Feb high finally give in to the buying pressure.

Traders’ Sentiment

The distribution between the bulls and bears is perfectly unchanged compared to the previous repost, as 26% of the positions are long and 74% are short. Meanwhile, the gap between the buy (39%) and sell (61%) orders 50 pips from the spot price went up.

USD/JPY approaches 102.20

“The CPI data could be a trigger for yen strength.”

- Nomura (based on Bloomberg)

Pair’s Outlook

While the 20 and 55-day SMAs failed to underpin USD/JPY, the support at 102.20 successfully repelled the attack. Accordingly, the current bearish correction is likely to end near the weekly PP and 38.2%, thus giving way for the latest rally to resume. If this demand turns out to be insufficient to turn the pair around, the support at 101.77/69 (monthly S1 and long-term up-trend) has an even greater chance of restoring the bullish outlook.

Traders’ Sentiment

The difference between the longs and shorts widened even more. Now 73% of traders wait for the U.S. Dollar to rise in value (71% yesterday). The change in the share of buy orders was much more substantial—from 55% to 67%.

USD/CHF to cede ground

“As (U.S.) equities underperform, this leads to buying of Treasuries and yields fall. The dollar is softer as a result because it is reflecting other markets rather than internal components.”

- Societe Generale (based on CNBC)

Pair’s Outlook

As the resistance at 0.8857 proved to be impenetrable, the bias towards USD/CHF is fairly negative. The currency pair could ultimately give up more than two figures to arrive at 0.86 (2011 lows) before regaining the upward momentum. Still, there is a number of formidable supports that may prevent a precipitous decline. The nearest is a combination of the 20 and 55-day SMAs, followed by the weekly and monthly pivot points.

Traders’ Sentiment

The portion of longs fell three percentage points, but the sentiment towards USD/CHF stays explicitly bullish, as 70% of traders expect the greenback to appreciate. The number of commands to buy the buck, in the meantime, plunged from 65% to 47%.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.