Forex News and Events

Brazil Q2 GDP in focus (by Arnaud Masset)

Brazil Q2 GDP is expected to print at -1.7%q/q or -2.1y/y, confirming that the contraction of the world’s seventh biggest economy accelerated during the second-quarter. A revision to the downside of Q1 cannot be ruled out as well (at -0.2%q/q for the moment). The central government’s primary fiscal result for July came in on the soft side yesterday with a deficit of BRL 7.2bn versus 6.8bn median forecast and 8.2bn in June as President Rousseff’s government struggles to pass austerity measures aiming at cutting government’s expenses.

Thus, in spite of a rebounding Brazilian real and a recovering stock market, both driven by renewed interest in risky assets, fundamentals remain roughly unchanged for Brazil. Even worse, mounting evidence of a faltering Chinese economy - China is the Brazil’s biggest trading partner as roughly 20% of its exports go to China - are clouding the country’s economic outlook. Even though we expect USD/BRL to trade lower by the end of the year, in the short-term the real should remain weak as long as the threat of a credit-rating downgrade persists.

Swiss GDP printed slightly higher than expectations (by Yann Quelenn)

The Swiss economy has been under pressure after the Swiss National Bank abandoned the minimum exchange rate of 1.20CHF per euro. In particular, Swiss exports are tumbling. Indeed exports in July slipped 4.9% from a year earlier. The impact on the revenues is therefore very important.

In order to tackle this competitiveness issue, we think that the SNB is still intervening in the market. According to us, it still buys euro to weaken the Swiss franc. Fortunately the bailout agreement with Greece reinforced good future expectations about the Eurozone. This timing opportunity was mainly too good to be true and the SNB has helped to drive the EURCHF at current levels.

This morning, the GDP printed at 0.2%q/q, slightly higher than expectations which were negative at -0.1%. It is true that concerns remain about the Swiss economy. Besides, in the short-term, we anticipate the EURCHF to go higher. We estimate that the pair will reach 1.10. However at some point, all the Eurozone issues will come back again (in particular the massive debt-to GDP ratio that most countries are struggling with) and the Swiss franc will move back to a safe haven currency. First results of the ECB quantitative easing will provide good timing to reload long Swiss positions. For the time being, ECB monetary policy expectations are still positive but this will not last forever.

Speculation on China’s US treasuries selling (by Peter Rosenstreich)

A series of mis-steps by Chinese authorities to manage financial transactions and refocus on weak economic conditions have triggered a massive sell-off in domestic equities, sparking capitulation in global financial markets. As a result, China’s officials were forced to abandon their ambitions to be included in the IMF’s SDR basket and devaluing the yuan (sparking fears of renewed currency wars). As the situation worsened, China began to take aggressive measures to halt the financial emergency. Alongside of currency intervention, rules on and direct purchases of equities, the PBoC cut the one-year lending rate 25bp to 4.60% (their fifth action since November) and dropped the RRR 50bp for all banks.

Official actions and shift in investors sentiment has monetarily stopped the selling pressure. But there are increasingly credible rumors that China has been selling its holdings of US treasuries in order to raise the dollars needed to boost the yuan. According to the latest treasury data, China controls $1.48 trillion of U.S. government debt. Interestingly, despite the safe-haven seeking behavior that came over global markets and corresponding fall in developed markets yields, US yields have remained firm. Given the potential transaction sizes involved, the selling of US treasuries could have prevented yields from dropping lower. China has a variety of yuan raising options available, so choosing to sell US treasuries could be questioned. Clearly, elevated US yields would be viewed by the Fed as rationale for waiting to tighten rates, while higher rates in the US would exacerbate capital outflow from China (prompting additional costly FX interventions). We could be witnessing, after years of carefully disguised threats, the first time that China is directly influencing US monetary policy.

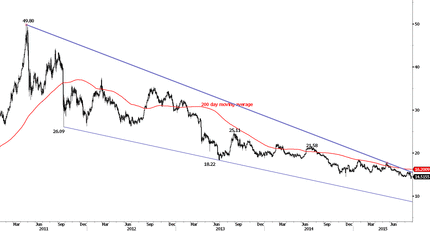

Silver - Holding Below The 200-Day MA

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.