Forex News and Events

RBA shift tone

As expected the RBA August Board meeting retained the cash rate at a record low of 2.00%. The central bank continue to see the current accommodative policy as “appropriate.” The policy outlook was generally balanced as, “further information on economic and financial conditions to be received over the period ahead will inform the Board's ongoing assessment of the outlook and hence whether the current stance of policy will most effectively foster sustainable growth and inflation consistent with the target.”

Yet the accompanying statement took a hawkish turn when members stated that AUD was adjusting to declines in commodity prices, sheading the language for more depreciations. In reference to the currency the statement said it was "the Australian dollar is adjusting to the significant declines in key commodity prices." This change in commentary indicates that the RBA has greater comfort in the current level of the AUD. The newly developing confidence in AUD pricing suggests that less verbal intervention or easing bias geared toward weakening the AUD will be required (baring no negative change in fundmentals). Local AUD yields jumped 3bps on the statement. Heavily sold AUDUSD quickly ran to 91.39 from 90.10 as shorts were squeezed. On the data front, Australian retail sales hastened 0.7% m/m in June, above estimates of 0.4% m/m and revised higher 0.4% m/m read in May. Finally, Australia’s trade deficit came in at A$2933mn in June slightly below expectations of deficit of A$3000mn. We will be watching developments in China carefully but favor carry based trades in AUDJPY and AUDCHF. The positive AU economic data specifically strong housing data combined with today’s slightly neutral statement (shift from dovish) indicates that it’s unlikely that the RBA will cut rates further. However, the SNB and BoJ are not tightening anytime soon.

Russia‘s inflation eyed:

“Today will be released the Consumer Price Index for Russia. This data represents a major concern for the Central Bank of Russia as it has prevented a larger downside change for the key rate last week. Indeed and as we expected, it has moved to 11% from 11.50% amid negative growth that printed at -2.2% year-on-year for the first quarter. Furthermore, the ruble is trading very low and as we are still thinking, a monetary policy must absolutely be cautious as there is a massive downside risk for the ruble coupled with a major inflation risk.

Traders will carefully watch the today’s CPI release, which is often interpreted as a monetary policy outcome. However, any key rate move takes at least a few months before being truly reflected in the economy. As a result, what really matters is the trend. Estimates for today’s data are about at 0.9% m/m while June figure printed at 0.2% m/m.

In its last week meeting, the CBR reiterated its inflation forecast for June 2016. The CPI is targeted to reach 7% before going lower to 4% in 2017. We think that those forecasts seem too optimistic as long as there is no sustainable growth trend. For the time being, easing rates has only supported high inflation. Nonetheless, we remain confident as there is still room for the CBR to act.

The USDRUB is set to increase again as long as the data are not fully supporting a pick-up in growth. We target a pair above 64 ruble within the next few weeks.”

Yann Quelenn – Market Analyst

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

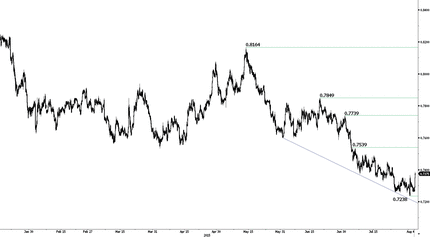

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.