Forex News and Events

Back to fundamentals

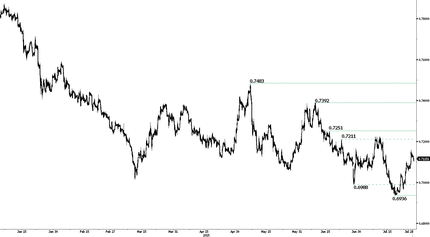

According to data released today, the UK economy expanded by 0.7% q/q in line with market expectations. Following a soft patch of 0.4% in 1Q the growth is now trending closer to 2015 expectations. The service sector was the bright spot expanding 0.7 q/q. While construction growth was flat, production has supported by output increase in the oil and gas industry. The strong GDP read complements the acceleration in the labor markets and points to further expansion in 3Q. Recent Bank of England meeting minutes acknowledged the solid outlook but the actual prints will provide some relief to hawkish members. This solid read should increase the likelihood that BoE members Weale and McCafferty vote for policy tightening at the August meeting. As the monetary policy divergence theme strengthen, GBP should become one of the primary beneficiaries as expectations for a February 2016 rate hike increase. Currently the BoE seems not really concerned by the GBP strength which should allow GBP to trade higher against EUR and USD. GBPUSD spiked to 1.5589 on the GDP release. GBPUSD should be supported by 1.5483 uptrend channel with a target of range top at 1.5732.

IMF advises ECB to expand its QE:

“The International Monetary Fund issued yesterday its annual report on the Eurozone’s economy. The tone of this report is somewhat alerting as the institution warns about contagion fears, high unemployment and lack of growth in the Eurozone. Also, it is stated that all the necessary tools must be used and ready to deploy to save banks. Hence, the European banking system should continue to have access to liquidity and sovereign debt markets must be maintained in order. Furthermore, it fosters the ECB to expand its quantitative easing (QE) program beyond September 2016. In addition, the IMF is pushing the ECB to use the exact same tools used by the United States since 2008 with the results we are now seeing. In other words, the ECB has to face against lack of growth with monetary tools that have proven to be inefficient to create growth and to avoid deflation. This does not the IMF to forecast a Eurozone GDP Growth of 1.5% this year and 1.7% next year. We remain even more sceptical about those forecasts as unemployment in the Eurozone is still high, averaging around 11% and near 25% in Greece and Spain and we anticipate QE will not have the desired effects. EURUSD price action is mainly driven by the US this week against a backdrop of FOMC meeting and Q2 GDP. However, we think that European Business confidence as well as start of negotiations for the third Greek Bailout and its uncertainties will provide downside pressure to the pair which is likely to challenge again the 1.1000 level.” Yann Quelenn - Market Analyst

Free Trading ideas & Signals

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD: The first upside target is seen at the 1.0710–1.0715 region

The EUR/USD pair trades in positive territory for the fourth consecutive day near 1.0705 on Wednesday during the early European trading hours. The recovery of the major pair is bolstered by the downbeat US April PMI data, which weighs on the Greenback.

GBP/USD rises to near 1.2450 despite the bearish sentiment

GBP/USD has been on the rise for the second consecutive day, trading around 1.2450 in Asian trading on Wednesday. However, the pair is still below the pullback resistance at 1.2518, which coincides with the lower boundary of the descending triangle at 1.2510.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.