Forex News and Events

The FX and commodities are volatile today as WTI crude approaches 3% loss on the session. The UK inflation dips to 1.0% on year to November, while the USD/RUB extends gains at all-time-highs despite the surprise CBR rate hike from 10.50% to 17%. Elsewhere, the carry reversal combined to political risks push USD/TRY to fresh record highs, the appetite in EUR-TRY rate spread is fully offset by the spike in implied vols.

Aggressive rate action from the CBR

In a wildly surprising move, the Russia Central Bank stated that it would increase its key interest rate to 17.0% from 10.50%, effective immediately. On the surface the decision was aimed at slowing the RUB collapse and lowering inflation risk. Yet, the massive unexpected adjustment reeks of panic and desperation. This hike come on the heels of the largest one-day drop in the ruble and largest single interest rate increase since 1998 prior to Russia default. However, despite the enticingly high yield, there is increasing probably that Russia will dip into recession due to the sliding oil prices making any long Russia trading extremely risky. In addition, with high-yield credit spreads making significant changes there is a material macro move to rotate from risky assets. And right now Russia is deemed one of the most risky assets on the market. It is uncertain that today’s hike, despite its size, will halt Ruble selling. Besides the geopolitical tensions, the oil exports stand for more than 50% of Russian income and with crude contracts trading below $55, we see the selling pressures on RUB hardly easing.

UK inflation drops to 1%

The UK inflation dropped by 0.3% on month to November (vs. 0.0% exp. & 0.1% last), pulling the yearly inflation down to 1.0%, significantly slower than 1.2% expected (& 1.3% last). The most of the CPI softness being already priced in, GBP/USD rebounded quickly after selling off to 1.5612.

At his speech on Financial Stability Report, the BoE Carney commented on housing markets, inflation and oil prices. Carney said that the housing market lost momentum, that the fundamental problem in UK housing is the “supply shortage”, while stamp duty change and low rates may revive the housing sector. He highlighted that the drop in oil is positive as it could support the economic growth, although it carries stability risk. “The CPI expectations could further be depressed” he added, as oil rallies to fresh lows. Combined to the strict stance on the fiscal leg (consolidation), the BoE has little room for surprisingly hawkish move, we keep our GBP-bias on the downside.

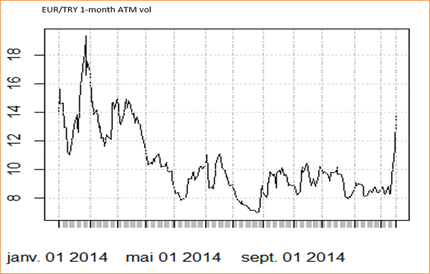

EUR/TRY implied vol spikes above 13%

After hitting our upper target at 2.75, EUR/TRY reversed direction sharply. The key unwind signal being the hike in volatilities, the spike from 8-9% to above 13% in one-month implied vols automatically cleared our bearish call on EUR/TRY on Monday. We expect the carry outflows to increase EUR/TRY-positive pressures after breaking the 200-dma (2.8790) on the upside. EUR/TRY tests resistance at 2.9488/3.00 (Fib 38.2% on January-November ease/psychological level). The 3-month cross currency basis rebounds alongside with the FX volatilities, confirming that the appetite in rate spread is now being fully offset by TRY-negative vols.

USD/TRY hits 2.3944, new record high. The pre-Fed USD appetite should help pushing the pair through 2.40-offers over the next trading sessions. Regardless of ECB, Fed news, the TRY is set to go through renewed wave of sell-off following global risk-off move, which in addition is amplified by rising political tensions recently. The average interbank repo rate hits the CBT overnight rate corridor upper end (11.25%). We stand ready for CBT intervention to cool-off the lira selling.

EUR/TRY volatility spikes above 13%

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.