Forex News and Events

It has been a heavy week for the EUR/CHF. As the propagandas for the Swiss Gold Referendum gain pace, the leveraged FX flows and put options weigh on the EUR/CHF spot markets. The 1.20 floor is dangerously at target. The BNS did not intervene to cool-off the pressures at the time of writing but the intervention risk is not ruled out depending on how low traders will push the EUR/CHF. The interest rate futures consolidate above par, hinting at the surge in negative rate speculations.

The collection of votes has already started, the results will be published on November 30th. All seven political parties stand sharply against the initiative, except the UDC – Union Démocratique du Centre – which indeed came up with the idea that the SNB should keep 20% of its reserves in physical gold. As we move on, news reveal that UDC’s central committee is also in the “no camp” (35 no votes vs. 34) while in the Parliament, less than 50% of UDC representatives are in favor of a “yes” vote. This situation is nothing new for the UDC, the party is regularly subject to divergent opinions regarding economic subjects. Although the UDC pretends to be the Central Democratic Union, the party is rather known for its right-tendency opinions and most often attacked on its extreme right purposes. However, the paradox in the heart of the UDC is an important signal for the Swiss voter: even the instigators of the project are not sure that this is the right direction to go. For the UDC President Toni Brunner, the differing opinions are nothing else than a sign of healthy democracy. He insists that the proportion of “no” voters in UDC remains small.

Originator Committee play on national feelings

The UDC supporters at the origin of the initiative base their propaganda on heavy nationalist arguments. “Following the massive pressures exercised by Americans, we have all of a sudden declared that 1550 tons of our reserves were excessive” argue instigators, and liquidated this quantity at “miserable” price. “This should never happen again. Gold is not a Monopoly currency at disposal of politicians and bankers. The product of past generations hard work belongs to the population.” The originators also express their disapproval to hold foreign debt as “investment”. These holdings are said to be “not real values”.

In opposition, the government and a clear majority of Swiss Parliament’s both chambers base their arguments on solid economic analysis. The SNB is mandated to ensure the price and financial stability and is successfully fulfilling its goals. The commitment to stock 20% of the SNB’s assets in physical gold will squeeze the Bank’s capacity to fulfill its mandate and may reduce its credibility. Federal Council adds that two thirds of SNB benefits are distributed to cantons, one third to the Confederation, and warns that the nation’s income would also be harmed by the introduction of such constraint.

It is time to play it clever!

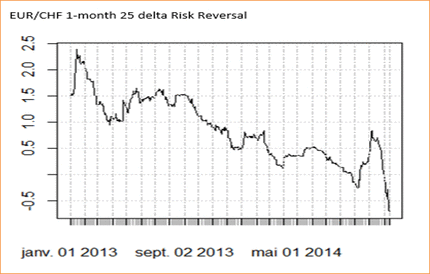

The tensions in Switzerland have been mounting over the past weeks due to unexpectedly balanced election polls on the Gold Referendum. However we believe that the rational will finally win over the Swiss gold debate. In our opinion, the markets have gone well beyond themselves. EUR/CHF edges the oversold conditions (RSI at 30%), the 1-month implied volatility advanced to 4.45%, highest levels over more than a year. The 1-month (25-delta) EUR/CHF risk reversals became quite negative as demand for put options increased overly. The rational calls for action. Given our biased view in favor of a “no” outcome, we believe that there is opportunity in the topside OTM calls. On the spot markets, EUR/CHF is seen at optimal entry levels for long EUR/CHF positions.

Today's Key Issues (time in GMT)

2014-11-14T13:30:00 USD Oct Retail Sales Advance MoM, exp 0.20%, last -0.30%

2014-11-14T13:30:00 USD Oct Retail Sales Ex Auto MoM, exp 0.20%, last -0.20%

2014-11-14T13:30:00 USD Oct Retail Sales Ex Auto and Gas, exp 0.40%, last -0.10%

2014-11-14T13:30:00 USD Oct Retail Sales Control Group, exp 0.40%, last -0.20%

2014-11-14T13:30:00 USD Oct Import Price Index MoM, exp -1.50%, last -0.50%

2014-11-14T13:30:00 USD Oct Import Price Index YoY, exp -1.60%, last -0.90%

2014-11-14T13:30:00 CAD Sep Manufacturing Sales MoM, exp 1.00%, last -3.30%

2014-11-14T14:55:00 USD Nov P Univ. of Michigan Confidence, exp 87.5, last 86.9

2014-11-14T15:00:00 USD Sep Business Inventories, exp 0.20%, last 0.20%, rev 0.20%

2014-11-14T15:00:00 USD 3Q Mortgage Delinquencies, last 6.04%

2014-11-14T15:00:00 USD 3Q MBA Mortgage Foreclosures, last 2.49%

The Risk Today

EUR/USD continues to consolidate in the short-term time frame. Hourly resistances can be found at 1.2509 (10/11/2014 high) and 1.2577 (04/11/2014 high). Hourly supports stand at 1.2419 (12/11/2014 low) and 1.2395 (11/11/2014 low). In the longer term, EUR/USD is in a downtrend since May 2014. The break of the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) has opened the way for a decline towards the strong support at 1.2043 (24/07/2012 low). A key resistance stands at 1.2886 (15/10/2014 high).

GBP/USD has confirmed its underlying downtrend by breaking the support at 1.5718 (21/08/2013 high, see also the 61.8% retracement). Hourly resistances now stand at 1.5781 (13/11/2014 high) and 1.5840 (intraday high). In the longer term, the break of the support at 1.5855 (12/11/2013 low) confirms an underlying bearish trend. A conservative downside risk is given by a test of the support at 1.5423 (14/08/2013 low). Another support can be found at 1.5102 (02/08/2013 low). A key resistance lies at 1.6038 (30/10/2014 high, see also the declining channel).

USD/JPY remains strong as can be seen by the new highs above the resistance at 116.10. Hourly supports can now be found at 115.31 (13/11/2014 low) and 114.89 (see also the rising channel). A long-term bullish bias is favoured as long as the key support 105.23 (15/10/2014 high) holds. The break of the major resistance at 110.66 (15/08/2008 high) opens the way for a further rise towards 120.00 (psychological threshold, see also the 61.8% retracement of the 1998-2011 decline). A major resistance stands at 124.14 (22/06/2007 high).

USD/CHF is moving sideways within the horizontal range defined by the hourly support at 0.9617 and the hourly resistance at 0.9701 (11/11/2014 high). Another resistance lies at 0.9742, whereas another hourly support stands at 0.9580 (04/11/2014 low). From a longer term perspective, the technical structure favours a full retracement of the large corrective phase that started in July 2012. The recent new highs above the key resistance at 0.9691 confirm this outlook. A strong support stands at 0.9368 (15/10/2014 low). A key resistance can be found at 0.9839 (22/05/2013 high).

Resistance and Support:

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.