The key seems to be the dual problems associated with the brewing financial scandal for Spanish Prime minister Rajoy and his government and the re-emergence of the populist Italian former Prime Minister Silvio Berlusconi as the Italian election draws closer. Both Spain and Italy have been the fulcrum for sentiment about Europe and the Sovereign debt crisis for much of the past year. Greece remains an issue but these two nations are simply too big to ignore if they come under pressure.

And so it was in the past 24 hours where the strong rally in the Euro has reversed heavily. Indeed a move from a high of 1.3711 on Friday to this morning’s low of 1.3508 is a heck of a reversal and European stocks didn’t fare much better with Milan and Madrid both falling around 4%. Adding to the European tension was an increase of Spanish unemployment in January of 132k after unemployment fell 59k last month and even though this outcome was lower than the 150k increase in unemployment expected by the punditry it just added to the Spanish gloom.

Additionally as noted above the release of polls showing the resurgence of Italian former PM Berlusconi as a key player in the upcoming elections has raised fears of backsliding of reforms and nationalism within Italy and as such may pose a problem for the Eurozone.

Technically though the Euro’s reversal isn’t even really a significant reversal – I know tell that to the bloke who bought at 1.3711 – but the point is that if 1.35 gives way there is a chance for a deeper retracement still, possibly as low as 1.34.

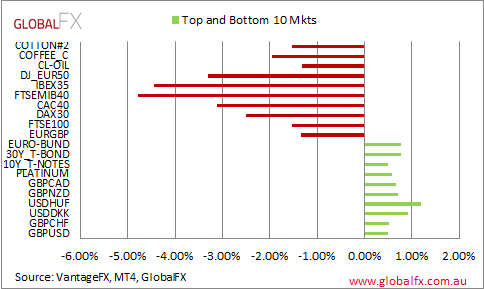

But the Euro’s loss was Sterling’s gain for a change as you can see in the table below of the top and bottom 10 performers of the almost 90 markets we watch each day at Global FX.

While the extent of the stock sell off dominates the weak markets EURGBP fall and the GBP cross rallies are important to note. That is not to say that GBPUSD is out of the woods by any stretch of the imagination – its outlook fundamentally and technically is pretty poor and we can see it back at 1.54 and below in time.

We’d summarise the Aussie Dollar’s technical outlook as consolidative within a 1 big figure box and overnight the Aussie dollar was stronger on the back of the tooing and froing in the other markets and reacted a little positively like a safe harbour should to the weakness in the stock market. EurAUD fell more than 1% and the Aussie rallied around 0.40% against its commodity cousins the CAD and Kiwi. Strangely it even rallied against the Swiss Franc but that had more to do with the Franc than the Aussie per se with EURCHF almost 1% lower.

So it was a big night for Global FX markets but equally for Stocks as you can see in the chart above.

Italy and Spain were hammered with Milan off 4.50% and Madrid dropping 3.76%. This pulled up the rest of Europe’s recent rally as well with the CAC down 3.01%, the DAX off 2.49% and the FTSE down 1.58%. As you can see in the chart below the FTSE bounced off an important trendline and a break back through this level would usher in a deeper retracement which is a position the DAX already looks like it is in.

Across the Atlantic in the US markets are not so aggressively bearish as they are in Europe which makes sense in the context of the catalyst for the selloff in Euro and European stocks. If anything whether this kerfuffle lasts just a day, a week or a month it reinforces the current reality that the US seems to be healing better than Europe and so the US dollar and US equity markets should outperform.

With 29 minutes before the close the dow is down 100 points but still with a net gain of 49 points over the two days for a fall overnight of 0.71%. The S&P is down 13 points to 1499 and my view that it will pull up under 1520 articulated in my 2013 outlook in January remains intact for the moment (Phew – very close so far) and the Nasdaq is off 1.29%. Of course Bonds are performing well in the risk off environment and were amongst the 10 best performing markets overnight.

In Asia today expect a day of weakness but not like the European falls as we are more keenly attuned to the US markets and remain a safe harbour as a region (ex Japan) if Europe decides to implode again.

In Australia it is RBA day and we favour the RBA to have a wait and see approach at this month’s meeting. The Australian economy has challenges still and only Pangloss himself would struggle to say that the Australian economy is not still facing substantial headwinds as the NAB survey showed again last week. So we retain an easing bias and believe the RBA will to. To the extent that there is a small risk of a cut the AUD might bounce post cut from where ever it is just before 2pm – I might play a binary.

Commodity markets didn’t escape the volatility with gold catching a bit of a bid although the move wasn’t that great at just +0.3% to $1674 – I retain my view that gold is struggling technically. Silver was 0.79% lower at $31.69 oz and Nymex crude fell 1.47% to $96.30. Coffee and Cotton were smashed lower and coffee is only half a percent away from its 20 day low so a further fall might get some action stirred up.

Data

In Australia it is House Price index, trade data and then RBA at 2pm Sydney. Services PMI’s in Europe are out tonight as is Eurozone retail sales and the non-manufacturing PMI.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.