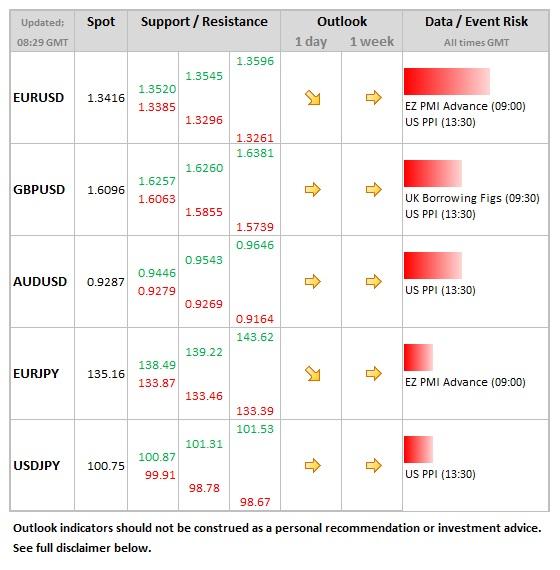

Data/Event Risks

EUR: Advance PMI data the early focus, being the first read of economic activity during November. Both manufacturing and services series are seen moving slightly higher for the Eurozone as a whole.

USD: The usual weekly claims data together with PPI data, both second tier releases for the dollar, so should have minimal impact.

Idea of the Day

The US central bank is making greater efforts to split the difference between withdrawing asset purchases and keeping rates low. This matters for currencies, because asset purchases tend to influence longer-term interest rates (around 5 years and beyond), whereas the Fed Funds target rate is more influential for the short-term rates (up to 2 years), which have a greater influence on currency values. The Fed minutes were discussing the fact that markets often link the two and in recent comments and guidance, the Fed has been keen to stress that a gradual withdrawing of the level of monthly bond purchase (named tapering) does not mean that rates are necessarily going to rise anytime soon. The same sentiment was also expressed towards the 6.5% unemployment rate threshold, with the discussion looking for ways for soften that, or assuring markets that rates would not automatically rise when it was reached. All this means that the prospect of tapering is not as dollar positive as perhaps previously thought. But the Fed’s attempt to split the two does, on balance, make tapering in December a little more likely.

Latest FX News

USD: Higher by 0.75% over the past 24 hours on the dollar index, but fair proportion of this has come from the euro move. Fed minutes were adding to dollar strength late into the NY session, with gains continuing in the Asia session.

JPY: The Yen weaker after the latest BoJ meeting. No major changes in policy, but there were some changes to language. There appears to be more doubt that the 2% inflation will be met by the April 2015 target date, with the BoJ saying it will continue to ease until the 2% inflation goal is achieved and stable.

EUR: Hit yesterday by a story suggesting negative deposit rate if main rate was cut further. Also this morning weaker PMI data from France has added to the weaker tone to the single currency.

FxPro UK Limited is authorised and regulated by the Financial Services Authority, registration number 509956. CFDs are leveraged products that incur a high level of risk and it is possible to lose all your capital invested. Please ensure that you understand the risks involved and seek independent advice if necessary.

Disclaimer: This material is considered a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. FxPro does not take into account your personal investment objectives or financial situation. FxPro makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any employee of FxPro, a third party or otherwise. This material has not been prepared in accordance with legal requirements promoting the independence of investment research and it is not subject to any prohibition on dealing ahead of the dissemination of investment research. All expressions of opinion are subject to change without notice. Any opinions made may be personal to the author and may not reflect the opinions of FxPro. This communication must not be reproduced or further distributed without the prior permission of FxPro. Risk Warning: CFDs, which are leveraged products, incur a high level of risk and can result in the loss of all your invested capital. Therefore, CFDs may not be suitable for all investors. You should not risk more than you are prepared to lose. Before deciding to trade, please ensure you understand the risks involved and take into account your level of experience. Seek independent advice if necessary. FxPro Financial Services Ltd is authorised and regulated by the CySEC (licence no. 078/07) and FxPro UK Limited is authorised and regulated by the Financial Services Authority, Number 509956.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.