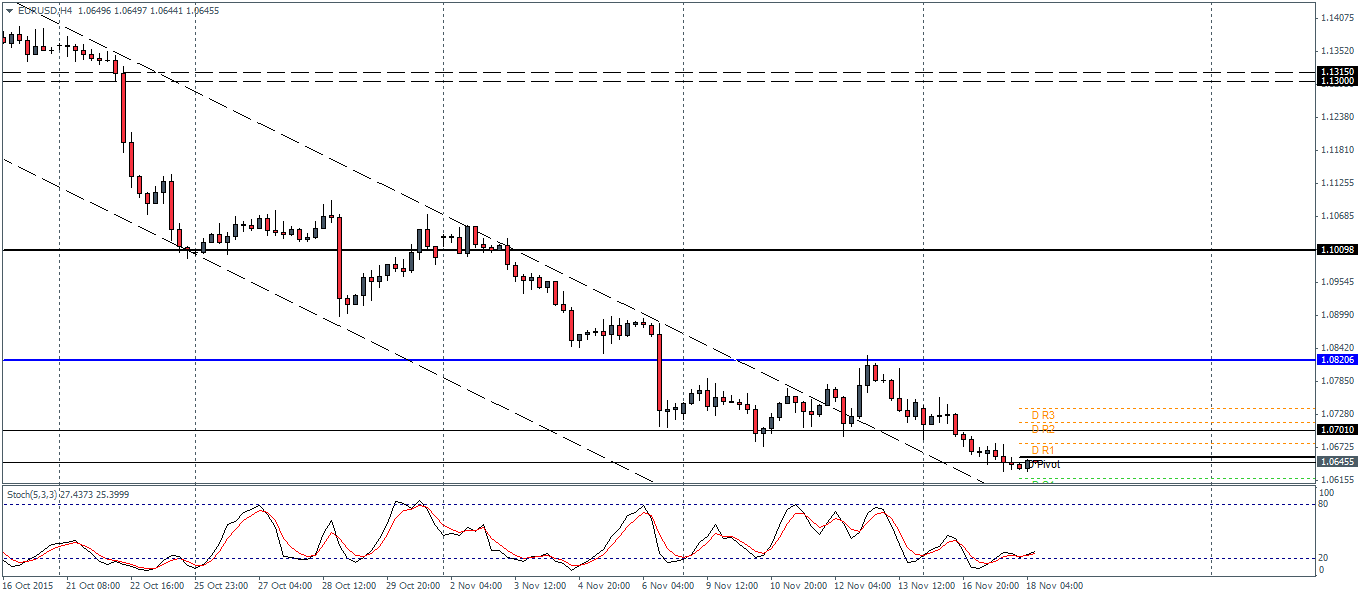

| R3 | 1.0738 |

| R2 | 1.0714 |

| R1 | 1.0677 |

| Pivot | 1.0653 |

| S1 | 1.0617 |

| S2 | 1.0592 |

| S3 | 1.0555 |

EURUSD (1.06): EURUSD's bearish close yesterday below 1.0697 support off the daily chart increases the likelihood for further declines to 1.0488 in the near term with the possibility of a bounce back to the broken support to establish resistance. On the H4 chart, the resistance is identified near 1.0701 where a retest is likely to happen. Failure to break the resistance between 1.0701 through 1.0697 could see continued declines in EURUSD to 1.0488. The upside is also limited by the next main resistance level at 1.08206 region.

| R3 | 123.879 |

| R2 | 123.678 |

| R1 | 123.557 |

| Pivot | 123.366 |

| S1 | 123.245 |

| S2 | 123.054 |

| S3 | 122.933 |

USDJPY (123.2): USDJPYhas formed a bullish flag patter on the daily charts with prices breaking outyesterday following a bullish engulfing candle the day before. prices arecurrently posting a decline but the downside is likely to be limited to 122.932support, while to the upside the rally could see a test to 124.775 region. Onthe H4 chart, with the support resistance at 123.088 being broken, this levelis likely to be tested for support ahead of further rallies. Failure toestablish support at 123.088 could however turn the USDJPY sentiment withdeclines likely to see a test to 121.921 support.

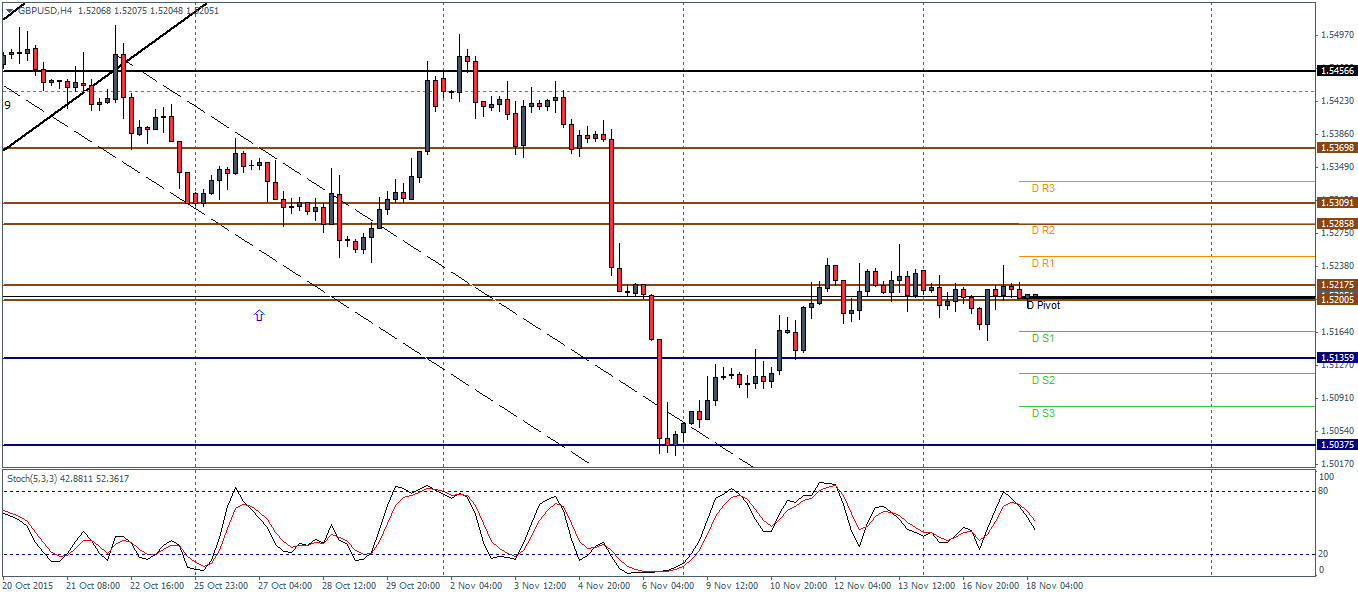

| R3 | 1.5332 |

| R2 | 1.5285 |

| R1 | 1.5248 |

| Pivot | 1.5202 |

| S1 | 1.5165 |

| S2 | 1.5118 |

| S3 | 1.5081 |

GBPUSD (1.52): GBPUSD's daily price action saw a doji candle being formed yesterday limiting the downside for the moment. However, with prices stuck below resistance level at 1.5237 further test to 1.5121 is likely. On the H4 charts, prices are moving sideways near the 1.5217 - 1.52 region, with the support at 1.5136 and resistance of 1.5288 being the first levels of support and resistance which needs to be broken to establish a bias.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.