Today's Highlights

Eurozone GDP flat

USD reacts to Jackson Hole comments

Canadian Inflation and retail sales forecast poor

FX Market Overview

Thursday brought news that manufacturing is growing modestly in Germany, slumping in France and flat across the Eurozone as a whole. There is some evidence that the service sector is balancing things up a little but is that enough? Probably not. The euro remains weak.

UK retail sales came in largely in line with forecasts but there was a fall in government borrowing. Sadly that was not enough to strengthen the Pound, which had another 'down' day. The lack of UK data ahead of the long weekend will probably leave the Pound to amble in enervated fashion through the rest of Friday.

Yesterday's US data was largely ignored as traders focussed on the economics symposium in Jackson Hole Mountain Resort on the Wyoming/Idaho border. Speeches from central bankers and economists are hitting the newswires thick and fast and these have great resonance when the fate of the global economy relies on central bankers getting their act together. The US Dollar will react to news from Jackson Hole over the next few days because there is a distinct lack of US data to focus on.

Today's big data comes from 400 miles north of Jackson Hole. Yews I am talking about Canada. Canadian retail sales and inflation data is forecast to be subdued. If the reality meets the forecasts, we will see weakness in the Canadian Dollar as we exit the week and that is great news for those moving to or importing from Canada.

I will end with a couple of bans. The world's most pierced man has been banned from entering Dubai. It isn't entirely clear why the authorities banned him but there is speculation they thought he may be involved in the occult. If you google, Rolf Buchholz you'll soon realise they probably just thought the sight of him would upset small children and the elderly. And Miley Cyrus has been banned from performing in the Dominican Republic because her act goes against their ' morals and customs' and that would means she would be breaking the law. Good on you Dominica for taking a moral stance. I would ban her too but only because she relies on shock and sleaze to disguise her lack of talent. That's enough of a crime in my book.

Have a great weekend and see you again on the 26th

Currency - GBP/Australian Dollar

The Sterling – Australian Dollar exchange rate has broken below the support line I thought would contain it and found support at the same level it did in May and June. It is an interesting development because this A$1.78 level doesn't register as a technical level of any substance but it is clearly being seen as a support line. As such, it is vulnerable and we may well see a break below here to the Fibonacci support level at A$1.7350. Whatever the outcome on the short term movements, this currency pair is capped at A$1.8150 at the moment and that gives AUD buyers the target they need to make plans.

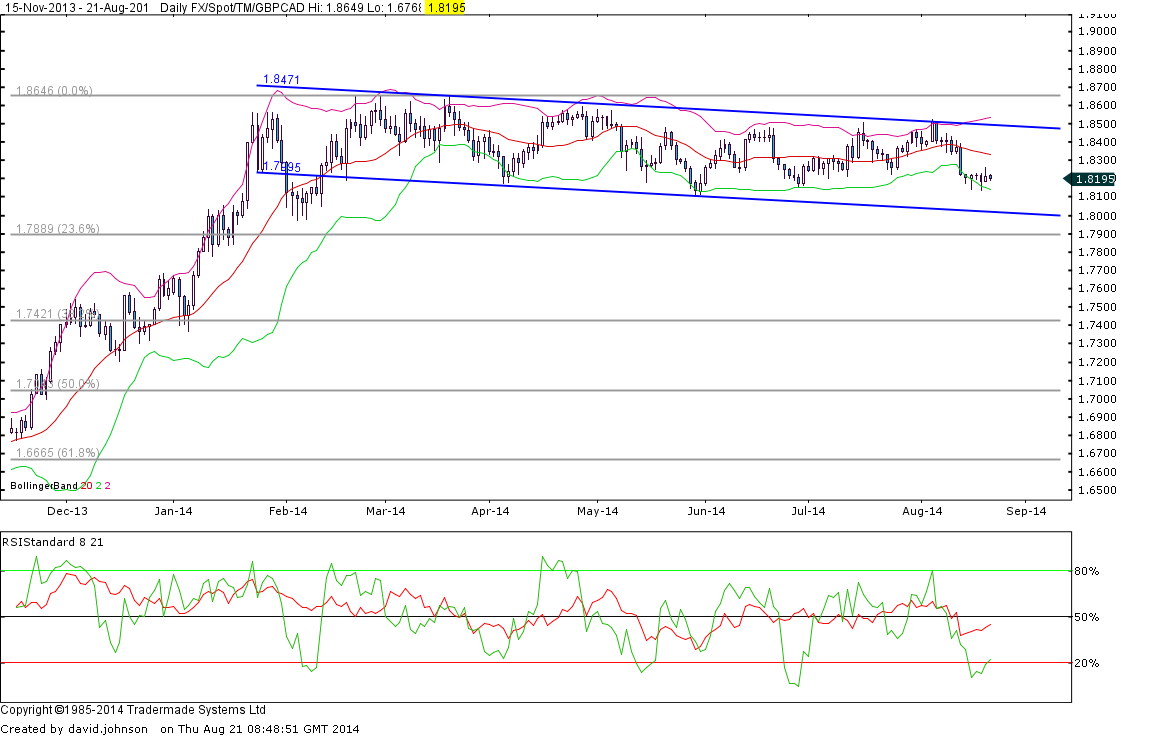

Currency - GBP/Canadian Dollar

Looking at this Sterling – Canadian Dollar chart is a bit of déjà vu. It is a channel that has been in place for the whole of 2014 and the top and bottom of that channel can be seen at C$1.85 and C$ 1.80 respectively. There isn't much more to be said about it really. CAD buyers should be leaping in with both feet at anything above the interbank level of C$1.83 and Cad sellers should be excited if they can sell at C$1.81 or better. It's not the most interesting report I have ever written but it is factually correct.

Currency - GBP/Euro

By rights, the Euro ought to be plummeting in value. The European economy is floundering, Germany is accusing France and Italy of breaking the fiscal rules, economists are battering the ECB and European union for their poor management of the Eurozone economy and unemployment remains grotesquely high across the region. However, the breadth of the liquidity in the euro is such that vast tranches of euro liquidity is wrapped up in central bank reserves; so there is comparatively little being traded. Hence the currency Sterling – Euro trading range is as tight as Maria Carey's vocal chords. €1.21 support and €1.2650 resistance mark the outer reaches of the current trading range. Use them to your advantage.

Currency - GBP/New Zealand Dollar

The Reserve Bank of New Zealand has stopped raising interest rates for now. That has weakened the Kiwi Dollar to some degree and yesterday's poor Chinese manufacturing data added to that weakness. However, the NZ base rate is still roughly 3% higher than most western economies; so the yield advantage ensures the NZD is in demand. That is what has kept the Sterling – NZD rate below NZ$2.00 to the pound. This pair is trading right in the centre of its range at the moment and seems unlikely to venture lower than NZ$1.9350 in the medium term.

Currency - Euro/USD

After rallying in a volatile pattern from July 2012 to the high in May 2014, the Euro-US Dollar exchange rate has retraced to some degree; hitting the technical level of a 38.2% Fibonacci retracement. That all sounds very complex but the key is that traders will all be aware of that and be ready to buy the Euro at this price-point. The improvement in US prospects, slightly better labour market data and an increased possibility of tighter money supply in the US are combining to strengthen the US Dollar but heightened tension in the Middle East and Ukraine are causing investor flight into the safe haven US Dollar. At the same time, infighting within the stagnating Eurozone is causing concern. France and Italy are being criticised by Germany and a group of eminent economists have cited the contractionist policies of the Eurozone as contributing to the lack of recovery in the region.

Nevertheless, we are highly likely to see some rebound in the EUR-USD rate after this recent fall and that could take us back to $1.3450 without disturbing the downward trend. Above $1.3450, we are likely to see a more substantial recovery but that is not envisaged unless US data plummets. If or when the Euro does break below $1.3250, the door is open to a test of $1.30 in the next few weeks.

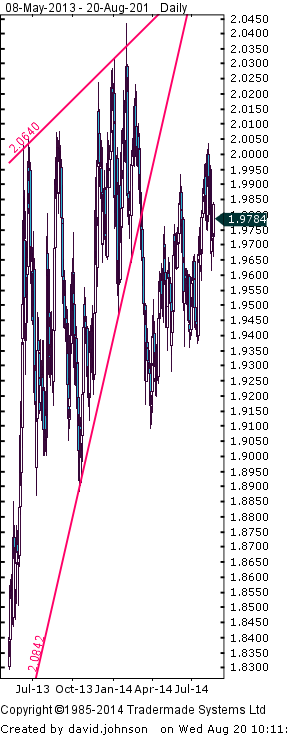

Currency - GBP/US Dollar

This long term chart shows the turnaround in the Pound’s fortunes and highlights the rally in Sterling that started in mid-2013. That rally ran out of steam in July 2014 after tensions in Ukraine and the Middle East started a flow of funds into the US Dollar for safe haven reasons. At the same time, Sterling started to lose its lustre as, amongst other things, inflation data softened and forecasts for the first interest rate hike from the Bank of England were pushed back to mid-2015. From a technical perspective, it appears highly likely we will see the correction in the GBP-USD rate continue and a drop to somewhere between $1.6325 and $1.6425 seems to be on the cards. The test for the pound will be whether it can stand up at that point or whether it falls below $1.63. The Pound will find trendline support at $1.62 and that should be strong enough to stop the rot but below there is a void which could see this pair drop to $1.58 in no time at all. With the general recovery in the UK economy still intact, such a collapse in the Pound is deemed unlikely at the moment and a recovery back to $1.70+ is the more likely scenario but protection against a fall of this kind is recommended for Sterling sellers.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.