Good morning from Hamburg and welcome to our latest Daily FX Report. Asian stocks looked set to rally, with index futures pointing to gains as markets from Hong Kong to Malaysia start trading for the week and Japan shuts holidays. Australia’s dollar maintained its advance ahead of an interest-rate review and a private gauge of Chinese manufacturing. Futures on equity measures in Sydney and Seoul climbed amid the steepest advance for U.S. stocks in two weeks, while Chicago-traded contracts on Japan’s Nikkei 225 Stock Average jumped following a selloff in Tokyo Monday. Oil fluctuated below $45 a barrel after driving a retreat in commodities despite the greenback’s slump to an almost one-year low.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

The dollar fell to the lowest level in almost a year amid speculation that the U.S. won’t raise interest rates any time soon. The U.S. currency lost ground versus most of its major peers as traders lowered expectations for a rate increase by the Federal Reserve in June to 12 percent. The greenback slumped against Europe’s shared currency for a sixth day, the longest run of losses since September, after a report showed manufacturing in the U.S. expanded less than forecast. Persistent weakness dragged the dollar down against the euro for a third straight month in April - its longest monthly losing streak since 2013 - amid signs that U.S. policy makers aren’t convinced either the global or domestic economy can withstand higher borrowing costs. The U.S. has posted disappointing growth data even amid nascent signs of recovery in Europe. The Bloomberg Dollar Spot Index, which tracks the U.S. currency versus 10 major counterparts, fell 0.3 percent at 5 p.m. New York time, reaching the lowest level since May 15. It slumped 2 percent last week as the Bank of Japan’s inaction coincided with Fed Chair Janet Yellen reiterating she’s in no rush to cool the U.S. economy by raising borrowing costs. The greenback fell 0.7 percent to $1.1534 per euro, the lowest level since Aug. 24. The Standard & Poor’s 500 Index advanced as consumer and financial shares paced gains amid corporate results. The euro topped $1.15 for the first time since August, while gold pared its climb after climbing above $1,300 an ounce for the first time since January 2015. Oil fell below $45 a barrel in New York, after a 20 percent surge in April. Brazil’s real led losses among its major peers, while 10-year Treasury yields rose to 1.85 percent.

Daily Technical Analysis

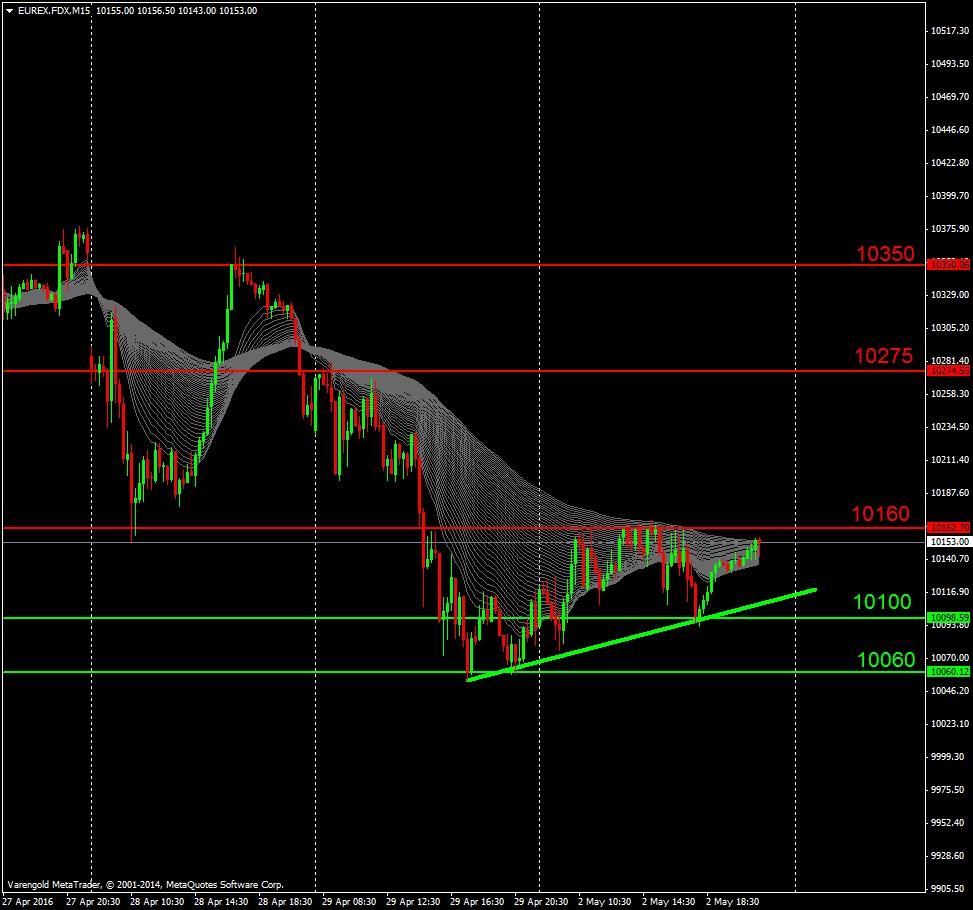

EUREX.FDX (Intraday, M15)

After the decline of more than 150 points on Friday, the German stock index recovered some losses yesterday. Bulls failed at 10160 points but found an intraday support around 10100 points. Next support and resistance might be very important for the next development after the market opening. The Average True Range could be a good support to manage the position size.

Support & Resistance (Intraday)

| Support Levels around | Resistance Levels around |

| 10100 | 10160 |

| 10060 | 10275 |

| N/A | 10350 |

USD/JPY (D1)

This major currency pair declined in a very sustainable trend over the last months. While the greenback reached new lows, the Relative Strength Index gave three times an oversold signal as you can see on the bottom of the chart. This current market situation may opens speculation for a recovery or at least a further rebound. The risk management should be considered.

Support & Resistance (Daily)

| Support Levels around | Resistance Levels around |

| N/A | 112 |

| N/A | 114 |

| N/A | N/A |

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, eyes on key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.