Good morning from beautiful Hamburg and welcome to our Daily FX Report. The low-cost airline Ryanair is getting into the private jet business. The Irish carrier announced Wednesday it's launching a private jet service to cater to large groups, including corporate customers, sports teams and official government trips. Ryanair (RYAAY) is considered a pioneer in Europe's airline industry by offering cut-throat pricing and a no-frills approach. So this new upscale service seems out-of-step with its traditional business. But the company maintains that it will continue offering low prices.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

EUR/USD inched down on Wednesday, as currency traders remained cautious ahead of a highly-anticipated interest rate decision from the European Central Bank. EUR/USD has been relatively steady over the last two and a half weeks, closing in a band between 1.086 and 1.102 in each of the last 14 sessions. Since the start of the 2016, the euro has edged up its American counterpart by approximately 1.35%. As expected, foreign exchange traders were hesitant to make any major moves in advance of Thursday's closely-watched ECB Governing Council meeting in Frankfurt. In recent weeks, ECB president Mario Draghi has sent strong signals that the central bank will approve further easing initiatives as a means for bolstering economic growth throughout the euro zone and staving off inflation. Analysts from ING have estimated that EUR/USD could fall as much as 1.5% if the ECB approves added stimulus, including raising the total of monthly asset purchases by as much as €5 billion. In addition, a group of a dozen analysts forecasted that the Governing Council could lower the deposit between 10 and 20 basis points and extend the bond buying program from anywhere between three and six months.

In the U.S., wholesale inventories rose by 0.3% in January, increasing by the highest level since last June and halting a three-month streak of negative moves. Analysts expected to see a slight decline of 0.1% for the month. As a result, the inventory to sales ratio fell by 1.3%, marking its fourth consecutive monthly decline.

The U.S. Dollar Index, which measures the strength of the greenback versus a basket of six other major currencies, fell to an intraday low of 96.94, before rebounding to settle at 97.19 on a volatile day of trading. The index, which is down more than 1% over the last two months, remained near two-week lows on Wednesday.

Daily Technical Analysis

USD/NOK (Daily)

Even though it is too early to say the trend in USDNOK has changed to bearish, the loss of the bullish channel shows a possible signal. If this change of trend is confirmed with the loss of the 8.4500 support we would assume to open shorts with target around 8.0300. Above the current level, 8.7400 looks the first resistance to consider if the bullish channel is recovered.

Support & Resistance (Daily)

| Support Levels around | Resistance Levels around |

| 8.4500 | 8.7400 |

| 8.0350 | 9.0000 |

| N/A | N/A |

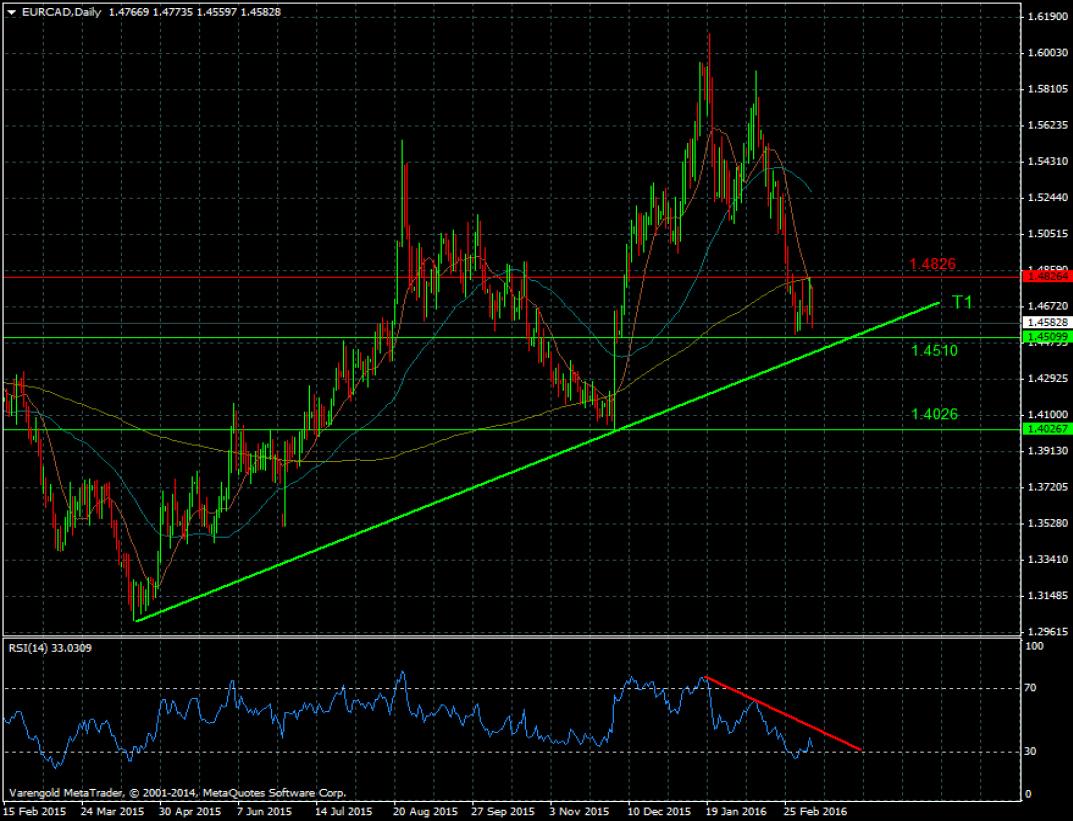

EUR/CAD (Daily)

Technically, the EURCAD is bullish as long as the price remains above the main trend-line (T1). The bearish correction form its highs reached in January and the RSI close to oversold zone could help as arguments for a possible bounce around the bullish trend-line. However, we still recommend caution as the RSI does not show bullish divergences yet and the previous bounce was not as vigorous as expected. On the other hand, if T1 is broken we would change the trend to bearish with target around 1.4026.

Support & Resistance (Daily)

| Support Levels around | Resistance Levels around |

| 1.4510 | 1.4826 |

| 1.4026 | N/A |

| N/A | N/A |

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD rebounds to 1.0650 on renewed USD weakness

EUR/USD gained traction and rose to the 1.0650 area in the early American session on Tuesday. Disappointing housing data from the US seem to be weighing on the US Dollar, helping the pair stretch higher.

GBP/USD climbs above 1.2450 after US data

GBP/USD extended its recovery from the multi-month low it touched near 1.2400 and turned positive on the day above 1.2450. The modest selling pressure surrounding the US Dollar after dismal housing data supports the pair's rebound.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.