Good morning from Hamburg and welcome to our last Daily FX Report. Russia will keep cooperating with the United States and its partners to fight Islamic State in Syria, but that cooperation will be in jeopardy if there are any repeats of Turkey's shooting down of a Russian jet, Russia's Vladimir Putin said. Speaking after talks in the Kremlin with French President Francois Hollande, Putin voiced lingering anger at Turkey's actions, saying he viewed the downing of the jet as an act of betrayal by a country Moscow had thought was its friend. But he said he would order Russia's military to intensify cooperation with the French armed forces - including exchanges of information about targets - and viewed that as part of creating a broader international coalition bringing together Russia and Western states.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

The dollar, euro and yen found themselves in familiar territory early on Friday, having shuffled sideways in thin trade with U.S. markets shut for the Thanksgiving Day holiday. The euro managed to hold above $1.0600 and last stood at $1.0606. It remained within reach of a 7-1/2 month trough of $1.0565 set earlier in the week. Against the yen, the common currency was flirting with 130.00 EURJPY, not far off a 7-month low of 129.77. The prospect of more easing from the European Central Bank at next week's policy review has been keeping the euro under pressure. Traders suspect this trend will probably continue in another subdued session with an early close for U.S. markets on Friday. The Reserve Bank of Australia and Bank of Canada also hold their respective policy meetings in the week ahead. In contrast to the ECB, the Federal Reserve seems likely to hike U.S. interest rates in December. Against the yen, the greenback fetched 122.65, remaining pretty much in consolidation mode after reaching a three-month high of 123.77 last week. Commodity currencies were resilient this week, thanks in part to higher oil prices and as investors turned less bearish on some base metals. Oil prices fell on Thursday after six days of gains, as concerns that escalating tension in the Middle East could disrupt supply faded, and the focus returned to a persistent market glut. The downing of a Russian jet by Turkey on Monday helped push up oil prices this week on the risk that rising geopolitical tension could hit Middle East supplies.

Daily Technical Analysis

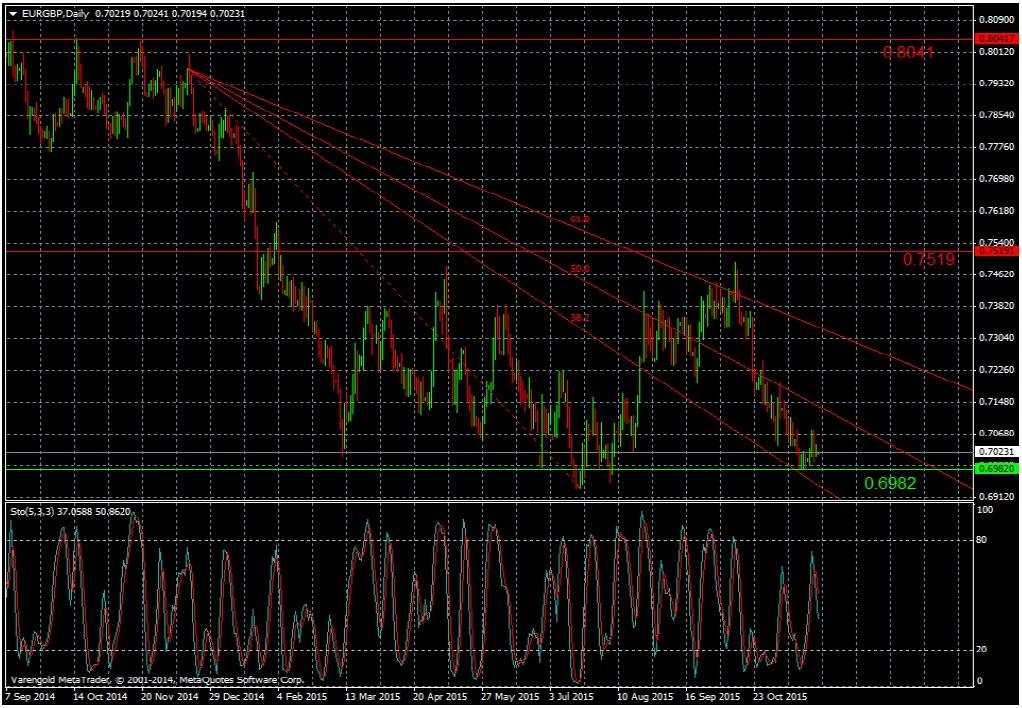

EUR/GBP (Daily)

Since January 2014 this currency pair is experiencing a strong control of the bears as it is falling below an downward Fibonacci fan. It could touch the third resistance line (61.8) two times but couldn’t strengthen its position and dropped again. The support line around 0.7063 was broken several times and doesn’t seem reliable any more. Nevertheless looking at the Stochastic one can see that it moves under the Center line, signaling that some losses might be possible.

Support & Resistance (Daily)

| Support Levels around | Resistance Levels around |

| 0.6982 | 0.7519 |

| N/A | 0.8041 |

| N/A | N/A |

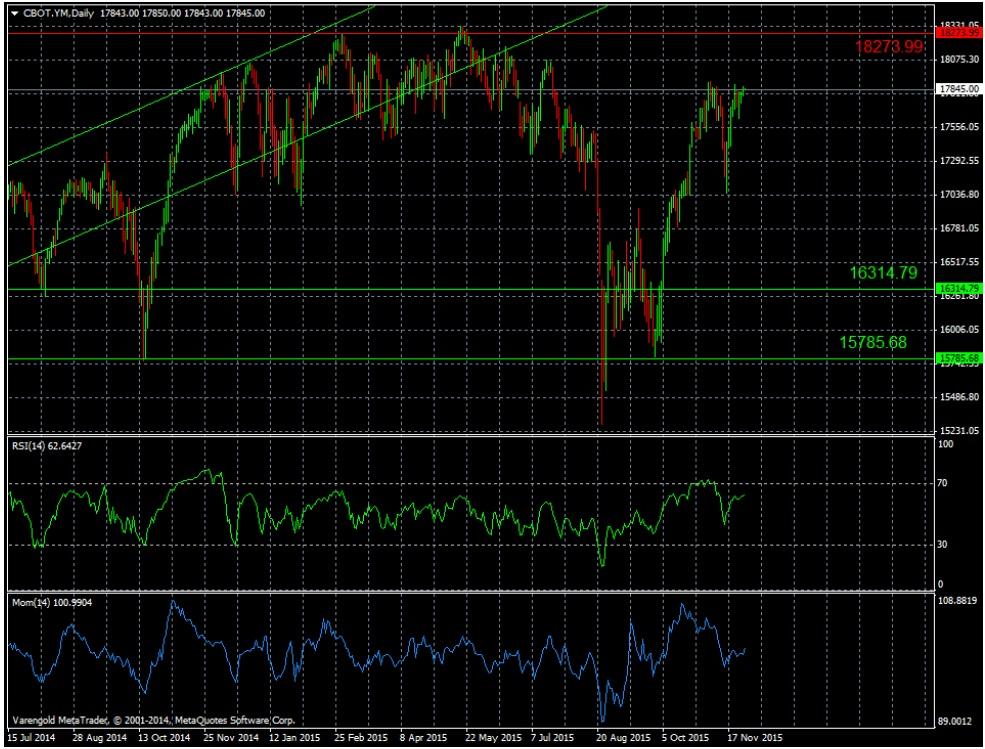

CBOT.YM (Daily)

Looking long term the main American index Dow Jones is recovering since October 2013. It was moving inside an upward trend channel, although there were some short term break-outs. The U.S. economic growth as well as the low unemployment rate help the bulls to dominate here long-term. Recently there was a sharp fall, based on turbulences in China. The RSI is signaling the index is moving slightly upward currently, as well as the Momentum.

Support & Resistance (Daily)

| Support Levels around | Resistance Levels around |

| 16314.79 | 18273.99 |

| 15785.68 | N/A |

| N/A | N/A |

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.