Good morning from beautiful Hamburg and welcome to our last Daily FX Report for this week. Asian shares gained in early trading on Friday, on track for a weekly rise, after Wall Street cheered a cool reading for producer price inflation that chilled expectations of a Federal Reserve rate hike. MSCI's broadest index of Asia-Pacific shares outside Japan was 0.3 percent higher, poised to gain about 1 percent for the week. Japan's Nikkei stock index was up 0.5 percent, set for a 1.5 percent weekly rise. On Wall Street, all three major indexes gained more than one percent, and the S&P 500 closed at a record. A spate of U.S. economic data painted an improving employment picture, but subdued producer price inflation quashed bets that the U.S. central bank would raise interest rates sooner rather than later this year.

Anyway, we wish you a successful trading day and a relaxing weekend!

Market Review – Fundamental Perspective

The dollar struggled at three month lows versus the euro early on Friday but encouraging news on the U.S. labour market helped it recover some ground against a host of other currencies. Data on Thursday showed the number of Americans filing new claims for unemployment benefits fell last week towards a 15-year low. Indeed, the dollar stayed on the defensive against the euro and sterling, which climbed to three- and 5-1/2 month highs of $1.1445 and $1.5815 respectively. Both currencies were just off those peaks in early Asian trade. That left the dollar index wallowing at four-month lows. The index is down 1.4 percent so far this week and has dropped more than 7 percent from a 12-year peak of 100.39 set in March. Yet, the dollar fared better against the yen and the Antipodean currencies. It last stood at 119.23 yen, having bounced off a two-week trough of 118.885. There was little market reaction to comments by European Central Bank President Mario Draghi on Thursday, who sought to assure markets that the ECB is fully committed to rolling out its trillion-euro-plus bond buying programme. The Australian dollar slipped to $0.8083 from a near four-month peak of $0.8164, while its New Zealand peer recoiled to $0.7488, from a one-week high of $0.7564. Crude oil futures edged down, with U.S. June crude shedding about 0.2 percent on the day to $59.78 a barrel, after dropping overnight on supply glut fears. Spot gold was on track for a weekly rise of more than 2 percent but was flat on the day at $1,221.20 an ounce after hitting a three-month high overnight as the USD`s weakness made it more appealing to investors holding other currencies.

Daily Technical Analysis

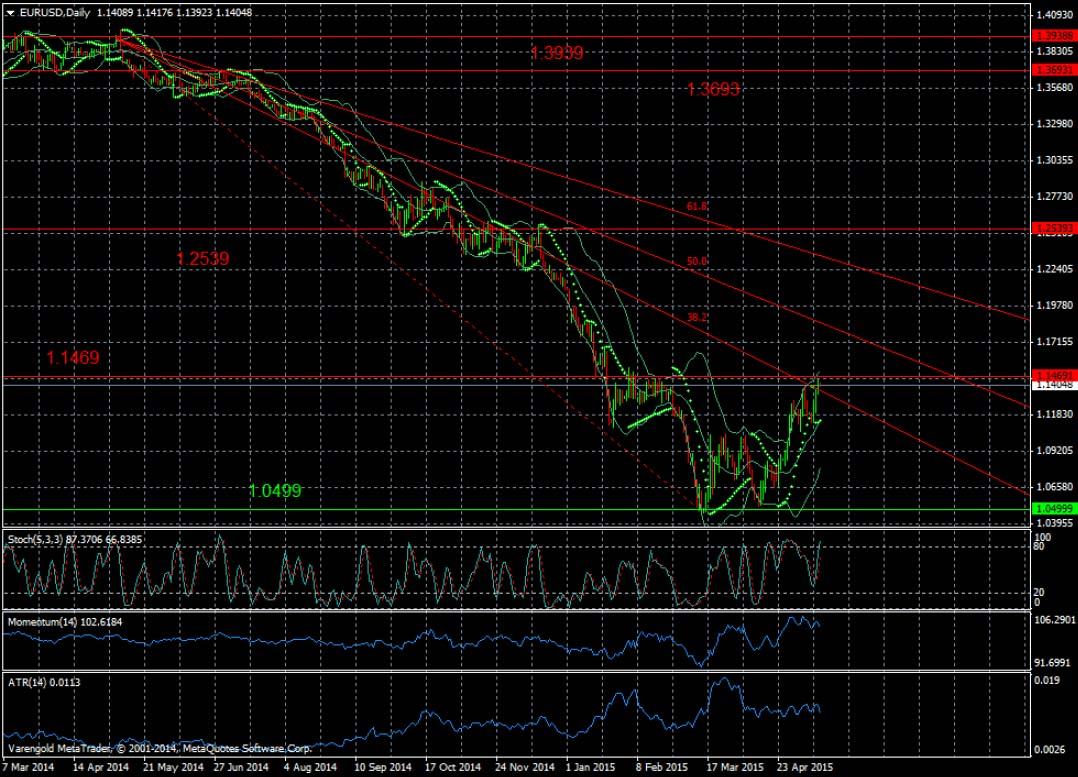

EUR/USD (Daily)

Since June the bears took control over this currency pair and the euro experienced a sharp decline versus the USD and even reached its lowest level for more than 10 years. After experiencing this decline to a level of around $1.04, the EUR was able to regain a bit and is now traded at around $1.14, where it may stay for a while should the resistance at around $1.14 hold. Otherewise a rise clearly above the mentioned level seems to be not unlikely.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.