Good morning from Hamburg and welcome to our first Daily FX Report for this week. A total of 2,460 people were confirmed killed in the 7.9 magnitude quake which was the worst disaster in Nepal since 1934 when 8,500 died. The death toll is likely to rise as rescue workers struggle to reach remote regions. Thousands of desperate Nepalese spent another night in the open and have been terrorized by strong aftershocks. Several countries rushed to send aid and personal while the hospitals are overwhelmed.

Anyway, we wish you a successful start into a new trading week!

Market Review – Fundamental Perspective

Last week data about US orders of durable goods, manufacturing, and new home sales all came in weaker-than-estimated. Fed officials are going to decide on monetary policy on April 29, the same day a report is projected to first quarter economic growth slowed. The Federal Open Market Committee was split at its meeting in March on when to begin rasing rates, which were in a range of zero to 0.25 percent to support the economy. In addition economics estimated that U.S. gross domestic product expanded at 1 percent annual rate in the first quarter in 2015, down from the prior 2.2 percent in the fourth quarter 2014. This lead to raising questions about whether the Federal Reserve will have scope to increase interest rates this year. As a result the USD declined for a second week. It dropped against most of its major peers and the market assumed that the USD will go through a period of consolidation. In the past week the USD decreased 0.4 percent versus the EUR and is currently trading at 1.0866. The USD/JPY weakened 0.5 percent to 118.99. The EUR/JPY was at 129.21.

On Friday Euro zone finance minsters warned Greece that its leftist government will get no more aid until it agrees a complete economic reform plan, as Athen moves closer to bankruptcy. The chairman of the euro zone finance ministers Jeroen Dijsselbloem said that there will be no partial disbursement for partial reforms for Greece.. Nevertheless yesterday Greek Prime Minister Alexis Tsipras ang German Chancellor Angela Merkel agreed in a phone conversation to maintain contact during talks between Athens and its lenders to reach a debt deal. Euro zone ministers bemoaned talks they they felt were going nowhere and one minister even said on Friday that maybe it was time governments prepared for the plan B of a Greek default.

Technical Analysis

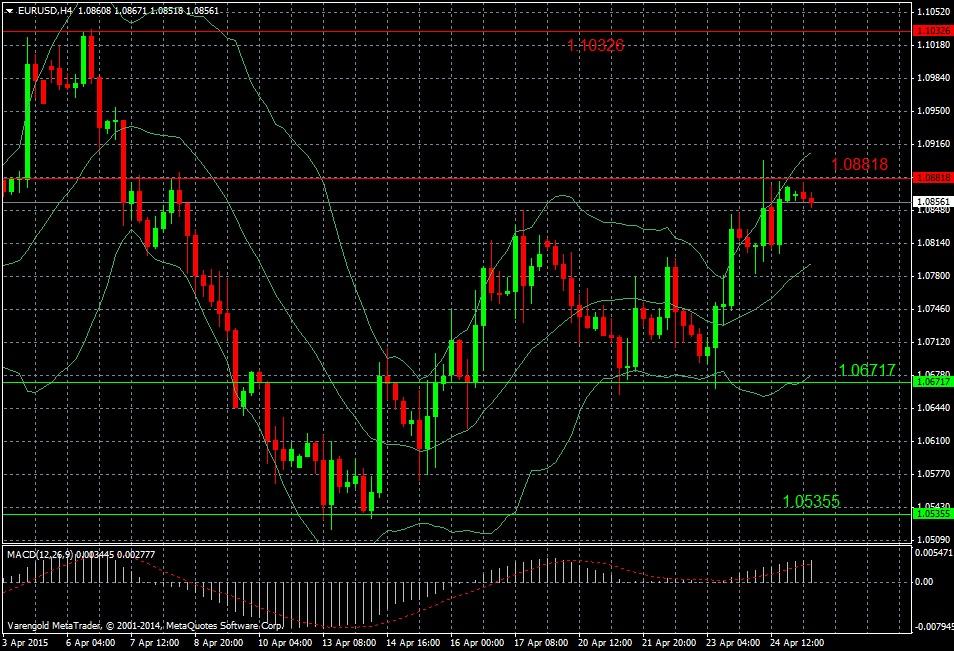

EUR/USD (4 Hours)

Two weeks ago the decrease of the EUR versus the USD had been stopped at the support line around 1.0535. Since then we can observer a trend reversal with strong gains for the EUR but it remains to be seen if this trend can persist. The current resistance level around 1.0881 and especially the next resistance around 1.1032 are very important levels which have to bee broken by the pair otherwise the current trend will come to an end. The MACD supports futher increases.

Support & Resistance (4 Hours)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.