Good morning from Hamburg and welcome to our last Daily FX Report of the week. Yesterday, the Prime minister of China, Li Keqiang announced in the China’s National People’s Congress that its military budget will increase by 10.1% in 2015 to a total of $144.2 billion, the largest in a series of double digit increases that will narrow the still significant gap with the United Stated on defense spending. The increase unveils the intention of China to prioritize military spending even when its economy is slowing down. This announcement also comes amid always unease relationship between China and its neighbors about the pursuit of its territorial claims in the South China Sea and East China Sea. China is the second country in the world in defense expenditure with 15% of the global.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

The euro rebounded from a 11 year low on Thursday as investors looked ahead to Friday’s non- farm payrolls report in U.S. which analyst expect a figure around 240K, lower from the previous data of 257K. Any figure around 200K might think to investors that the optimism on labor market has been overdone. The share currency hit this 11 year low earlier in the session after European Central Bank President, Mario Draghi said the central bank wouldn’t buy bonds with yields lower that the central bank’s deposit rate of negative 0.2%. The euro traded at 1.1025 against dollar, after falling to 1.0987 during the session, the lowest since September 2003. It also touched its lowest level against the British pound since December 2007, to 72.20 pence, but recovered slightly to 72.36 pence in recent trade. The Canadian dollar dropped 0.3% against dollar to C$1.2465. It touched almost six year low at C$1.2799 on January 30th. Australian dollar also declined 0.3% to 77.94 U.S cents, approaching a 5 and half year low of 76.26 reached last month. The Turkish lira fell to an all-time low against the dollar on Thursday once the Turkey’s central bank decided to lower interest rates at a faster clip. The lira has depreciated by about 10% this year, making the second worst performing of the emerging market currency, traded as low as 2.62 against the dollar yesterday. It is clear that the currency market is just reflecting faithfully the different stage of the economies around the world, with the U.S. dollar as the indisputable winner, followed by the British pound, and with so many losers immersed in interest rates cuts and quantitative easing programs.

Daily Technical Analysis

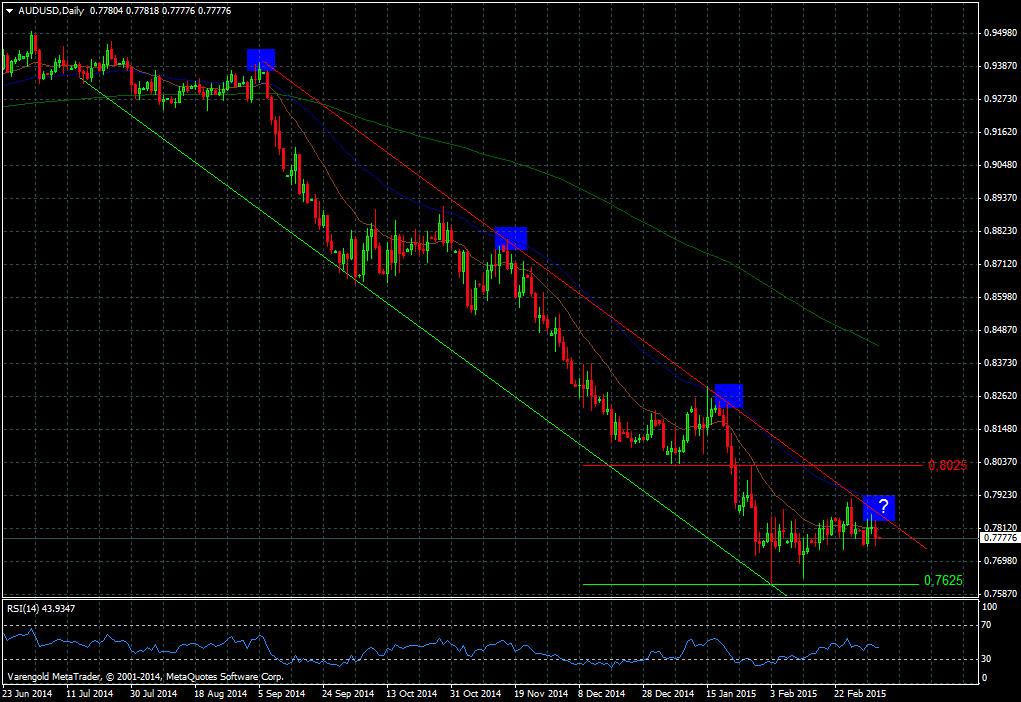

AUDUSD (Daily)

Technically the AUDUSD is back again to the top side of a clear downtrend channel which, considering the Australian growth weakness, with the RBA saying that the monetary policy is not working, and the U.S dollar getting stronger, it’s going to make difficult for the Aussie to hold prices over 78 cents. However, if this resistance is finally broker, we identify the next level around 0.8025, even though we believe it will be more probably for the pair to come back to its lows, placed around 0.7625.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700, eyes on US first-quarter GDP data

EUR/USD hovers around the 1.0700 psychological level on Thursday during the early Thursday. The modest uptick of the major pair is supported by the softer US Dollar. Later in the day, Germany’s GfK Consumer Confidence Survey for April will be released.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.