Good morning from beautiful Hamburg and welcome to our last Daily FX Report for this week. Islamic State fighters seized more than a third of the Syrian border town of Kobani, a monitoring group said on Thursday, as U.S.-led air strikes failed to halt their advance and Turkish forces looked on without intervening. With Washington ruling out a ground operation in Syria, Turkey said it was unrealistic to expect it to mount a cross-border operation alone to relieve the mainly Kurdish town.

Anyway, we wish you a successful trading day and a relaxing weekend!

Market Review – Fundamental Perspective

Investors have long believed that a solid U.S. recovery will eventually help lift many other sluggish economies around the world, including those in Europe. But now there is growing fear that the U.S. economy cannot escape unscathed when Europe is stalling and many other big economies, including China, Japan and Brazil, face their own hardships. The latest shock came from Germany, which reported on Thursday that its exports fell 5.8 percent in August, the worst decline since January 2009. While U.S. Federal Reserve policy makers start to raise concerns that the recetns dollar strenght may impact growth, the Bank of Japan is banking on policies designed to weaken the yen for boosting its economy.

As stocks declines and signs of a overall global slowdown boosted demand for haven assets, the yen was set for gains against most of its 16 major peers this week. The yean headed for its biggest weekly advance in almost nine months versus the dollar. It touched 107.53, which was the strongest level since Sep. 17. The euro stayed on the back foot after the weak German data. It had reached a 2-1/2 week high of $1.2791 per euro early on Thursday, but beat a hasty retreat and was last trading at $1.2688.

Unsurprisingly, commodity currencies were among the hardest hit with the Australian dollar sliding back below 88 U.S. cents from near 89 cents. It last traded at $0.8764. Its New Zealand peer fell back to $0.7861 from a two-week high of $0.7975, while the Canadian dollar dipped to C$1.1187 per USD from C$1.1082.

Concerns about global economic growth hit oil prices hard, with Brent oil prices falling to $89.24 a barrel, its lowest level since mid-2012. U.S. crude futures traded at $84.68, having fallen to $84.06 on Thursday, its lowest level in almost two years.

Daily Technical Analysis

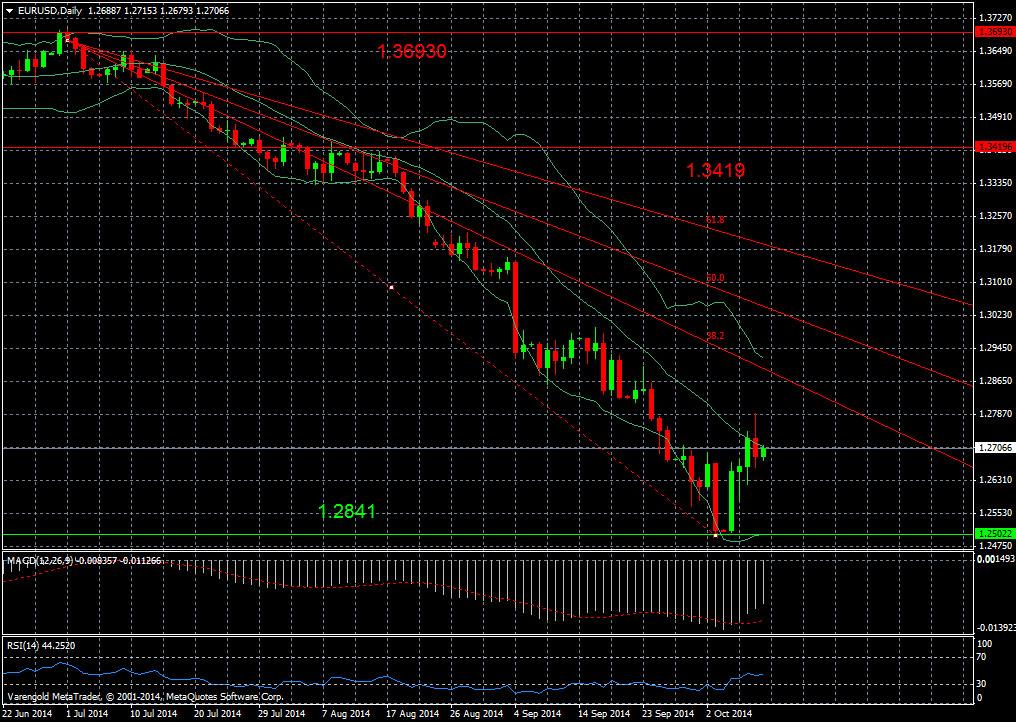

EUR/USD (Daily)

After reaching the resistance level at 1.3693 in the end of June, the EUR experienced a sharp decline against the USD. As we already said on Monday, the currency pair experienced a further decline and was even able to break through the previous support level of 1.2889. At the moment the EUR is experiencing a light recovery and both indicators support the evidence that the recovery phase may hold for a while.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.