Good morning from rainy Hamburg and welcome to our Daily FX Report. U.S. health officials said yesterday that the first patient infected with the deadly Ebola virus had been diagnosed in the USA. The patient had flown from Liberia to Texas and is a new sign of how the outbreak can spread globally. A handful of people, mostly family members, may have been exposed to the patient after he fell ill. There shouldn’t be any threat to any passengers who had traveled with him.

However, we wish you a much luck in trading today!

Market Review – Fundamental Perspective

Yesterday the Dow Jones index of shares declined 0.2 percent and the Standard & Poor’s index fell 0.3 percent. The EUR had its worst quarter since 2010 amid the Erupean Central Bank’s moves to swell its balance sheet and cut borrowing costs to spur growth. The EUR dropped to the lowest level in two years versus the USD as slowing inflation boosted the case for the ECB to add further monetary stimulus to avert deflation. Data yesterday showed that consumer price index in the euro area fell to 0.7 percent. Furthermore reports yesterday showed too that retail sales in Germany rose 2.5 percent in August and unemployment rate remained low at 6.7 percent. In europes second biggest economy data showed that France’s national debt hit a record high in the second quarter underlining the country’s struggle to rein in public finances before today the 2015 budget will be presented. In addition another report yesterday showed that U.S. consumer confidence declined in the past month for the first time in five months and home prices in July climbed less than forecasted from a year earlier, underscoring the unsteady nature of U.S. growth. Consumer confidence depreciated to 86.0 from a upwardly revised 93.4 in August and the Institute for Supply Management-Chicago business barometer fell to 60.5 in September from 64.3 in August. The EUR/USD decreased 0.4 percent to 1.2631 and tumbled already 3.8 percent in September. The EUR/JPY weakened 0.3 percent to 138.49. The USD/JPY advanced 0.1 percent to 109.63. The JPY sank versus most major counterparts and lost 7.6 percent versus the USD in the third quarter 2014. The Bank of Japan is going to meet next week and the ECB will meet tomorrow but further rate cuts are not expected.Daily Technical Analysis

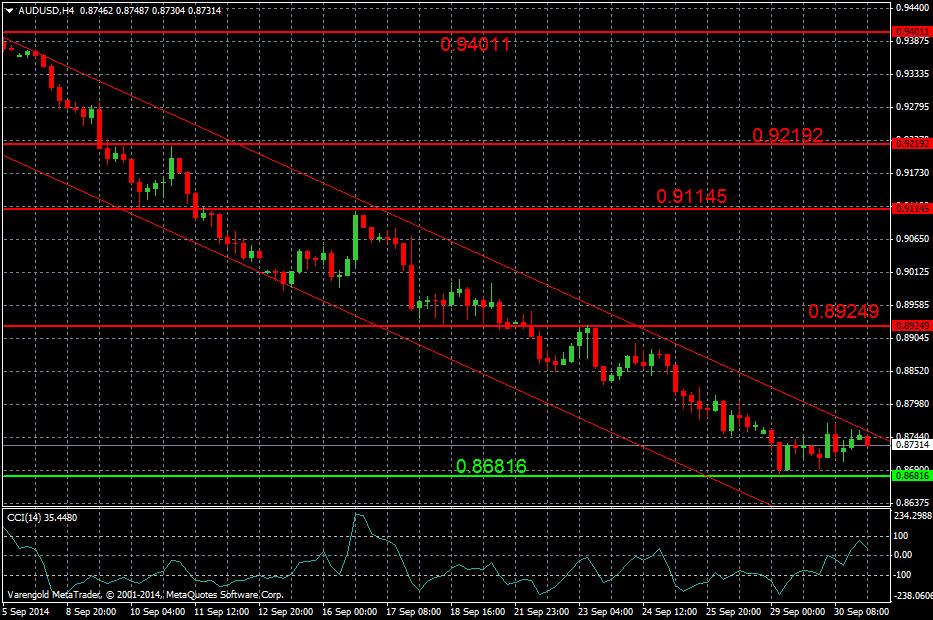

AUD/USD (4 Hours)

For almost four weeks now the currency pair is decreasing inside a bearish trend channel and reached an eight month low around the support line 0.8681. And a trend reversal is not foreseeable yet while the CCI is on high level and indicates further losses.

Support & Resistance (4 Hour)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.