Good morning from beautiful Hamburg and welcome to our latest Daily FX Report. On Monday, the three major indexes in the U.S. experienced significant losses as investors still remain cautious about instability in Ukraine and Gaza. The S&P 500 fell as much as 0.6 percent, the Dow Jones industrial average fell 0.28 percent and the Nasdaq Composite dropped 0.17 percent. In total about 61 percent of stocks traded on the New York Stock Exchange ended the day with losses.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

In the U.S. an increase in short-term Treasury yields signaled investors mounting expectations the Federal Reserve will raise interest rates. The USD reacted and was 0.1 percent from the highest in almost a month. Yesterday, the 20-day correlation beween dollar-yen and yields on two-year Treasuries climbed to the highest level since March and was at 0.66 percent. Treasury two-year yields climbed to 0.50 percent, a level not seen since July this year. The appreciation of the USD is also stimulated by the assumption that the consumer-price inflation held at the fastest pace since October 2012. After the EUR depreciated against the USD and fell to a level below $1.35 per EUR, traders are expecting even a further depreciation and it is likely that the EUR reaches the $1.30 level in the near future. The euro is also losing its connection with Europe`s bond market. A look on the correlation of the euro with the yields spreads of Italy, Spain and Portugal reveals a correlation of almost zero. The euro`s 14-day correlation to peripheral euro-region bond spreads dropped to 0.19 on Monday. In January this year the correlation was at 0.75 and even 0.71 in the beginning of July.

The USD added 0.1 percent to 101.47 yen. It traded at $1.3525 per EUR and even touched $1.3491 on July 18, which marked the strongest level since February 2014. The EUR appreciated versus the JPY by 0.1 percent to 137.25 yen. The AUD was little changed at $0.9368. The key theme of this week was and will still remain the higher oil price caused by the geopolitical risks. Oil prices have risen in the younger past due to the threat of escalating tensions between Russia and the West over the crisis in Ukraine. U.S. crude oil reached a three week high on Monday and crude oil for August delivery shot up 1.4 percent to settle at $104.59 ahead of Today`s contract expiry.

Daily Technical Analysis

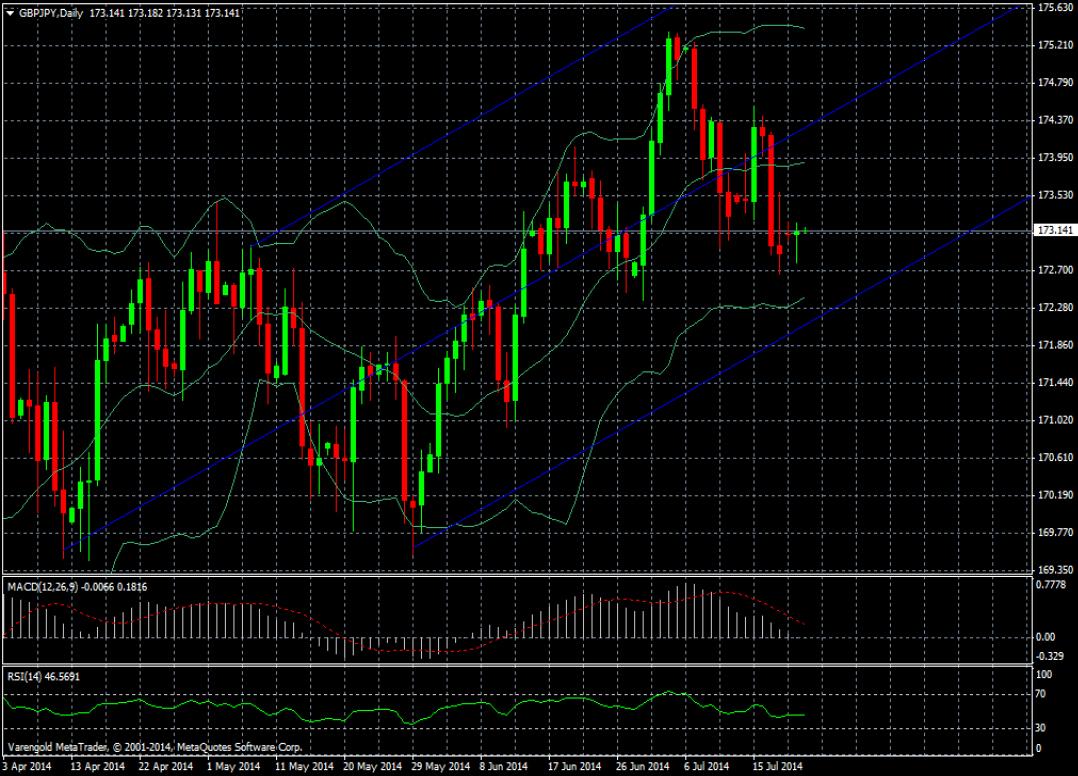

GBP/JPY (Daily)

Overall, the chart shows a clear upward movement of this currency pair since the end of May. At the moment the currency pair is moving into the direction of its lower Bollinger Band. Whenever we had this scenario before, the pair rebounded. As the MACD and the RSI indicate, the upward movement lost its strength. However, it can be expected that a future appreciation of the GBP versus the JPY may occure. The Adrews`Pitchfork trend channel supports this assumption.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.