Good morning from a cloudy Hamburg and welcome to our final Daily FX Report for this week. As a break to the news on the FIFA World Cup, some interesting news was released from the tech giant Apple late yesterday. Reports are that it will start mass production of the company’s first smartwatch in July as the company follows its market rival Samsung in producing a timepiece to match other portable products. The rumours are already circulating as to what it will look like and what features it may have with wireless charging capabilities said to be one of those. Many will be hanging out for this latest release from Apple!

Anyway, we wish you a successful trading day and a relaxing weekend!

Market Review – Fundamental Perspective

Currency volatility has declined to a record low according to a Deutsche Bank guage whichmeasures the activity in world forex markets. It fell to 5.28% yesterday which is the lowest value since the bank first started making measurments in 2001. It reflects the general lack of trade which is being seen across a number of asset classes as investors seem to be waiting for the next big news which sets the direction for world markets. There seems to be no clear trends in the markets with most currencies pushing generally sideways as many analysts note that range trading seems to be the measure of the day at the moment. Trading volumes are down which is adding to the lack of volatility. As a result the overnight trade in Asia failed to produce any large movements in currency markets.

The Bloomberg Dollar Spot Inbdex also declined 0.1 percent overnight to sit just above 1,000 at 1,009.28 and that is just above the lows seen on May 21. Most analysts note that investors are soft on the Greenback due to the dovish signals from the Federal Reserve. Adding to the downward pressure is perhaps the Markit Economics report of U.S. manufacturing which is due out today. The index is expected to drop in data to be released today. Furthermore, GDP data due out next week is also expected to be weak and possibly even show a contraction of the world’s largest economy. The U.S. dollar is poised for a 0.6 percent decline against the euro on the week which is the sharpest fall since April 11. In other currencies, the Australian dollar added another 0.1 percent against its U.S. counterpart overnight trading above 94 U.S. cents. It is set to post a four week gain.

Daily Technical Analysis

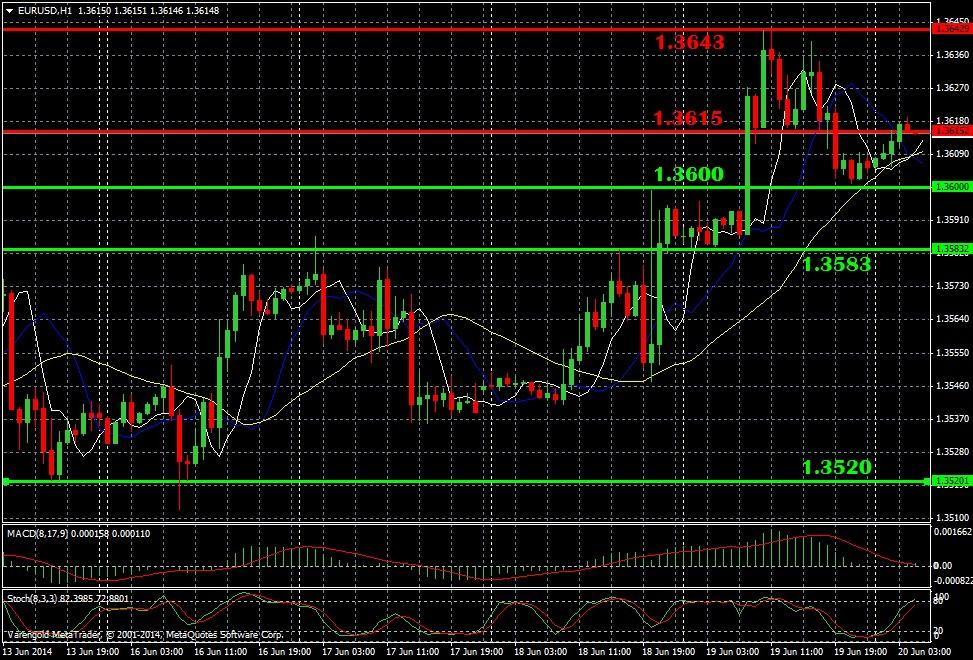

EUR/USD (1 Hour)

After a long period of weakness for the euro, it finally made a recovery this week and pushedback above the $1.36 level. The break of the large lower range and the $1.36 figure was confirmed by the rebound which happened late yesterday. The MACD and Stoch indicators show that the move has also stabilized and the bears have, at least for the moment, lost control of the currency pair. The next step would be a push back towards the resistance level around $1.3643 with the action there to determine the middle-term future for the euro.

Support & Resistance (1 Hour)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD comes under pressure near 1.0630

Further gains in the Greenback encourage sellers to maintain their control over the risk complex, forcing EUR/USD to retreat further and revisit the 1.0630 region as the US session draws to a close.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.