In the past week, there have been a couple of days that showed unusual breadth readings wherein the S&P 500 generated a very small change on the day, but there was a large number of stocks on the NYSE that advanced. This means that issues other than the largest stocks are pushing the advance-decline line up. This can be a bearish signal as was the case near the end of 2014, prior to that the end of 2006, the spring of 2004.

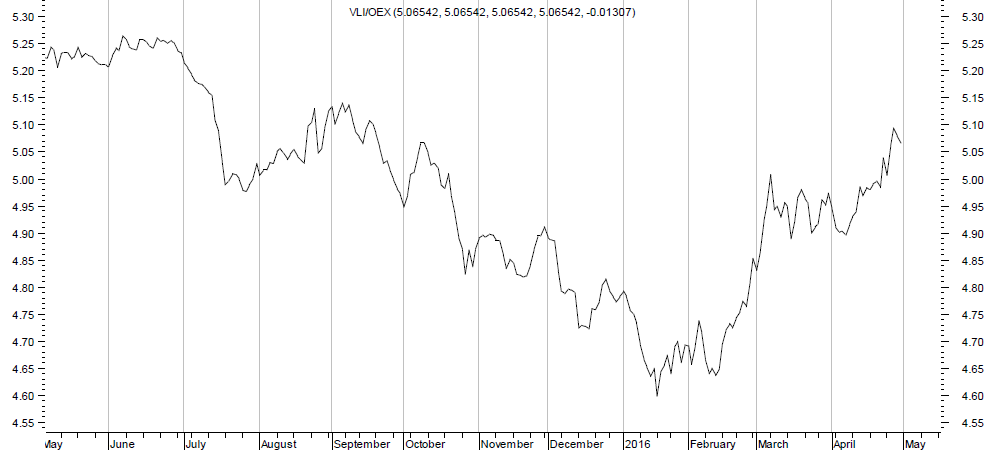

The best way to monitor this development is to track the relative price behavior of the VLIS (equally-weighted) versus the OEX (heavily-weighted by large-cap stocks). This ratio has been rising since the February low. The drops in IBM, NFLX, GOOG, MSFT and AAPL are indicating a big-cap bear market. The overall bear market is not over. It is simply more developed in the small-cap stocks and just beginning in the big-cap shares. The latter stock group has more weight in the indices and is where weakness is likely to be concentrated.

This is an excerpt from the monthly Cycles Research Early Warning Service, a monthly e-mail report that analyzes the trends in the US stock market, the bond market, and the gold market. There are stock and ETF recommendations and high-probability S&P turning points.

Cycles Research Investments, LLC does not guarantee the accuracy and completeness of this report, nor is any liability assumed for any loss that may result from reliance by any person upon such information. The information and opinions contained herein are subject to change without notice and are for general information only. The data used for this report is from sources deemed to be reliable, but is not guaranteed for accuracy. Past performance is not a guide or guarantee of future performance. The information contained in this report may not be published, broadcast, re-written, or otherwise distributed without prior written consent.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.