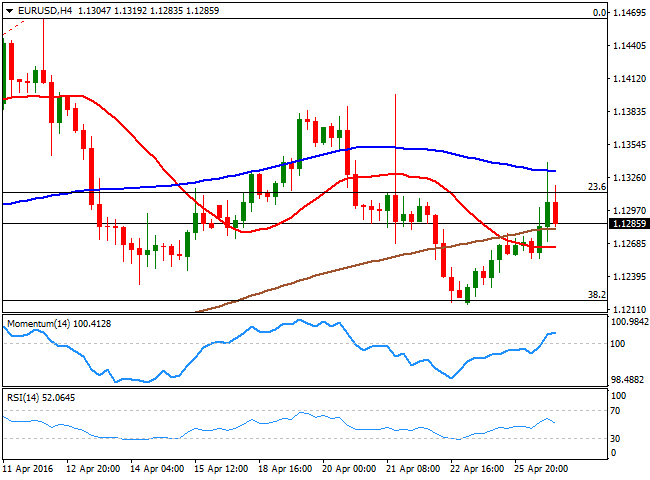

EUR/USD Current Price: 1.1284

View Live Chart for the EUR/USD

Major currencies' pairs have been mostly stable in Asia, partially ahead of the upcoming Central Bank's events and partially due to an empty macroeconomic calendar. London opening brought some USD selling interest, with the American currency weakening against most of its major rivals, and accelerating its decline after the release of March US Durable Goods orders, which rose 0.8% compared to February, less than expected as demand for capital equipment remained weak. The core reading fell by 0.2% in the same period, indicating the economy is still struggling to recover. Also, Consumer confidence fell 1.9 points in April, down to 94.2, while the Markit services PMI rose to 52.1, missing expectations of 52.3.

The EUR/USD pair advanced up to 1.1339 before turning south to trim most of its daily gains, and closed the day in the 1.1280 region, as investors are not willing to risk much ahead of the FOMC decision. The US Central Bank is expected to remain maintain the status-quo, with focus then on the wording of the statement. Should the FED announce that it sees the risks to the outlook for both economic activity and the labour market as “balanced” or "nearly balanced," it will be understood as a sign that the FED is one step closer to raise rates and therefore give the greenback some support.

The 4 hours chart posts a mild positive tone, yet the upcoming direction will solely depend on how the market reacts to the FED. The mentioned daily high is the immediate resistance, followed by the 1.1380/90 region, where the pair presents multiple daily highs from these past months. Gains beyond this last should lead to a test of the critical 1.1460 region, whilst beyond this last, the rally can extend up to 1.1500 in the short term, but leave then doors opened for a rally up to 1.1713, August 2015 monthly high. The immediate short term support comes at 1.1270, followed by the mentioned 1.1220 Fibonacci level. It seems unlikely that the pair can break below this last, unless the FED makes it clear that it will actually raise rates in June, with the next bearish target then at 1.1160.

Support levels: 1.1270 1.1230 1.1200

Resistance levels: 1.1315 1.1340 1.1385

EUR/JPY Current price: 125.70

View Live Chart for the EUR/JPY

The EUR/JPY extended its weekly rally up to 125.96 this Tuesday, and holds around 125.70, the 61.8% retracement of latest daily decline, by the end of the day. The Japanese yen came under some selling pressure mid American afternoon, as the market is pretty much convinced that the Bank of Japan which meets early Thursday, will refrain from adding more easing this month, while bets on the US Federal Reserve are of a hawkish stance. The 4 hours chart for the pair shows that the price is above its 100 and 200 SMAs, but that the technical indicators are diverging lower within positive territory, suggesting the rally may have reached an interim top. Also, the poor performance of Wall Street suggests that Asian share markets will be unable to recover sharply, adding to a short term bearish case in the EUR/JPY. The pair has an immediate support around 124.50, and it will take a break below it to confirm a downward move during the upcoming sessions, while only above 126.25, the pair will be able to extend its rally towards the 127.00 region.

Support levels: 124.50 124.00 123.65

Resistance levels: 126.25 126.60 127.00

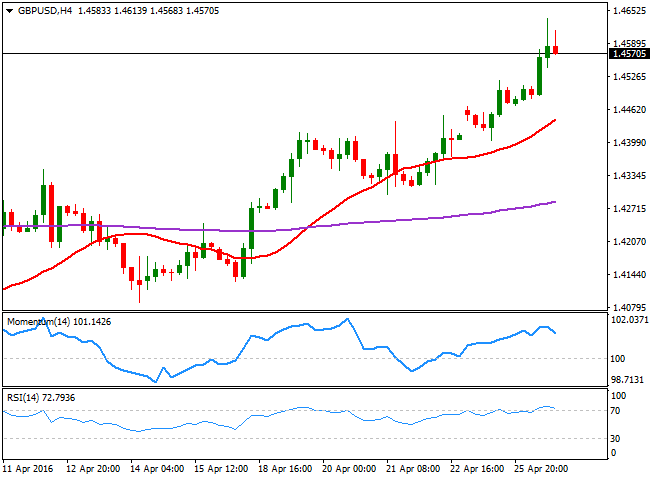

GBP/USD Current price: 1.4572

View Live Chart for the GBP/USD

The GBP/USD pair advanced to a fresh 2-month high of 1.4637 this Tuesday, with the Pound still being the best performer across the board. The pair caught a bid early Europe, despite slight downbeat UK money data, showing that mortgage approvals were 20% higher from a year ago, but down to 45.01K from previous 45.65K, the lowest since December. Dollar's recovery during US trading hours have helped the pair to correct lower, but it holds on to gains daily basis, now finding some short term buying interest in the 1.4560/70 region, where the pair has stalled its advance early February. Technically, the 4 hours chart shows that the price remains far above a bullish 20 SMA, but also that the technical indicators have turned slightly lower within overbought territory, suggesting some consolidation ahead of the next directional move. Nevertheless, is clear that bulls are in control of the pair, and things will remain that way as long as the price holds above the 1.5420 region, a strong static support.

Support levels: 1.4550 1.4520 1.4470

Resistance levels: 1.4610 1.4660 1.4700

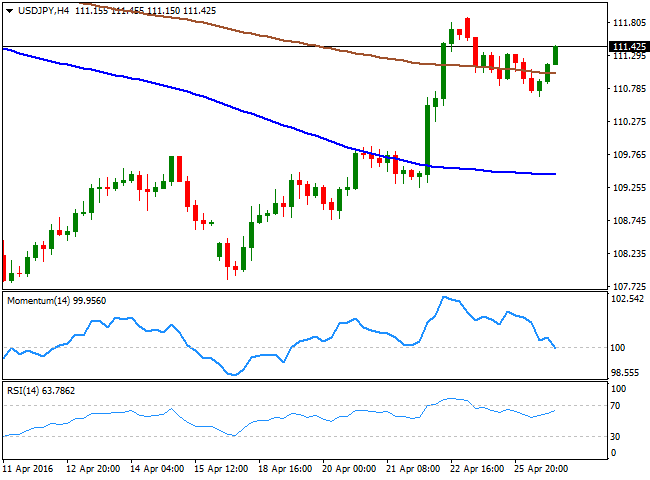

USD/JPY Current price: 111.42

View Live Chart for the USD/JPY

The USD/JPY pair started the day with a negative bias, falling down to 110.66 a major static support. Buying interest, however surged around the critical level, despite US disappointing data, and sent the pair back higher ahead of Wall Street's close as investors are pricing in a generally hawkish FED and an on-hold BOJ. Now trading around 111.40, the 1 hour chart shows that the pair has held well above a bullish 100 SMA, currently approaching the mentioned support, whilst the technical indicators consolidate well above their mid-lines, lacking clear directional strength, but suggesting the downward potential will remain limited. In the 4 hours chart, the price has kept struggling around a mild bearish 200 SMA, unable to clearly detach from it, whilst the Momentum indicator diverges from price action, heading south below its 100 level, and the RSI goes nowhere around 63. The pair will likely remain range bound ahead of the US Central Bank decision, limited below 111.90, this week high, and the mentioned 110.66 level. Should the FED signal a more confident stance over the economic situation, the pair can break higher, and extend its rally up to 113.79, Mach 29th high during the following sessions.

Support levels: 111.00 110.65 110.30

Resistance levels: 111.90 112.30 112.80

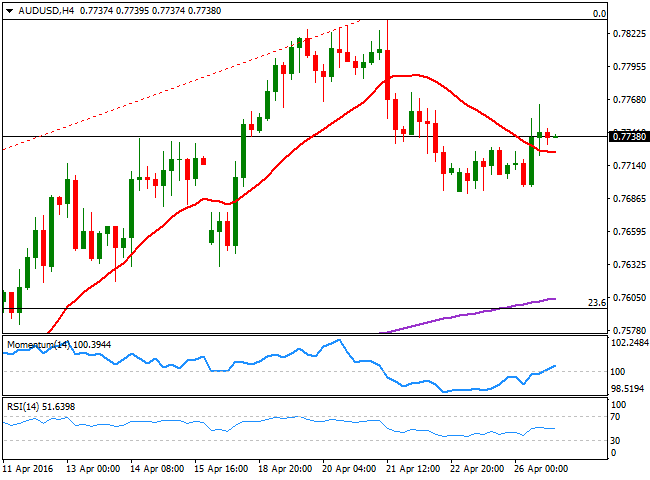

AUD/USD Current price: 0.7738

View Live Chart for the AUD/USD

The AUD/USD pair advanced modestly for a second consecutive day, reaching a daily high of 0.7764 before retreating some 30 pips as dollar found some short term demand by the end of the day. The Aussie found some support in a recovery in commodities' prices, as gold and gold surged on Tuesday as China continues to give signs of improving economic conditions. During the upcoming Asian session, Australia will release its Q1 consumer inflation numbers, expected to have advanced less than on the last quarter of 2015. The weekly recovery has been barely enough to erase Friday's losses, and the pair is not far from its yearly high of 0.7834, although the upward potential in the long term has eased somehow. Nevertheless, the pair has a long way to go to confirm a sustainable decline, as the 23.6% retracement of this year rally stands around 0.7600, and is the level to beat to confirm such slide. In the meantime, the 4 hours technical stance is barely positive, as the price is a handful of pips above a bearish 20 SMA, whilst the RSI indicator stands flat around 41 and the Momentum indicator heads slightly higher, right above its 100 level.

Support levels: 0.7690 0.7655 0.7620

Resistance levels: 0.7750 0.7790 0.7835

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0600 as focus shifts to Powell speech

EUR/USD fluctuates in a narrow range above 1.0600 on Tuesday as the better-than-expected Economic Sentiment data from Germany helps the Euro hold its ground. Fed Chairman Powell will speak on the policy outlook later in the day.

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

Gold price remains depressed near $2,370 amid bullish USD, lacks follow-through selling

Gold price (XAU/USD) attracts some sellers during the early part of the European session on Tuesday and reverses a major part of the overnight recovery gains from the $2,325-2,324 area, or a multi-day low.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

Canada CPI Preview: Inflation expected to accelerate in March, snapping two-month downtrend

The Canadian Consumer Price Index is seen gathering some upside traction in March. The BoC deems risks to the inflation outlook to be balanced. The Canadian Dollar navigates five-month lows against the US Dollar.