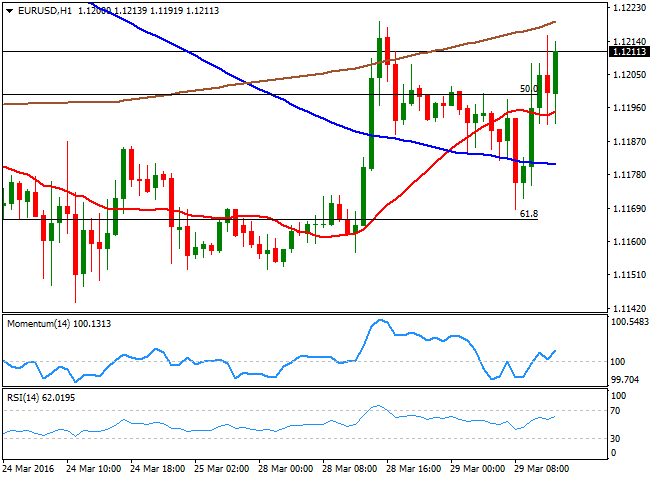

EUR/USD Current Price: 1.1211

View Live Chart for the EUR/USD

The EUR/USD pair trades unchanged intraday, still stuck around the 1.1200 level and waiting for a trigger, one way or the other. So far, the macroeconomic calendar has remained light, but the US will offer some data, including a house price index and consumer confidence for March, alongside with a Yellen's speech. This last will probably set the tone for the next couple of days, when the market will enter back in wait-and-see mode ahead of the US NFP report on Friday.

Technically, the EUR/USD 1 hour chart presents a neutral-to-bullish stance, given that the technical indicators head barely higher around their mid-lines, whilst the 20 SMA remains horizontal, and the price moves between the 100 and 200 SMAs. In the 4 hours chart, the technical indicators have turned lower above their mid-lines, but the price remains above an also flat 20 SMA. Some follow through beyond 1.1245 is required to confirm additional advances, while below 1.1160, the risk turns towards the south.

Support levels: 1.1160 1.1120 1.1085

Resistance levels: 1.1245 1.1290 1.1330

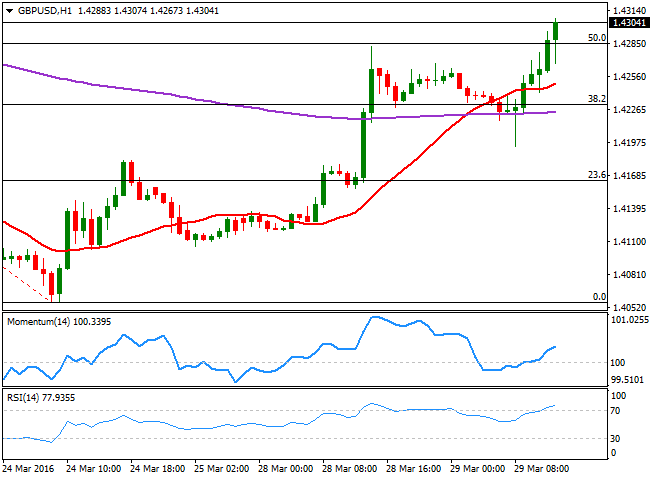

GBP/USD Current price: 1.4303

View Live Chart for the GBP/USD

The GBP/USD pair trades at its highest for the week, a few pips above the 1.4300 level. The pair recovered sharply from a daily low of 1.4193 reached with the London opening, with no actual catalyst behind the run, but the continuation of the upward momentum seen on Monday. There was no data coming from the UK, and if anything, the latest Stability Outlook report from the BOE has been negative, given that it said that the outlook has worsened since November 2015. Nevertheless, the pair presents a bullish tone, with the RSI indicator in the 1 hour chart heading slightly higher and the price accelerating above its 20 SMA. In the 4 hours chart, the price is back above its 200 EMA, now the immediate support around 1.4265, while the technical indicators head sharply higher within positive territory, indicating a continued advance towards the 1.4335 region, the 61.8% retracement of the latest daily decline.

Support levels: 1.4265 1.4230 1.4190

Resistance levels: 1.4335 1.4370 1.4410

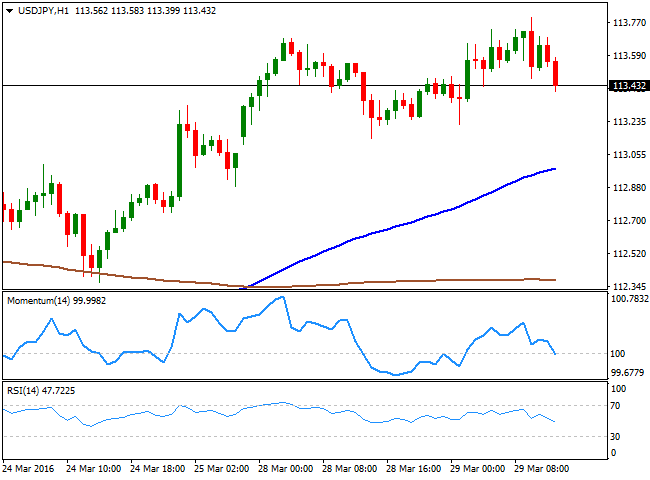

USD/JPY Current price: 113.43

View Live Chart for the USD/JPY

Holding near the highs, despite dollar's weakness. The USD/JPY pair turned south ahead of the US opening, but remains within its latest range above the 113.00 level. The pair advanced during the Asian session, on the back of poor Japanese, as retail sales fell 2.3% monthly basis in February, being the biggest drop since April 2014. Also, news showed that PM Abe is still in track to raise the sales tax next 2017, in spite of latest rumors. The 1 hour chart shows that the price remains well above its 100 SMA, currently around 113.00, but that the technical indicators have turned lower, and are currently aiming to break below their mid-lines. In the 4 hours chart, the technical indicators also turned south within positive territory, but without confirming a downward move, which will be confirmed on a downward acceleration below the 112.75 support.

Support levels: 113.00 112.75 112.30

Resistance levels: 113.70 114.10 114.45

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.