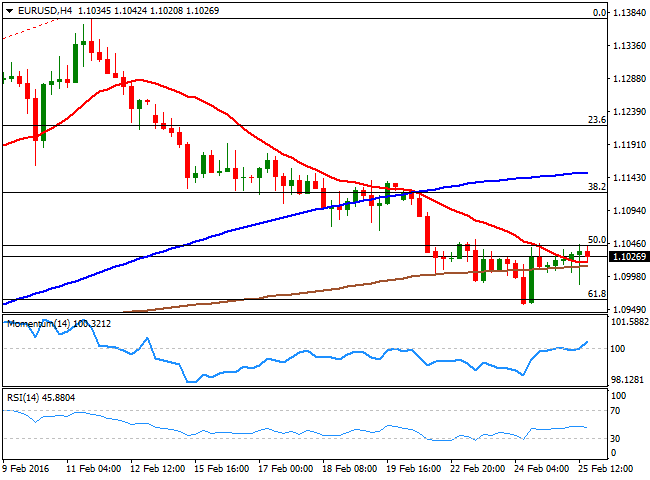

EUR/USD Current Price: 1.1027

View Live Chart for the EUR/USD

The US dollar traded steady against the euro and the pound on Thursday, receiving a mild, temporary boost on the back of better-than-expected US data. New orders for durable goods rose a seasonally adjusted 4.9% in January, beating expectations of a 2.9% increase while excluding transportation, orders grew by 1.8%, above the 0.2% rise of consensus. Separated data showed that even though initial jobless claims came in at 272,000 versus 270,000 expected, they have been below the 300,000 for almost a year, pointing to improvement in labor market. On Friday, US will release Q4 GDP revision, which is expected to show US economy expanded by 0.4%.

The dollar benefited briefly from data, dragging EUR/USD to a low of 1.0987 at the beginning of the New York session, only to give back gains afterward. Ending the day at the 1.1030 zone the short-term technical picture has turned slightly positive, as per indicators pointing higher above their mid-lines. However, the pair needs to regain the 1.1045/50 zone, where the 200-day SMA has been capping upside attempts over the last three days. On the other hand, a decisive break below the 1.0960/55 area, 61.8% retracement of the 1.0710/1.1376 rally and this week’s low, would put focus back on the downside, with the 1.0900 area as next bearish target

Support levels: 1.0960 1.0900 1.0880

Resistance levels: 1.1050 1.1090 1.1120

GBP/USD Current price: 1.3948

View Live Chart for the GBP/USD

The pound took a breather on Thursday following three days of sharp losses after UK scheduled an EU membership referendum for June 23rd. GBP/USD managed to move away a 7-year low of 1.3877 scored the previous day, as fears of a downward revision in the initial estimate of UK Q4 GDP did not materialize and stood at 0.5%. However, GBP/USD recovery lacked momentum and remained capped by the 1.4000 level. In the 1 hour chart, indicators head higher above their mid-lines reflecting today’s bounce while the pair trades slightly above the 20-SMA, suggesting room for further recovery. However, in the 4 hours charts indicators remain in negative territory and with the RSI having already corrected oversold conditions, limiting the upside potential. If GBP/USD breaks above 1.4000 it could extend the recovery to the 1.4080 zone, but the move will remain merely corrective as both technical and fundamental factors continue to favor the downside.

Support levels: 1.3877 1.3800 1.3700

Resistance levels: 1.4000 1.4080 1.4155

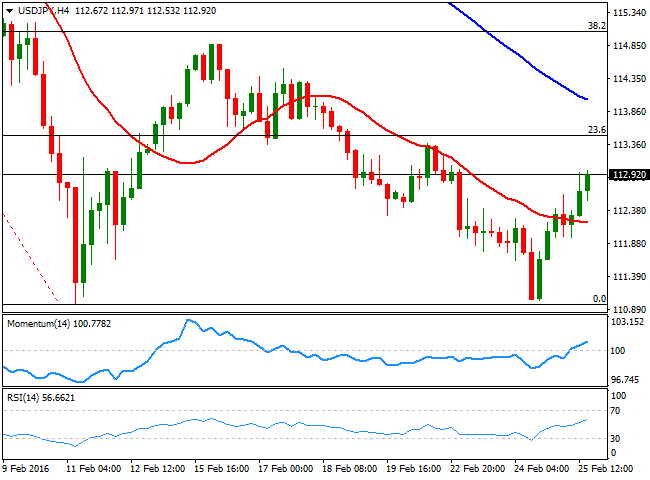

USD/JPY Current price: 112.92

View Live Chart for the USD/JPY

USD/JPY continued to recover from 2-week lows on Thursday as the dollar benefited from upbeat durable goods orders report, while broad JPY-weakness fueled the upside. The pair climbed to a high of 113.01 during the American session helped by the positive tone in stocks but failed to consolidate above the psychological level. From a technical perspective, indicators in 1 hour chart are heading higher above their mid-lines while spot hovers above a bullish 20-SMA, all of which suggests the pair might extend the bounce. Indicators in the 4 hours chart also favor a steeper recovery, with 113.50, 23.6% retracement of the 121.68/110.97 fall, as key level. A break above 113.50 will be a positive sign, confirming the double bottom at the 110.97/111.00 area.

Support levels: 111.90 110.97 110.10

Resistance levels: 113.05 113.50 114.15

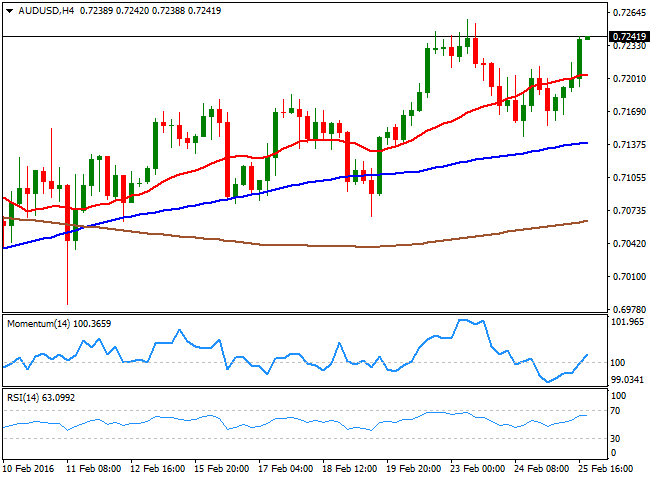

AUD/USD Current price: 0.7241

View Live Chart for the AUD/USD

AUD/USD advanced on Thursday and reversed previous two day losses during the last couple of sessions, helped by stronger than expected Australian capex for fourth quarter 2015 and the positive tone in European and US stocks. The pair regained the 0.7200 level and climbed to a 2-day peak of 0.7242 before the Wall Street close. From a technical perspective, 1 hour chart shows indicators maintain their bullish slopes while spot trades above a bullish 20-SMA, suggesting further advances for Friday, although the RSI in overbought territory might limit gains. Bigger timeframes support the short-term view, with the 0.7260/70 zone as key resistance to overcome to signal resumption of the broader recovery from multi-year lows.

Support levels: 0.7150 0.7100 0.7070

Resistance levels: 0.7270 0.7300 0.7325

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.