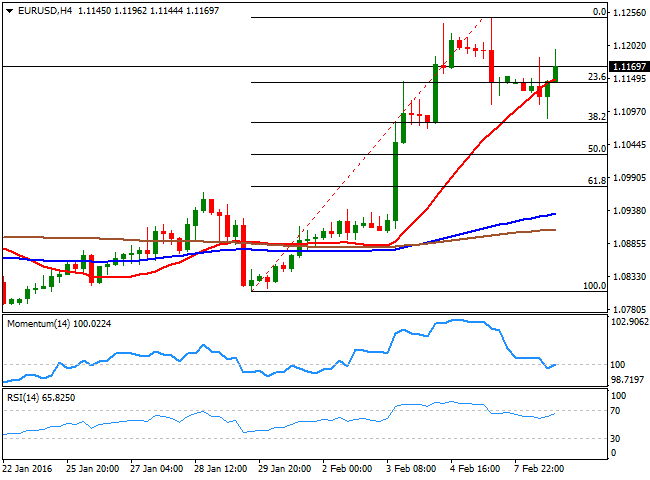

EUR/USD Current Price: 1.1188

View Live Chart for the EUR/USD

A quiet Asian session, was followed by a bout of volatility mid European morning, as crude oil prices fell below $30.00 a barrel, spurring risk aversion trading, and with the Japanese yen and the gold rising the most against the greenback. The common currency initially fell against its American rival down to 1.1086 ahead of the US opening, recovering back towards the 1.1200 figure after flirting with the 38.2% retracement of its latest advance. The macroeconomic calendar was quite light this Monday, with the EU Sentix Investor Confidence for February, down to 6.0 against previous 9.6 and expectations of 7.6, and the US labor market conditions index for January, resulting much worse than the previous one, resulting at 0.4 from a previous 2.9, revised down to 2.3. But there were stocks plummeting and oil's decline which led the way higher, as the EUR advanced due to its funding currency condition.

The EUR/USD pair trades near its high, and despite the lower low daily basis, the short term picture favors additional gains as in the 1 hour chart, the price is currently above the 23.6% retracement of the mentioned daily rally, at 1.1145, where the pair also presents its 20 SMA. In the same chart, the technical indicators have recovered from negative territory, but present limited upward strength at the time being. In the 4 hours chart, the price recovered above a bullish 20 SMA, also around 1.1145, while the RSI indicator resumes its advance near overbought territory, and the Momentum indicator turns higher around its mid-line. Overall, the pair lacks strength to confirm additional gains, but the downside seems well limited with buyers surging on dips.

Support levels: 1.1145 1.1085 1.1040

Resistance levels: 1.1200 1.1245 1.1290

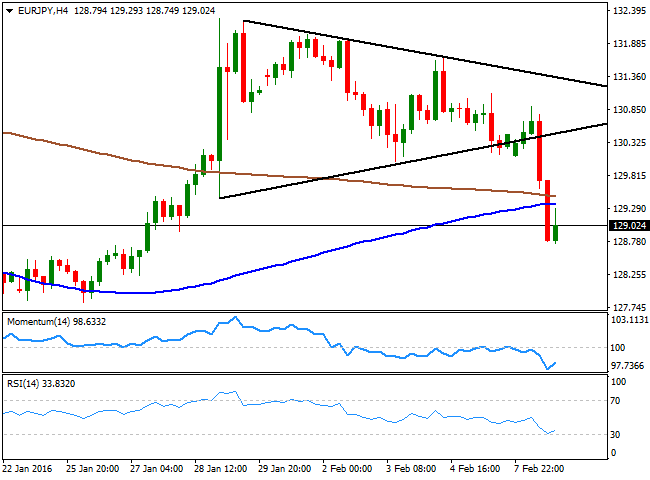

EUR/JPY Current price: 129.02

View Live Chart for the EUR/JPY

Nose diving stocks and falling US yields, fueled the Japanese yen's advance, which gained against all of its major rivals. The EUR/JPY pair plummeted to its lowest since late January, reaching 128.75 before bouncing back some. The pair broke below a short term ascendant trend line and fell sharply afterwards, indicating increasing bearish interest around the pair. Short term, the 1 hour chart shows that the price is below its 100 and 200 SMAs, with the shortest crossing below the largest in the 130.70 region. Also in the same chart, the Momentum indicator heads south near oversold levels while the RSI hovers around 30 after correcting extreme oversold readings, all of which maintains the risk towards the downside. In the 4 hours chart, the price is below its moving averages, while the technical indicators are posting tepid bounces from near oversold territory, but remain far from supporting some additional gains.

Support levels: 128.60 128.20 127.70

Resistance levels: 129.50 129.90 130.40

GBP/USD Current price: 1.4428

View Live Chart for the GBP/USD

The GBP/USD pair fell down to 1.4350, ahead of the US session opening, but later recovered firmly above the 1.4400 level, amid broad dollar's weakness. There were no fundamental releases in the UK, but on Tuesday the kingdom will release its December trade balance figures, which could bring some self live to the weakened currency. In the meantime, a bearish tone prevails in the pair, as the price declined further after correcting the 50% of its latest daily slump. Short term, the 1 hour chart shows that the price is well below a bearish 20 SMA, while the technical indicators have bounced from oversold levels and are currently flat well below their mid-lines, all of which supports some further declines. In the 4 hours chart, the pair has accelerated its decline after breaking below the 38.2% retracement of the same rally around 1.4525, while also breaking below its 200 EMA. In the same chart the technical indicators are aiming to bounce from near oversold levels, but the risk remains towards the downside, particularly if the 1.4400 level gives up again.

Support levels: 1.4395 1.4350 1.4315

Resistance levels: 1.4460 1.4490 1.4530

USD/JPY Current price: 115.31

View Live Chart for the USD/JPY

The USD/JPY pair fell down to its lowest in over a year, reaching 115.16, level not seen since October 2014. The Japanese yen gained as stocks plummeted worldwide, with the DJIA losing over 300 points intraday and the US 10-year Treasury yields hitting their lowest in a year down to 1.75%. The pair remains near the mentioned low and seems poised to extend its decline during the upcoming Asian session, with little now in the way towards the 112.60 region, the next strong long term support on a break below 115.00. Shorter term, and according to the 1 hour chart, the bias is towards the downside, as the technical indicators lower within oversold territory, while the 100 SMA has accelerated its decline well above the current level, and now offers an intraday resistance around 117.70. In the 4 hours chart the downside is also favored, with the RSI heading lower around 22 and the Momentum indicator lacking directional strength well below its mid-line.

Support levels: 115.00 114.65 114.20

Resistance levels: 115.55 115.90 116.30

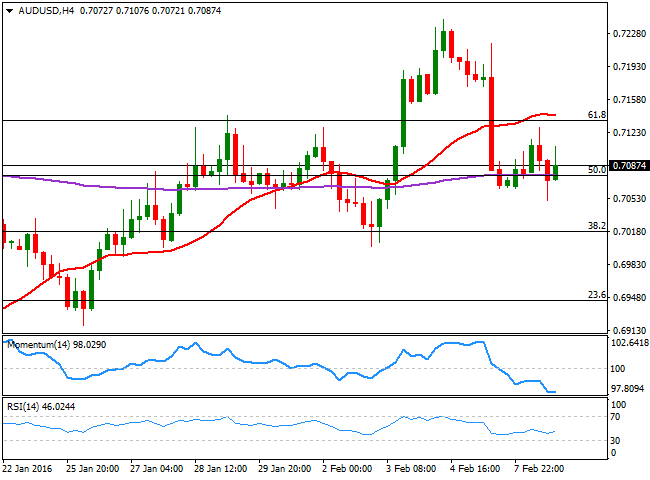

AUD/USD Current price: 0.7088

View Live Chart for the AUD/USD

The AUD/USD pair fell down to 0.7050 this Monday, but recovered the lost ground and trades slightly higher daily basis, as sentiment turned negative towards the greenback in US trading hours. The Aussie started the day with a positive tone, advancing briefly above the 0.7100 level against its American rival, but oil's decline weighed on the commodity-related currency. During the upcoming Asian session, the country will release the NAB business confidence and conditions indexes for January, alongside with New Home sales for December. Should the data suggest the local economy is growing, the AUD may jump back above the 0.7100 and advance, at least short term. But negative readings can pressure the Aussie further, with a break below 0.7040, a strong static support level, anticipating some further declines. Technically, the 1 hour chart presents a neutral stance, as the price hovers around its 20 SMA, while the technical indicators turned south around their mid-lines, limiting chances of a stronger recovery. In the 4 hours chart, the 20 SMA is flat around 0.7150, while the technical indicators lack directional strength within bearish territory, in line with the shorter term outlook.

Support levels: 0.7040 0.7000 0.6970

Resistance levels: 0.7100 0.7140 0.7185

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.