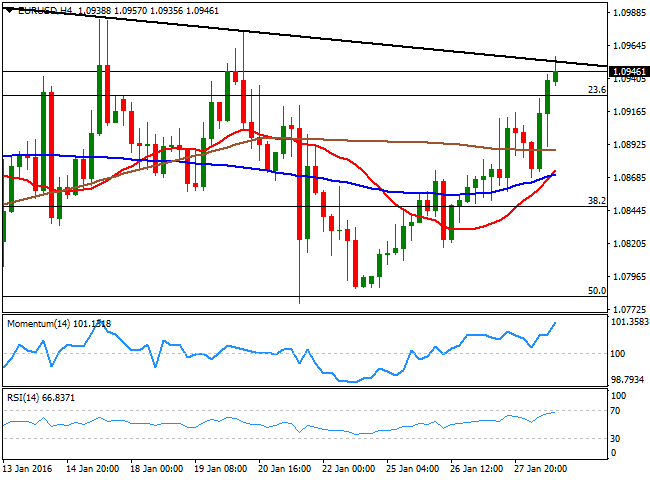

EUR/USD Current Price: 1.0946

View Live Chart for the EUR/USD

The EUR/USD pair managed to close its fourth day with gains, helped by poor US Durable Goods Order data, ahead of the release of GDP figures this Friday, and in spite of higher crude prices that if anything, halted the advance of the common currency. Plenty of data was released this Thursday, with the most relevant being German inflation up in January to 0.5% YoY, from 0.3% in December, on the back of higher food prices. On the month, German prices dropped by 0.8%, matching expectations. In the EU the economic sentiment index for February resulted at 105.0, below the expected 106.4. But the star of the day was indeed US Durable Goods Orders, much worse-than-expected as monthly basis it fell by 5.1%, while the US weekly unemployment claims came out at 278K for the week ending Jan 22. Crude prices were also in the eye of the storm, with WTI up to $34.80 a barrel before retreating towards $33.00 by the end of the day.

The EUR/USD holds near a daily high set at 1.0957, where a daily descendant trend line coming from December high, finally halted the advance. The technical picture for the pair shows that it is at a brink of breaking higher, given that its ending the day above a Fibonacci level, and it's also above its 100 DMA, closing above it for the first time since last October. Short term, the 1 hour chart shows that the technical indicators hover near overbought levels, while the 20 SMA heads north around the 1.0900 figure, acting as an intraday support. In the 4 hours chart, the price has moved away from its moving averages, while the Momentum indicator presents a clear upward slope, supporting additional advances, particularly on an upward acceleration above 1.0960.

Support levels: 1.0930 1.0900 1.0860

Resistance levels: 1.0960 1.1000 1.1045

EUR/JPY Current price: 129.43

View Live Chart for the EUR/JPY

The EUR/JPY pair traded briefly above 130.00 for the first time in over three weeks, with the Japanese yen weighed by an improved market sentiment and rising oil prices. Another reason of Japanese yen's weakness comes from speculation, or better said, hopes that the BOJ will announce some additional form of stimulus during the economic policy meeting early Friday. Technically, the 1 hour chart shows that the price has been steadily advancing above a now bullish 100 SMA, while the Momentum indicator heads north in positive territory, and the RSI indicator hovers around 72. In the 4 hours chart, the technical indicators are beginning to look exhausted in overbought territory, but are far from suggesting a downward move ahead, while the price is hovering around its 200 SMA, and near its daily highs, suggesting the risk remains towards the upside.

Support levels: 129.60 129.10 128.50

Resistance levels: 130.10 130.45 130.90

GBP/USD Current price: 1.4317

View Live Chart for the GBP/USD

The British Pound is still having a hard time when it comes to recover ground against the greenback, although the pair advanced up to 1.4406 this Thursday, helped by the release of the first estimate of the UK Q4 2015 GDP that came in at 0.5%, in line with the consensus forecast and above previous quarter reading of 0.4%. The report also showed that the services sector continues to lead the economic advance, whilst manufacturing remained flat, still a drag. From a technical perspective, the pair is looking painfully bullish, as intraday rallies continue to attract selling interest. Nevertheless, higher highs are seen whilst a daily ascendant trend line coming from 1.0478 contains the downside. Short term, the 1 hour chart shows that the technical indicators have lost upward strength, now flat near overbought levels, while the price is above a bullish 20 SMA. In the 4 hours chart, the technical indicators have turned lower from overbought levels, but the price remains above a bullish 20 SMA. Renewed buying interest beyond 1.4400, should see the rally extending, particularly if oil continues recovering ground.

Support levels: 1.4360 1.4310 1.4270

Resistance levels: 1.4400 1.4440 1.4485

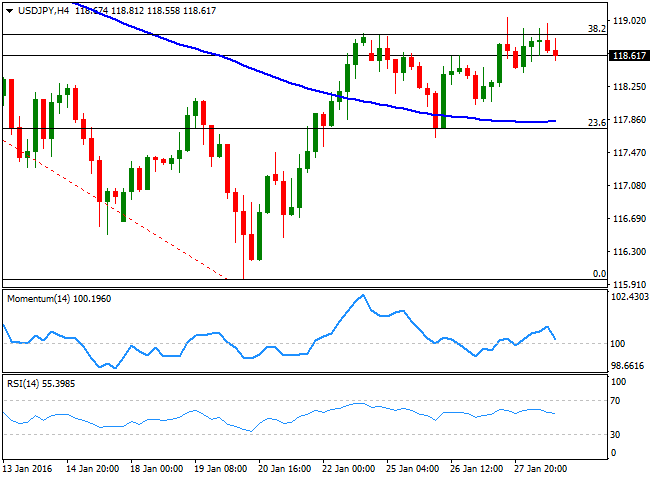

USD/JPY Current price: 118.60

View Live Chart for the USD/JPY

The USD/JPY pair traded around the 118.90 Fibonacci level for most of the day, with attempts to advance beyond it resulting in limited retraces. Even the release of disappointing US data was not enough to boost the yen, as investors are waiting for the BOJ's economic policy decision during the upcoming session, before establishing positions. Japan will also release its Tokyo and National CPI figures ahead of the meeting, generally expected to remain subdued. Short term, the 1 hour chart shows that the price has been confined to a tight intraday range above its 100 SMA, the immediate support now around 1118.50. In the same chart, the technical indicators have turned south around their mid-lines, lacking directional strength at the time being. In the 4 hours chart, the pair is halfway between its moving averages, while the technical indicators have turned south, but remain above their mid-lines. The JPY may likely appreciate if the BOJ remains on hold, with a break below 118.10 opening doors for a steady decline on Friday.

Support levels: 118.50 118.10 117.70

Resistance levels: 118.90 119.35 119.70

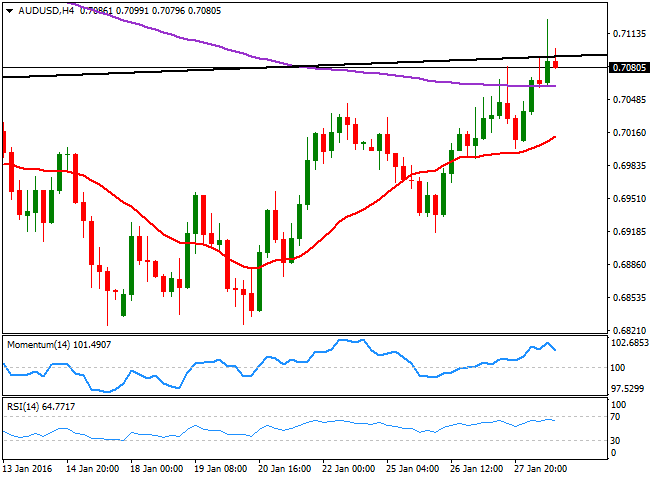

AUD/USD Current price: 0.7082

View Live Chart for the AUD/USD

The AUD/USD pair traded as high as 0.7127, with commodity currencies underpinned by rising oil prices. The Aussie however, retreated from its high and trades against the greenback, right below the daily ascendant trend line broken late December. Only time will tell if the latest recovery has been a pullback to it, or if an interim bottom has taken place. Australia will release its PPI data for the last quarter of 2015 during the upcoming hours, and a soft number may affect the currency. Nevertheless, is expected to remain strong ahead of the RBA economic policy meeting next week. In the meantime, the 1 hour chart shows that the technical indicators are posting lower lows and head south within positive territory, while the 20 SMA heads higher around 0.7060, providing an immediate short term support. In the 4 hours chart, the technical indicators are also turning south from overbought territory, but the pair holds above its 200 EMA and the 20 SMA this last with a strong bullish slope, all of which maintains the risk towards the downside limited.

Support levels: 0.7060 0.7020 0.6980

Resistance levels: 0.7110 0.7150 0.7190

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.