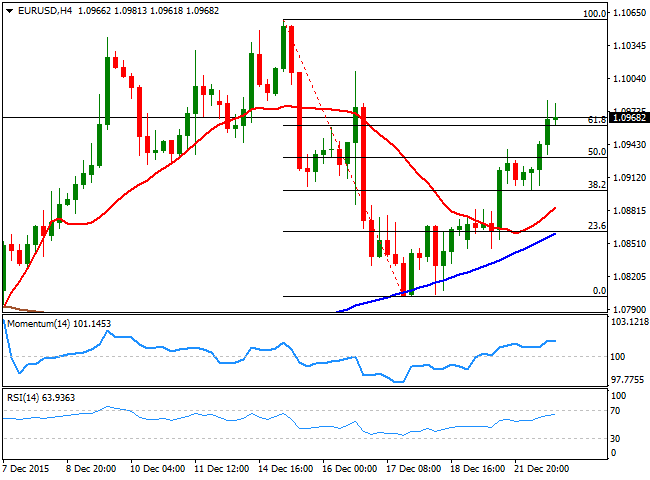

EUR/USD Current price: 1.0967

View Live Chart for the EUR/USD

The common currency advanced against the greenback for a third day in-a-row, extending up to 1.0983, its highest in almost a week. The macroeconomic calendar was pretty busy as Germany released its CFK consumer confidence survey, finally up after 4 straight declines, while in the third quarter, import prices decreased by 3.5% in November 2015, less than expected and compared with the corresponding month of the preceding year. The first round of US data was relatively positive, with the final revision of the US third quarter GDP resulting at 2.0%, and core personal consumption expenditure beating expectations. Yet housing data was again a miss, as the US existing home sales dropped in November to the slowest pace in 19 month, falling by 10.5%, pushing the dollar further lower against the EUR.

The pair holds near its recent high and presents a short term positive tone, as in the 1 hour chart shows that the price rallied above its moving averages, with the 20 SMA maintaining its upward slope after extending above the 100 and 200 SMAs, although the technical indicators are giving sings of exhaustion in overbought territory. In the 4 hours chart, the latest candle has opened above the 61.8% retracement of the latest daily decline, while the price has also advanced beyond a now bullish 20 SMA, while the technical indicators are losing their upward strength above their mid-lines, in line with the shorter term outlook.

Support levels: 1.0955 1.0915 1.0880

Resistance levels: 1.1000 1.1045 1.1090

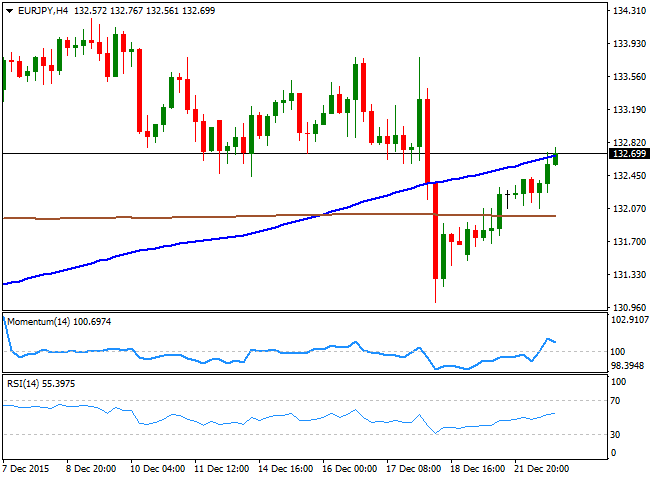

EUR/JPY Current price: 132.69

View Live Chart for the EUR/JPY

The EUR/JPY advanced as the common currency trades generally higher against its major rivals, with the pair having erased almost all of its Friday's losses, triggered by the BOJ. The Japanese yen has held quite a neutral stance this Tuesday, and will likely remain so, as Japanese banks will be closed in observance of The Emperor's Birthday. Technically speaking and in the short term, the pair has advanced up to its 200 SMA in the hourly chart, now containing rallies with its bearish slope, while the technical indicators are turning slightly lower above their mid-lines. In the same chart the 100 SMA heads lower below the current price, providing an immediate support at 132.40. In the 4 hours chart, the price is struggling around a bullish 100 SMA, still unable to break above it, while the Momentum indicator turns south in positive territory and the RSI maintains its bullish slope around 55, all of which should help in keeping the downside limited.

Support levels: 132.40 131.95 131.50

Resistance levels: 132.80 133.30 133.80

GBP/USD Current price: 1.4810

View Live Chart for the GPB/USD

The GBP/USD pair has extended its decline further, reaching a fresh 8-month low of 1.4806 and holding nearby by the end of the day. There were no catalyst behind the movement, although data released in the UK was soft with public sector net borrowing excluding public sector banks increased by £1.3 billion to £14.2 billion in November 2015 compared with November 2014. The decline in the Pound however, extended despite broad dollar weakness during the American afternoon, and the 1 hour chart points for further declines as the technical indicators have corrected within oversold territory before turning back lower, while the 20 SMA gains bearish slope above the current level. In the 4 hours chart, the RSI indicator anticipates some additional declines by heading lower around 27, while the 20 SMA contained advances for one more day, and stands now around the 1.4890 level.

Support levels: 1.4790 1.4760 1.4735

Resistance levels: 1.4855 1.4890 1.4920

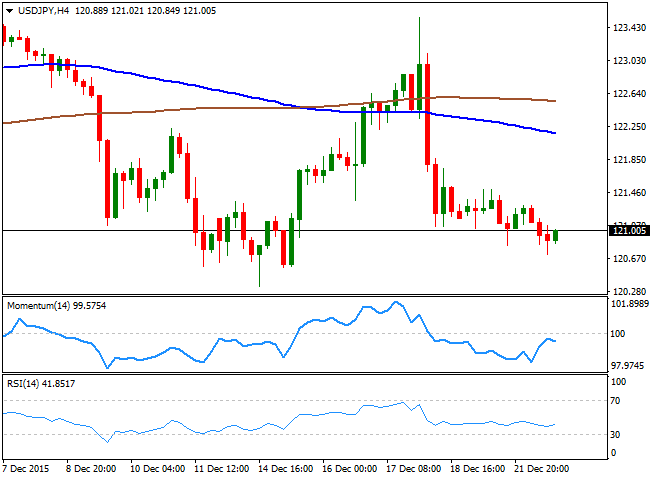

USD/JPY Current price: 121.00

View Live Chart for the USD/JPY

The USD/JPY pair edged lower this Tuesday, having extended its weekly decline by a few pips, reaching 120.71 before finally bouncing some. The pair has been developing a tepid bearish continuation ever since the Bank of Japan announced some changes to its facilities program, in a desperate attempt of boosting inflation, which resulted in a strong Japanese yen rally across the board. Ahead of the Asian opening, the short term picture is bearish as the price is still well below its 100 and 200 SMA, while the technical indicators are heading slightly higher below their mid-lines, following the latest recovery rather than suggesting a stronger advance. In the 4 hours chart, the bearish potential remains intact as the 100 SMA is accelerating below the 200 SMA, both well above the current level, while he Momentum indicator is turning south below the 100 level and the RSI indicator hovers around 42.

Support levels: 120.70 120.35 119.90

Resistance levels: 121.40 121.70 122.20

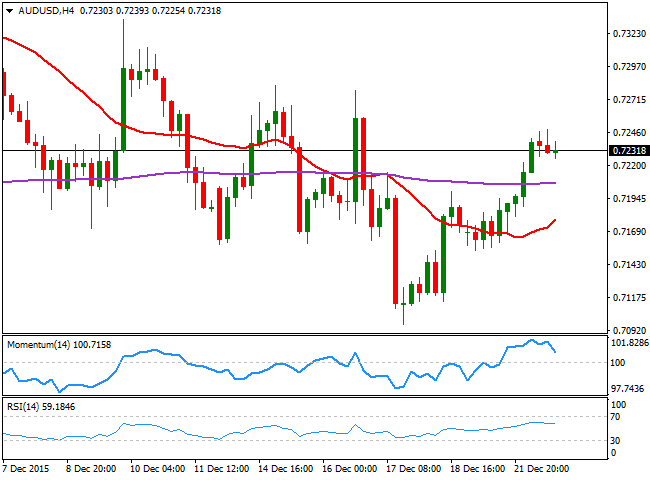

AUD/USD Current price: 0.7230

View Live Chart for the AUD/USD

The Australian dollar has advanced up to 0.7248 against the greenback, with the Antipodean currency finding demand early Asia, following the sharp rally posted Monday by base metals. The AUD/USD pair, however, was unable to sustain gains above .7240, a strong static resistance level, and eased some before the closing bell, mostly due to the lack of volumes across the financial word and ahead of the Christmas holidays which will keep most financial markets closed since mid Thursday. From a technical point of view, the pair is poised to continue easing, as in the 1 hour chart, the price is about to break below its 20 SMA, while the technical indicators continue retreating from overbought readings, and remain within positive territory. In the 4 hours chart, the Momentum indicator has turned sharply lower, still holding above its 100 level, while the RSI indicator heads lower around 58 and the 20 SMA continues heading higher far below the current level, around 0.7165.

Support levels: 0.7200 0.7165 0.7120

Resistance levels: 0.7240 0.7280 0.7330

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD flirts with 1.0700 post-US PMIs

EUR/USD maintains its daily gains and climbs to fresh highs near the 1.0700 mark against the backdrop of the resumption of the selling pressure in the Greenback, in the wake of weaker-than-expected flash US PMIs for the month of April.

GBP/USD surpasses 1.2400 on further Dollar selling

Persistent bearish tone in the US Dollar lends support to the broad risk complex and bolsters the recovery in GBP/USD, which manages well to rise to fresh highs north of 1.2400 the figure post-US PMIs.

Gold trims losses on disappointing US PMIs

Gold (XAU/USD) reclaims part of the ground lost and pares initial losses on the back of further weakness in the Greenback following disheartening US PMIs prints.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.