EUR/USD Current price: 1.0657

View Live Chart for the EUR/USD

The EUR/USD pair remain stable around the 1.0650 region for most of this Tuesday, immune to the macroeconomic data released in both economies earlier today. Starting with Germany, the final Q3 GDP reading came in line with expectations, as the economy grew 0.3% in the three months to September. Better news came from the IFO survey, as the leading indicator showed confidence among local business increased to 109.0 in November, from 108.2 in October, offsetting last month’s drop. US data came out mixed, with an improving trade deficit in October, and an upward revision of the Q3 GDP, up to 2.1% from a first estimate of 1.5%, but worse-than-expected November consumer confidence, down to 90.4 from a previous 99.1.The technical picture is still neutral-to-bearish according to the 4 hours chart, as the price remains unable to advance beyond a mild bearish 20 SMA, whilst the technical indicators have recovered from near oversold levels, but remain below their mid-lines. In the 1 hour chart, the price advances above a bullish 20 SMA, but has met sellers around its 100 SMA, while the technical indicators aim higher above their mid-lines. Some follow through beyond 1.0690 could see the pair advancing up to 1.0760, where the dominant bearish trend is expected to resume.

Support levels: 1.0620 1.0590 1.0550

Resistance levels: 1.0690 1.0730 1.0760

EUR/JPY Current price: 130.44

View Live Chart for the EUR/JPY

The EUR/JPY pair remains under selling pressure, having extended its decline down to 130.18 daily basis, a couple of pips below the previous weekly low a new multi-month one. In fact, the pair has posted a lower low and a lower high daily basis for a fourth day in-a-row, and despite the limited downward momentum the bearish trend is firmly in place. Short term, the 1 hour chart shows that the price has extended well below its moving averages that present strong bearish slopes, while the technical indicators have recovered partially, but remain below their mid-lines, limiting the possibilities of an upward movement. In the 4 hours chart, the technical indicators are correcting from oversold territory, but remain well into negative territory, while the lack of follow through in price, maintains the risk towards the downside.

Support levels: 130.20 129.80 129.40

Resistance levels: 130.90 131.30 131.70

GBP/USD Current price: 1.5076

View Live Chart for the GPB/USD

The British Pound plummeted to 1.5052 against the greenback, following the UK inflation report hearings. The BOE's Governor, Mark Carney, and a couple of MPC members testified on inflation and the economic outlook before the Parliament's Treasury Committee, painting a dark future for a rate hike case during the first half of 2016. First was chief economist Haldane, who said that that the downside inflation risk is worse than the one reported in the latest inflation report. Then, Carney stated that rates e likely to remain low "for some time." Sentiment towards the GBP turned negative and the pair stands near its lows, barely bouncing in the short term, rather on oversold conditions than an actual change in market's sentiment. In the 4 hours chart, the technical picture is quite bearish still, as the 20 SMA has turned sharply lower above the current level, whilst the technical indicators are bouncing some from extreme oversold levels. Nevertheless, and as long as the price remains below 1.5110, the immediate short term resistance, the pair is set to decline down to 1.5010, with further declines below the psychological 1.5000 figure opening doors for a downward move towards 1.4850.

Support levels: 1.5050 1.5010 1.4980

Resistance levels: 1.5110 1.5160 1.5190

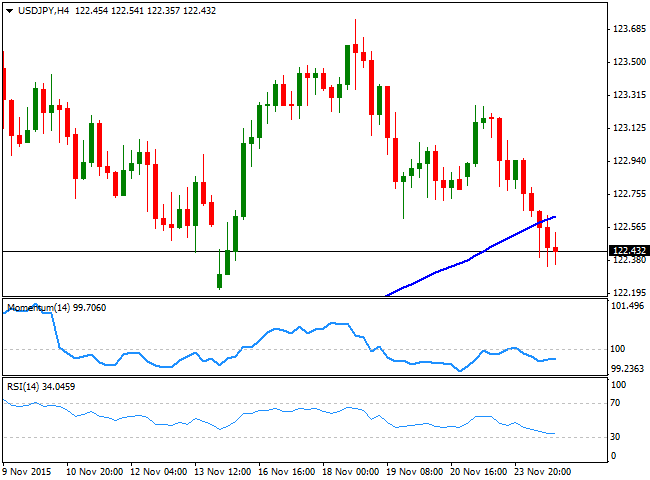

USD/JPY Current price: 122.42

View Live Chart for the USD/JPY

The USD/JPY pair trades near the daily low set in the American afternoon at 122.34, nearing a key support level at 122.20, as US data failed to boost sentiment towards the greenback. During the upcoming Asian session, the Bank of Japan will release the Minutes of its latest meeting, and investors will be looking there for clues on whether the Central Bank is planning to extend its ongoing stimulus program during the upcoming months or not. Technically, the pair seems to have established a double top in the 123.60 region, with the neckline being the 122.20 mentioned level, November 15th daily low, which means that a break below this last should confirm the figure and therefore anticipate a continued decline. Short term, the technical picture is bearish in the 1 hour chart, as the price is well below its 100 and 200 SMAs, whilst the indicators head sharply lower below their mid-lines. In the 4 hours chart, the price has moved below a still bullish 100 SMA, while the technical indicators head south below their mid-lines, in line with the shorter term view.

Support levels: 122.20 121.70 121.35

Resistance levels: 123.00 123.40 123.75

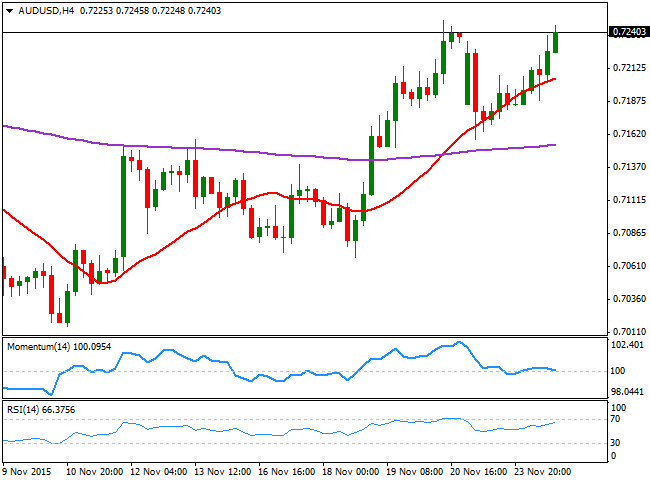

AUD/USD Current price: 0.7240

View Live Chart for the AUD/USD

The Australian dollar recovered ground against its American rival, helped by a comeback in base metals, as gold prices recovered some from multi-year lows , whilst the price of copper bounced from its lowest level since May 2009. Some risk aversion, triggered by lingering tensions in Syria favored the bright metal, although sentiment was not the only reason behind the AUD recovery. The antipodean currency is getting closer to confirm an interim bottom against the greenback, as better-than-expected local employment data and increasing confidence in the economic developments from the Central Bank had put a halt to the previous bearish trend. Technically the 1 hour chart shows that the price is near its daily high around 0.7250, and above a bullish 20 SMA, but that the technical indicators are losing upward strength well above their mid-lines, suggesting some consolidation ahead. In the 4 hours chart, however, the upside remains favored with a break above 0.7249 last week high required to confirm further gains towards the 0.7330 region.

Support levels: 0.7200 0.7150 0.7110

Resistance levels: 0.7250 0.7285 0.7330

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.