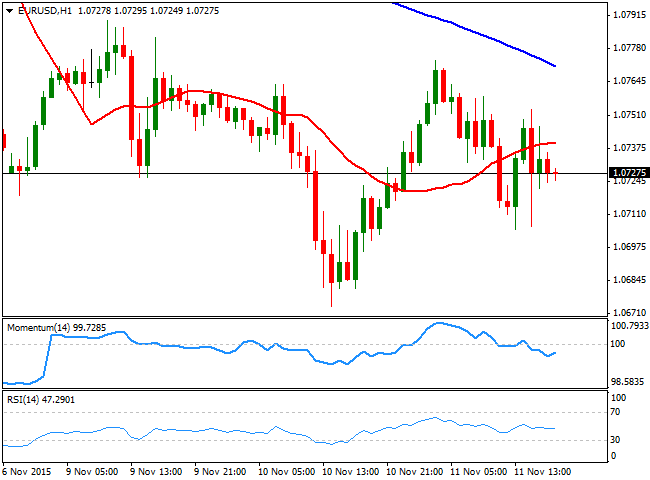

EUR/USD Current price: 1.0727

View Live Chart for the EUR/USD

Majors traded uneventfully for another day this Wednesday, exception made by the Pound that recovered part of its shine. Adding to a light calendar in Europe, US banks were closed on holidays, which resulted in a range bound EUR/USD pair, which remained contained within its early week range. Early in the day, German's selling prices in wholesale trade decreased by 1.6% in October 2015, compared to a year before, and by 0.4% compared to September this year, in line with the depressed inflation in the region. ECB's Draghi spoke at the Bank of England's Open Forum 2015, in London, but offered no news on economic policy.The pair traded as high as 1.0773 intraday, but retreated down towards the lower range of the 1.0700 figure, ending the day slightly lower. The short term picture is neutral-to-bearish, given that the 1 hour chart shows that the technical indicators hold below their mid-lines, with no directional strength. In the same chart, the 100 SMA has extended further its decline above the current price, while the pair is currently developing below a flat 20 SMA. In the 4 hours chart, the price failed on several attempts to overcome a bearish 20 SMA, currently around 1.0745, whilst the technical indicators head south below their mid-lines, after the Momentum indicator failed to hold above its 100 line, all of which maintains the risk towards the downside.

Support levels: 1.0695 1.0660 1.0620

Resistance levels: 1.0740 1.0775 1.0810

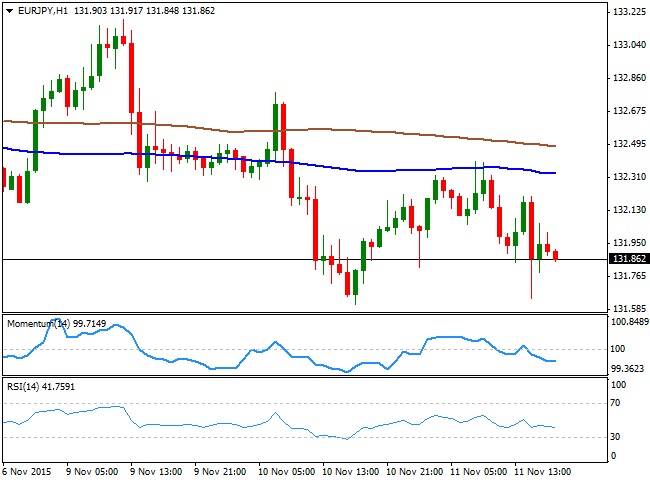

EUR/JPY Current price: 131.85

View Live Chart for the EUR/JPY

The EUR/JPY pair ended the day slightly lower, below the 132.00 level, but within Tuesday's range. The early comments from BOJ's member Harada, saying that the Central Bank can delay its decision to ease, should inflation remain subdued, helped the Japanese yen to advance some at the beginning of the day. Anyway, the short term picture for the pair continues favoring the downside, as the price has been rejected by its 100 SMA in an early advance according to the hourly chart, where the technical indicators hold in negative territory. In the 4 hours chart, the technical indicators maintain their bearish slopes below their mid-lines, whilst the 100 SMA has accelerated further lower above the current level, in line with a continued decline.

Support levels: 131.60 131.20 130.75

Resistance levels: 132.60 133.10 133.55

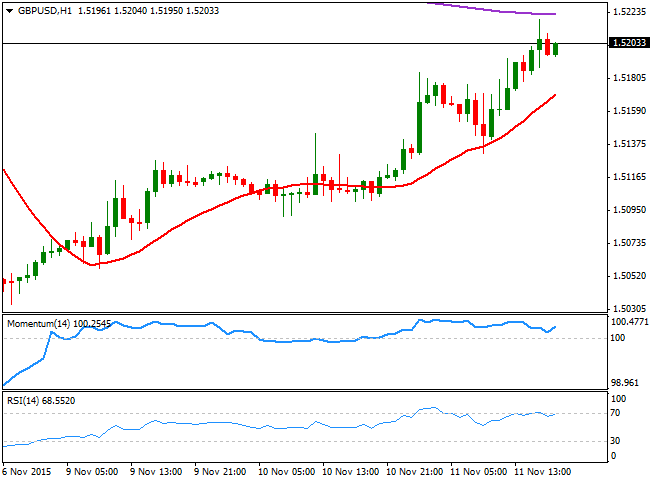

GBP/USD Current price: 1.5203

View Live Chart for the GPB/USD

The British Pound advanced beyond the 1.5200 level against its American rival, with the GBP buoyed ever since the day started, amid some dollar weakness during Asian hours. Early in the European session, the UK released its latest employment figures, which showed that the number of unemployed people, rose above expected in October, up by 3,300, although the unemployment rate fell down to 5.3%, the lowest since 2008. Wages grew at a softer pace, as earning excluding bonuses rose an annual 2.5% in the quarter. The mixed news interrupted the pair's rally temporarily, but the pair recovered afterward, advancing steadily during the rest of the day. Technically, the 1 hour chart shows that the price found support in a bullish 20 SMA, currently around 1.517, while the technical indicators head higher well into positive territory, in line with a continued advance. In the 4 hours chart, the price has advanced sharply above its 20 SMA that now turned higher in the 1.5110 region, whilst the Momentum indicator has lost its bullish strength and is turning now south in positive territory, and the RSI indicator hovers around 57, all of which indicates some consolidation ahead of a new leg higher.

Support levels: 1.5170 1.5135 1.5110

Resistance levels: 1.5220 1.5250 1.5290

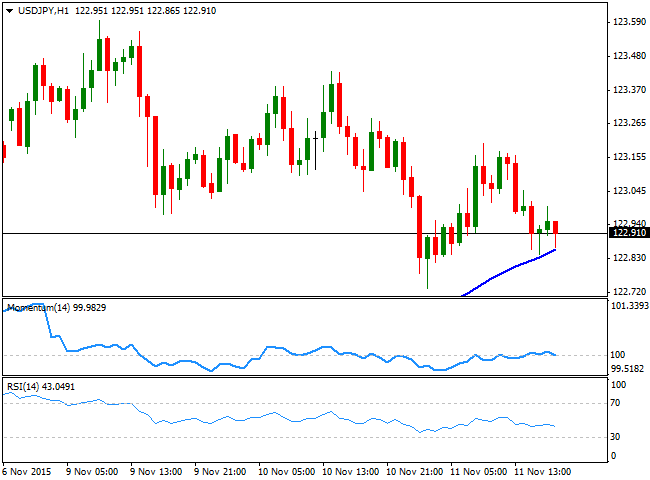

USD/JPY Current price: 122.91

View Live Chart for the USD/JPY

The USD/JPY pair ended the day in the red, below the 123.00 level for the first time since last Friday, when the pair soared up to 123.58 on the back of a strong US employment report. The Japanese yen has posted a limited advance against most of its major rivals, following some comments from BOJ's Harada, who said that he sees no need for further economic easing right now, while PM Abe stated that he may lower corporate taxes more than planned during the upcoming fiscal year. The short term technical picture, however, is still far from confirming a bearish continuation, as in the 1 hour chart, the price is bouncing from a bullish 100 SMA, a few pips below the current price, whilst the technical indicators lack directional strength around their mid-lines. In the 4 hours chart, however, the Momentum indicator extended its decline below the 100 level, whilst the RSI stands around 54, increasing the risk of a deeper bearish movement on a break below the static support at 122.50.

Support levels: 122.80 122.50 122.20

Resistance levels: 123.45 123.80 124.25

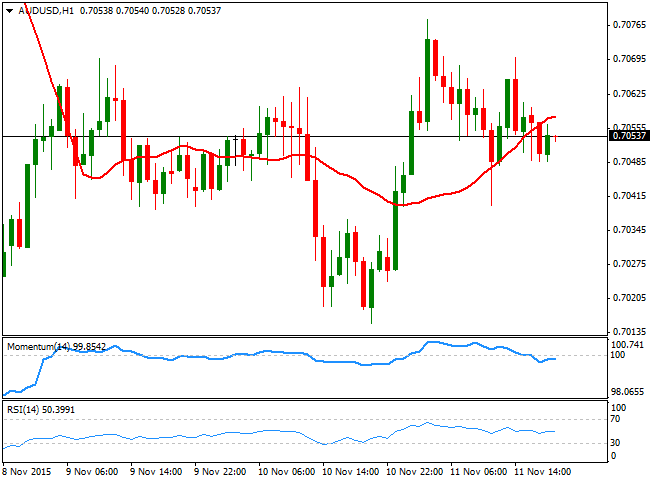

AUD/USD Current price: 0.7053

View Live Chart for the AUD/USD

The AUD/USD pair continued trading in a limited intraday range, but it may wake up from its lethargy during the upcoming Asian session, given that Australia will release its November consumer inflation expectations, previously at 3.5%, and the employment data for October. According to market expectations, the report should result in a positive surprise as the country is expected to have added 15,000 new jobs, while the unemployment rate is expected to remain steady at 6.2%. The Australian dollar has suffered from poor Chinese data, and a steady decline in gold prices, situations that are far from changing. Therefore, any intraday advance may be reverted by longer term traders waiting to sell at higher levels. Technically, the 1 hour chart shows that the price holds below its 20 SMA, while the technical indicators head slightly lower below their mid-lines, but lacking momentum, supporting a downward move. In the 4 hours chart, the price is hovering around a flat 20 SMA, while the technical indicators have turned lower around their mid-lines, also showing no directional strength.

Support levels: 0.7030 0.7000 0.6970

Resistance levels: 0.7070 0.7110 0.7145

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.